CSST has a sprawling 800,000 sq ft factory in Shenzhen.

Terence Yap is a Singaporean, and vice-chairman-cum-CFO of CSST.

WITH INCREASED SUCCESS and prosperity comes an enhanced desire to protect ones assets, both intangible and concrete.

Perhaps no other company in China understands this better than China Security & Surveillance Technology Inc (CSST).

The NYSE and Nasdaq Dubai-listed firm (NYSE: CSR) also benefits from being based in the southern Chinese boomtown of Shenzhen, which has some of the highest surveillance camera penetration rates in the country.

CSST Vice Chairman and CFO Terence Yap, a Singaporean, is not a newcomer to the world of high technology.

Prior to joining the firm, he was president, CEO and director with Digital Network Alliance International, a Delaware company providing satellite Internet connections to customers in Asia including Hong Kong, Singapore, Indonesia, Bangladesh, Pakistan and Mongolia. It also provides managed broadband services to commercial office and apartment buildings in Singapore and Hong Kong.

In an interview last week with NextInsight and Aries Consulting, he said rising profits for Chinese firms, as well as fattening government coffers, meant that those looking to protect their growing assets were increasing in both number and spending power.

“A lot of companies are looking for more security and surveillance. Security is no longer a luxury item, but more of a necessity. They want to minimize risk by protecting assets,” Mr. Yap said.

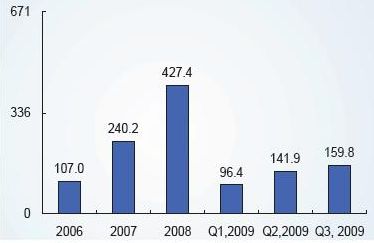

CSST's revenue in USD millions

For 3Q 2009, CSST (www.csst.com) saw about 45% of its revenue sourced from corporate clients, and the remainder from local and provincial governments looking to enhance safety on their streets and public spaces.

“On the government side, we mostly supply to cities, but occasionally we get provincial orders,” he said.

Mr. Yap is also familiar with the southern China market, having earned an MBA from the Chinese University of Hong Kong.

He said that Guangdong province – and in particular Shenzhen – was an opportune place to headquarter CSST, given the region’s widely acknowledged strengths in electronics manufacturing.

“Over three-fourths of our revenue comes from our system installation services, so the high penetration rate of surveillance cameras in the region.

“And Shenzhen is still China’s electronics factory, so we are well-based.”

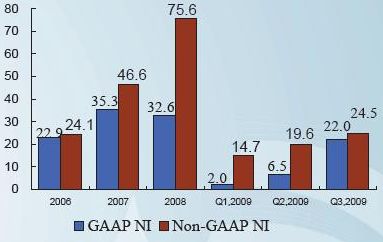

CSST's net income in USD millions

Eyeing major revenue jump

CSST is the largest domestic security surveillance company. And its turnover growth befits its leading status. Mr. Yap said the company’s revenue rose tenfold in three years, skyrocketing to 427 mln usd in 2008 from 33 mln usd in 2005.

“We see revenue reaching between 600 mln usd and 630 mln usd this year,” he said. “We recently signed a 944 mln yuan contract with Nanjing Science & Technology Park and have a one bln yuan deal in Haimen City in Jiangsu Province, related to their E-city project.”

Recent legislation in China may prove a watershed moment for CSST’s income generation going forward.

“And then there is Government State Ordinance No. 458 which stipulates that all entertainment venues must have CCTV (closed circuit television) cameras.”

Mr. Yap said this represented a massive business opportunity for CSST, as now all karaoke parlors, bars and discos must be so equipped.

And Shenzhen’s high CCTV camera penetration rate, coupled with its reputation as a work hard-play hard province replete with numerous entertainment venues, was likely to drive orders upward going forward.

“Look at London, which has three mln installed CCTV cameras. And there are 800,000 in Shenzhen, a city of around 12 mln, which is bigger than London. So there is a huge growth capacity for cameras here. And also, nearby Guangzhou is bigger than Shenzhen and has just one mln cameras.”

Looking elsewhere across China, with its 1.3 bln people looking for safer public spaces and workplaces, Beijing is second nationwide in terms of CCTV installation due to the recent jump in Olympics-related demand, and Shanghai is third boosted in part by next year’s hosting of the World’s Fair.

“We do have a presence at the world’s largest airport, Beijing’s Terminal 3, at their carpark. It’s not a huge presence but it’s a presence. For our government orders, we are mostly in cities, but highways are big growth areas for us, including traffic management.”

Another high-growth area was crime prevention and disaster relief, and rising crime rates in some Guangdong province cities as well as recent Acts of God in China were making delays on surveillance installation a dangerous gamble for both companies and government entities.

“Just look at last year’s killer winter storm in the south and central parts of China. And also the Sichuan earthquake. These help boost demand as rescue staff need to know where to send trucks, where are the fires, how many trucks should they send? It’s all about resource allocation,” he said.

The stock trades currently at a PE of 6.4X

Harmonious development, heavenly dividends

The latest phase of China’s economic growth, which has been phenomenal using any barometer given its near consistent double-digit GDP growth over the past few years, has in recent times been stressing a more equitable fellowship in the gains on the backs of 1.3 bln potential workers.

In a word, or two: harmonious development. Beijing is no longer content to see the relatively prosperous maritime provinces prosper year after year while the hinterlands continue to lag behind their coastal peers. Therefore, not only prosperity, but protecting success, are high on the government’s radar. This is where CSST steps in, or peers in as it were.

“The Chinese government plans to increase 15 bln usd on security, including surveillance, this year. In 2009 it should total some 35 bln usd,” Mr. Yap said.