GIVEN THE sharp slump in crude palm oil prices in the past few months, a variety of views on the future of CPO prices has sprung up.

They represent pretty wide extremes indeed.

In her Oct 29 report, Credit Suisse analyst Tan Ting Min argued that fear dominates in the market, and palm oil prices are likely to overshoot on the way down.

Palm oil prices have fallen to a 30-month low within a span of 13 weeks, due to concerns on shipment defaults, the credit crunch and the stronger USD.

After IndoAgri Resources announced its Q3 results on Thursday, Kim Eng Securities and CIMB-GK issued reports which provided vastly different target prices of $1.65 and 61 cents, respectively. Goldman Sachs, DMG & Partners, and UOB Kayhian were somewhere in between that range.

All that can only suggest that the future is really a big unknown. So, for what it's worth, here are excerpts from the reports, starting with that of Credit Suisse.

Before that, a bit of background on Tan Ting Min who is based in Kuala Lumpur. She has a degree in bio-technology from Cambridge University and began her career as an analyst back in 1993 covering the plantations sector.

■ Back to basics: 1) Consumption of edible oils has never contracted, even during global recessions. 2) Biodiesel demand has increased, as palm oil prices have fallen.

3) The financial crisis will suppress supply growth, as it will certainly make financing more expensive or difficult to source, and this will curb oil palm expansion. Lower fertilizer application will result in lower yields in six to 12 months. 4) “Tree stress” will kick in before the year-end.

■ What can we learn from past cycles? 1) Palm oil should decouple from crude oil, as the bulk of vegetable oils end up in food. Before the coupling was established in late 2006, palm oil prices were about RM1,700 per tonne, while crude oil prices were about US$60 per barrel.

2) Palm oil prices have historically traded at a premium to crude oil, until the past month. 3) Close to the end? Past historical cycles for palm oil lasted for 37 to 46 months. The current cycle is in its 44th month (see chart below).

■ In the short term, while fear dominates, palm oil prices are likely to overshoot on the way down. We believe that palm oil prices will rebound in 2009, more convincingly at the end of 2009. We have cut

our earnings forecasts by 3-34%, assuming that palm oil prices average RM1,400 for the rest of the year and RM2,250 in 2009.

Following the sharp fall in palm oil prices, it is not surprising to see shipment defaults, especially from small buyers in China, India and the Middle East. These defaults result in buyers postponing purchases, as they wait for palm oil prices to settle down.

This then aggravates the downward spiral in palm oil prices in the short term, because the potential buyers stop their buying activity. These defaults could take months to clear, but one thing is clear, as the inventories get drawn down in importing countries, buyers must return to purchase vegetable oils at some point.

*****

Indofood Agri Resources on Thursday released its Q3 results:

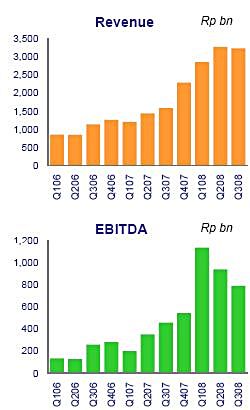

7.6% rise in net profit to Rp. 300.7bn.

105% rise in revenue to Rp. 3.2 trillion.

Gross profit: up 95% to Rp. 1.0 trillion.

Gross margins down 2 points to 31.1%

The company suffered a net forex loss of Rp. 27bn from a revaluation of its US$ denominated loans and a decline in the value of inventory of Rp.65bn from lower CPO prices. Selling costs were also up 174% on higher freight costs.

These whittled pre-tax profit growth to 39.7%. Minority interests rose 262% on a year-on-year basis due to the consolidation of London Sumatra.

We don’t yet have the full reports of Goldman Sachs and DMG & Partners, but here are excerpts from Dow Jones’ market talk reports:

Goldman Sachs says results below expectations, 9M08 core net profit only 68% of broker's full year estimate, 76% of consensus. Broker expects 4Q08 earnings to decline on quarter due to lower crude palm oil (CPO) prices, seasonally lower CPO production. Cuts FY08 net profit forecast by 17%, cuts target price to S$1.05 from S$1.15, but maintains Buy rating as says valuation attractive.

DMG cuts target price for Indofood Agri Resources (5JS.SG) to S$1.12 from S$2.65 after lowering forecasts for CPO prices, FY08-09 earnings to reflect weakening global economy, falling crude oil prices; with 90% of year-to-date EBITDA contributed by its plantation segment, "we believe there is no escape from the negative impact of lower CPO prices." But keeps Buy call on view valuations attractive at under 3X forward P/E. Adds refinancing of short-term loans shouldn't be problem as banks still willing to support, while company has IDR1.7 trillion in cash.

Kim Eng Securities said cooking oil average selling prices (ASPs) are not sustainable. CPO prices have fallen by 35% to Rm1500 per tonne over the past month, and will exert pressure on profits from its plantation business.

However, IndoAgri will benefit from falling fertiliser and fuel costs. IFAR has not yet had to cut its cooking oil prices, and should be able to enjoy good margins especially with lower CPO costs input.

“However, we believe that it is inevitable that cooking oil average selling prices will eventually fall with lower CPO prices. We are factoring a higher 24% cooking oil ASP assumption decline in FY09, versus a 3.4% decline previously.”

Interest costs set to spike

IndoAgri’s gearing stands at a manageable 0.47x. Interest bearing debt stands at Rp. 5.8 trillion, with a US$ to Rupiah ratio of around 45:55. IndoAgri has cash of around US$170m, enough to cover a US$52m loan repayment due next year.

Interest expense rise is likely to rise substantially, with IndoAgri guiding a blended average interest rate of around 10% for the full year, said Kim Eng Securities. This implies an interest expense of Rp.600bn for the year, significantly higher than the Rp.290bn year-to-date.

Furthermore, with the recent devaluation of the Rupiah versus the Dollar, more mark-to-market revaluations of its Dollar denominated loans are possible. Kim Eng Securities cut is forecast across the board by around 18%.

“Despite this, valuations still look compelling, as its core operations remain solid. We maintain our Buy call to our target of S$1.65.”

At 42 cents, the stock trades at 2.5X this year’s expected earnings, and 2.4X and 2.2X the next two years’ earnings.

Excerpts from CIMB-GK’s report by analyst Ivy Ng:

9M08 core net profit (excluding biological gains) of Rp1,101bn accounts for 96% of her full-year estimate and 68% of consensus. We consider the results to be above our expectation but below consensus.

• Key surprises in 3Q.

The cooking oils and fats continue to perform above our expectations in 3Q due to higher than expected sales and margin. The group gained market share in the branded cooking oil segment and enjoyed higher sales volumes due to the festive season. However, EBITDA margin for thisdivision was down qoq due to the write-down in the value of its palm stearin inventories.

• Higher CPO price drove up earnings.

3Q08 core net profit grew 8% yoy, thanks to higher selling prices and additional contributions from London Sumatra. The group achieved higher CPO price (fob) of Rp6,606 per kg in 3Q08 against Rp6,515 per kg in the previous year. To recap, IndoAgri started consolidating LonSum’s results from 1 Nov 07. Quarter on quarter, core net profit fell 12% due to a lower CPO price achieved and weaker cooking oils & fats margin.

• Raising FY08-10 EPS forecasts by 11-31%.

We have raised our earnings estimates by 11-31% for FY08-10 to account for the better contributions from the cooking oils & fats division, a weaker Rupiah exchange rate assumption against US$ and our 1-7% earnings upgrade for LonSum.

• Upgrade to TRADING BUY with higher target of S$0.61.

After our earnings revision and adopting a lower forward P/E of 7x to account for concerns of its debt repayment, we raised our end-09 target price to S$0.61 from S$0.58. Share price of Indo Agri has corrected by 82% year-to-date on concerns of weak CPO price and its ability to service and rollover its short-term debt that are due next year.

We are raising our rating on the stock to Trading Buy from Neutral for the following reasons: (1) the stock is currently trading on forward P/E of 6x for CY09 against the sector average of 9x; (2) we believe market has oversold the stock on concerns of debt repayment issue and weak CPO price. The group’s net gearing position was 47% as at 30 Sept 2008 and (3) positive governments intervention to support CPO price recently.

UOB Kayhian:

“Due to uncertainty in the global financial market, we lower our target 2009 PE of IndoAgri from 16x to 8x (integrated plantation player). Coupled with our lower CPO price assumption, we have cut the target price of IFAR to S$0.80/share. This target price implies a target 2009 P/B of 0.9x (2009 ROE of 11.2%).”

You are welcomed to post a comment or question at our forum.

Recent stories:

INDOFOOD AGRI: 1H net profit up 263%

INDOAGRI: Price rebound on strong palm oil price outlook?