THE STOCK price of Singapore-listed Lion Asiapac has been creeping up, closing at 35.5 cents yesterday (Dec 18), compared to 34 cents at the start of the week.

A catalyst for that is the fact that the joint venture company Lion Asia Resources set up by Lion Asiapac has failed in its bid for ASX-listed Polaris Metals.

Lion Asia Resources lost out to the bid by Mineral Resources which, as of 14 Dec 2009, reached a relevant interest in 51.3% of Polaris, rendering it in effective control.

It was a long four-month takeover battle which saw multiple bid revisions, leading to Polaris spiking from 30 Aussie cents to above 70 Aussie cents.

Following the failed takeover, the stock price of Lion Asiapac has crept up to S$0.36 a share, probably because the odds of the company paying out a special dividend from its massive cash pile increases.

The management of Lion Asiapac has paid a dividend of 1 cent per share in the last two financial years.

Interestingly, a total dividend of 5 cents per share was declared in June 2006. Back then, the cash coffers had increased following the disposal of its stake in Zhejiang Qianjiang Motorcycle Company.

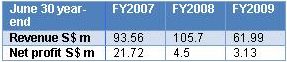

This time, following the disposal of the Anhui Jianghuai stake, it is estimated that its net cash (cash less total debt) is about S$0.48 per share.

Even by the stricter measure of cash less total liabilities, it still equates to about S$0.44 per share. The current trading price of this stock truly passes even value investing guru's Benjamin Graham's classic net-net test.

Value Investor is a professional in the investment community and a shareholder of Lion Asiapac. His earlier story: LION ASIAPAC: Stock is at big discount to its net cash