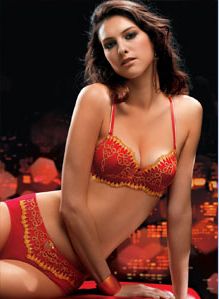

Latest product from China's best-selling lingerie brand - Embry - at recommended retail prices of HK$339 (bra) and HK$99 (panty)

Embry Holdings Ltd, owner of the Embry Form, Fandecie and Comfit line of women’s lingerie, swimwear and sleepwear, is looking to boost its leading market share in China backed by a robust balance sheet and an ambitious M&A strategy.

The Hong Kong listed firm (HK 1388) is currently debt free, with net cash of over 350 mln hkd.

“We’ve been the No.1 player in China for the past 13 years, and now have a low double digit market share. And although players two through five are close behind, we are one of only two listed firms among them,” said Mr. Clement Chan, Embry’s CFO.

The Hong Kong-based firm was well aware of the high growth potential in China for its products considering the relatively low market penetration in the country.

“In China, average annual brassiere purchases are just two or three per consumer, compared to between six and 12 in Western markets. Obviously, there is plenty of room for expansion in China,” Mr. Chan said.

The company has been riding the success of its increased brand recognition in China, with the Embry Form line being awarded the “Best-selling lingerie products in the industry in China” for 13 consecutive years, and its Fandecie brand named “Top 10 best sellers in the industry in China” for three straight years.

“We are continually progressing, already holding 19 applications patents, 13 appearance design patents, with all our products well-received by the market.

"And we have increased the number of our outlets from 1,352 in 2007 to 1,557 last year,” he added.

Embry Holdings also brought online the first phase of its Shandong Industrial Park, and the company’s total annual production capacity has now climbed to 14.8 mln standard product units.

China's lingerie market has ample room for expansion, according to CFO Clement Chan. Photo by Don Tam.

Robust demand in China

The company has seen its sales revenue rise 36.8% last year to 973.3 mln hkd, exceeding the CAGR of 13.5% between 2003 and 2007.

Even in a slower consumer market, the company managed to grow its EBITDA (excluding a one-off gain) by 6.3% last year to 118.7 mln hkd.

Though having its corporate headquarters in Hong Kong, Embry was clearly looking to the Middle Kingdom to drive its sales going forward, with major production facilities in Shandong province and Shenzhen, and sales in China growing last year by nearly 45% to 856.1 mln hkd, compared to more modest growth of 8.6% to 90.7 mln in Hong Kong itself.

Retail sales accounted for 88% of turnover last year, with Embry’s top market China expected to continue to lead the way amid a rather sluggish economy.

The company believes its multi-brand strategy will remain a competitive advantage, enabling it to focus on different demographics and target markets by providing it with a broad range of products with different designs and features.

Taifook Research has a rosy outlook for the company, giving its end-March valuation a 12-month target price of 2.44 hkd, representing a 36% upside, spurred by robust demand for Embry’s products in China.

Mr. Chan said the company was benefiting from its current focus on China.

“Hong Kong-listed Top Form is another industry player, but they are mainly an exporter,” he said.

Therefore Embry has continually bolstered its sales channels in China, with revenue from its concessionary counters growing by 35.4% last year, its retail stores by 39.2% and its wholesale outlets by 109.5%.

Photo: Embry Form

Meanwhile, its Embry Form brand still continues to dominate its total revenue proportion, contributing 60.2% last year, with Fandecie at 31.5% and Comfit at 5.6%.

“Our lingerie remains by far our top seller, with sales growing 44.4% last year to 843.6 mln hkd,” Mr. Chan said, giving the company’s brassieres and underwear products a whopping 86.7% of total orders.

He said Embry Form and Fandecie will continue to be the leading brands in China’s lingerie market due to multi-brand strategies, marketing investment and promotional campaigns.

“Our media advertising is quite effective, including TV advertising and print ads in both fashion publications and outdoor venues.

"Our company is cautiously optimistic about growth potential in the lingerie industry and future demand, despite challenges posed by the global economic slowdown.

"Therefore, we will continue to maintain a pragmatic expansion strategy.”