Mark Lee is executive director of Aries Consulting (

MANY SINGAPORE investors would not be unfamiliar with Want Want China Holdings, which was delisted from Singapore Stock Exchange in September 2007 and relisted in Hong Kong Stock Exchange on 26 March 2008.

In the same year, Want Want was selected as a constituent of the Hang Seng Mainland Composite Index and the Morgan Stanley Capital International China Index.

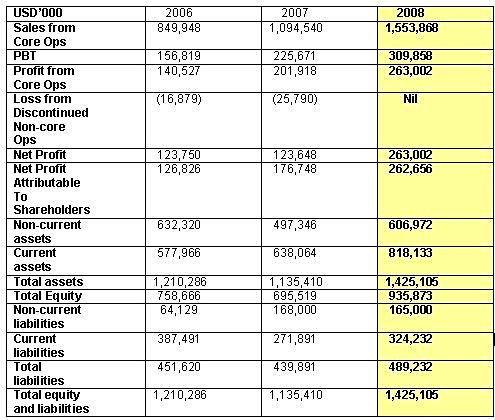

With sales in excess of USD 1.5 billion, market capitalization of HKD 49 billion and 30% net profit growth in FY08, Want Want is a natural choice for the “Winners After The Crisis” Institutional Investor Conference to be held on Apr 20 in Hong Kong.

The principal activities of Want Want China are the manufacturing, distribution and sale of rice crackers, dairy products and beverages, snack foods and other products. Most of its operations are in mainland China, with the remainder in Taiwan, Hong Kong, Singapore and Japan.

The Group has an extensive nationwide sales and distribution network throughout China, and exports to other markets like Thailand, Korea, USA and Canada.

As at December 31, 2008, Want Want China has more than 15,000 wholesalers, 329 sales offices, 34 production bases and 106 factories (104 factories in Mainland China and 2 in Taiwan).

The company’s three major product segments are rice crackers, dairy products and beverages and snack foods, which accounted for 36.1%, 34.5% and 28.8% of the Group’s FY2008 sales, respectively.

Sales jumped 42% in 2008

Want Want continues to record significant sales growth in all product segments. For the financial year ended 31 Dec 2008, the Group’s total sales jumped 42% to USD 1.55 billion while net profit attributable to shareholders improved 30.6% to USD 263 million.

A major factor for this rapid growth in 2008, was the Group’s focus on development of the sales network in second-tier and third-tier cities, said Ms Connie Lai, Head of IR at Want Want China.

The company has approximately 14,000 full-time sales representatives in 329 sales offices. “This extensive network allows us to provide direct services to these markets. In addition, we have been actively implementing sales activities such as “delivering Want Want to villages” which improved our penetration directly into the towns and villages,” she said.

As at end 2008, the company has over a million retail points.

Sales of rice crackers increased 49.1% from USD 376.3 million to USD 561.1 million in FY2008. Its core brand “Want Want” accounted for 66.4% (2007:65.5%) in sales mix and recorded an increase of 51.1% in sales over the previous year.

The growth is attributed to an increase in sales volume and a slight increase in average selling price. On the other hand, contribution from sub-brand rice crackers declined to 8.9% in FY2008 compared to 12.8% in FY2007.

Although the “melamine” crisis in 2008 caused a significant decrease in the sales of dairy products in the Chinese market, sales of Want Want’s dairy products and beverages grew 37.3% to USD 535.8 million in FY2008.

Sales of tetra-pak Hot-Kid milk, in particular, grew 27.1% over the previous year. Sales of other beverage products also recorded a 72.5% increase, which highlighted the growing acceptance of its new products by consumers.

The smallest division by sales – Snack Foods, also recorded a 41% growth in sales from USD 317.8 million to USD 448.1 million in FY2008, of which Popsicles and jellies, candies and ball cakes recorded sales growth of 51%, 38.7% and 35.1% respectively.

From 6,000 sales rep to 14,000

Ms Lai highlighted that the Company has increased its sales representatives from 6,000 in 2007 to 14,000 at end of 2008. It will not be hiring further as it shifts its focus to increasing the efficiency of the sales force.

The number of point-of-sales is expected to increase from 1 million as at end 2008 to 1.12 million in 2009. “This year’s focus will be on both the depth (having more SKUs) and breadth (more Point-of-Sale). We expect the third-tier cities to continue its growth momentum while the coastal regions may be affected by the economic slowdown,” Ms Lai added.

Having secured an established position in the dairy drinks segment, Want Want is expanding into other beverage products such as the “pocket convenient beverage” which is a kind of diluted juice drinks but with unique packaging and design. Currently, the juice drinks market is dominated by Coca-cola, Uni-President, Tingyi, Hui Yuan and Wahaha.

Want Want China is recommending a final dividend of USD 1.36 cents for FY2008, which is equivalent to a payout ratio of 68.5%. Taifook Securities estimates that its USD 336 million operating cashflow and capex plan of USD 102 million for FY2009 would provide the Company with a solid balance sheet, which will allow it to seize opportunities for growth in the future.