Price has risen 15% in the past year.

Price has risen 15% in the past year.Prices of Gardenia High Fiber White Bread (400g)

|

COMMODITY PRICES have crashed but that may not translate to a lower household bill.

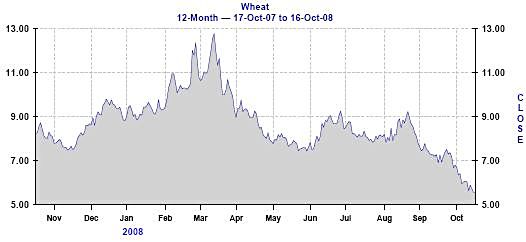

Prices for Gardenia bread, the most popular brand consumed in Singapore, for example, have continued their uptrend unabated (up 15% over the past year), despite wheat prices having fallen by half in the past six months, as the chart below shows.

Plunge in the price of wheat

Plunge in the price of wheat

.

Source: Bloomberg

This can be seen in petroleum prices coming off some 12.5% in the past 3-4 months, reflecting the 50% drop in crude oil prices over the same period.

(From a high of close to US$150 a barrel in July 2008, crude oil prices have halved to about US$70 a barrel currently.)

The lack of price correlation between retail goods with the cost of source materials is a reflection of how fragmented the end-customer market is.

Bread eaters, having a more fragmented customer profile than automobile drivers, are more likely to be price takers with little bargaining power.

Source: Bloomberg

This can be seen in how bunkering costs fell in direct tandem with crude prices, falling 50% from over US$700 a ton to about US$350 currently.