Second report

Dr Ng Cher Yew, executive chairman of Oceanus, with his high-energy presentation at the Agri Roadshow.

Dr Ng Cher Yew, executive chairman of Oceanus, with his high-energy presentation at the Agri Roadshow. Photo by Sim KihOCEANUS GROUP has not seen a trading day when its stock did not change hands rapidly and in big volumes since its listing in May this year.

The stock has also been chased up from its 20-cent placement price to around 34 cents recently, which translates into a market capitalisation of S$595 million for the company.

Oceanus is led by executive chairman Dr Ng Cher Yew, who is also its biggest shareholder. He is one voluble speaker who can effortlessly marshal facts and figures to describe his business – what it is now and what it might be in the future.

And he delivers in an energetic way which is spiced with doses of humour, as he did at a roadshow for analysts and fund managers at Financial PR’s “Bountiful Harvest – Agricultural Roadshow” on Monday (July 7).

Dr Ng is a trained veterinarian who graduated from Murdoch University, Australia where he studied under a Colombo Plan scholarship. After working six years for the AgriFood and Veterinary Authority in Singapore, he metamorphosed as an entrepreneur and venture capitalist.

Oceanus' abalone farm at the edge of the sea in Fujian province. Photo courtesy of Oceanus

So, he understands business, and investments and animal science, which puts him in a sweet spot as executive chairman of Oceanus, the largest land-based abalone farming company in China.

For his hour-long presentation at the roadshow, Dr Ng, who holds 39.1% of Oceanus, summarized it this way:

* “We are in a high-margin space as the abalone is expensive.”

* “We are growing extremely fast.”

* “Our business is very visible.”

* “We are the lowest-cost producer.”

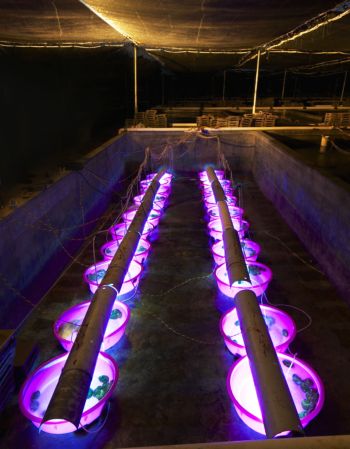

Getting abalones to spawn by shining UV light on them. Females can spawn between 5 million and 10 million eggs. Photo: Oceanus

Lowest cost producer

Being located next to the sea, Oceanus can cheaply tap sea water to rear abalones. It feeds the creatures with algae harvested from the sea surface.

The algae is abundant: A small piece out at sea will grow into a few tonnes in half a year.

Fast growth

In 2005, Oceanus had 12 million abalones which were a year old. The following two years, the numbers were 60 million and 85 million. This year, Oceanus expects to own at least 120 million abalones of a year old.

“We are big business – not small,” quipped Dr Ng.

”And we are big in China, which consumes 70% of worldwide consumption of abalone. Every abalone farmer – whether from Mexico or Australia, everywhere – are trying to sell to China. The problem for them is getting in and the cost of getting in.”

Their landed cost is RMB160 per kati. Oceanus, in comparison, can sell at that price with a 60% margin.

High visibility

Oceanus has publicised figures for its abalone population.

The creatures will reach eventually be ready for sale at various ages. Most will be sold as live abalones, some at an older stage to be processed and canned.

“We are on the cusp of a tremendous jump in sales,” said Dr Ng.

As a matter of accounting practice, Oceanus does not recognize the value of its abalones until they reach around a year old and are then grown in cages. From that point on, the mortality rate is under 5%, said Dr Ng.

High profit margin

Abalones sell for conservatively about RMB 120 a kati for year 3 abalones; RMB160 for year 4 and RMB280 for year 5.

Compare that with the total cost of rearing a kati of abalone: RMB 35.

Selling prices will continue to be maintained at that level as the demand for abalones continues to exceed supply, said Dr Ng. There is a global shortage of 8,000 tonnes of abalone a year, which will continue for several more years at least.

Abalone dish at Ah Yat Abalone Restaurant,which is a shareholder of Oceanus.

For the consumer in China, an abalone costs about RMB 20, which is affordable to those who live in Tier-1 and Tier-2 cities.

The bottomline: “We are having a return on investment of just 5 months per tank. Whatever investment we put in, we will get it back in 5 months. It doesn’t come to us in all cash but as fair-value gain until we sell it.”

Oceanus expects cashflow to be very healthy in due course, and will start to pay dividends.

”Sooner or later, the market will realize we are a fast-growing, high-margin and very visible business.”

Highlights of the Q&A session that followed:

Q: Given high inflation, do you see demand for abalone decreasing?

Dr Ng: We are selling more now than before. Dealers come to us for more but we can’t sell or we don’t have anything to retain for the future. If you talk to the processors, they are still demanding more supply to process 2-3 months ahead of various peak seasons such as Chinese New Year. The other thing is, if you read Chinese newspapers, you will know that algae blooming in the sea has killed a lot of abalone. So we are seeing a price increase. We are also selling to high-end restaurants in bigger amounts than before.

Daiwa report: Target price 53.5 cts

Q: What is your market share in China?

Dr Ng: China farms grow two types of abalone – the Japanese (30%) and Taiwanese (70%). The Taiwanese abalone is only for the live market and are cheaper than the Japanese abalone. A lot of people are growing the Japanese crossed with the Taiwanese. Today, China supplies 8,000 tonnes of abalone a year. Only 2,000 over tonnes are Japanese and Japanese-mixed species. Our production this year is a minimum of 750 tonnes.

Globally, today we are about 6%. If you read Daiwa’s report, it says by 2009, we will have 16% of the market. We don’t think they are wrong. In a couple of years, we think we will have 30% of the world market in terms of production.

*****

July 10 update: Citigroup issued a non-rated report on Oceanus, stating that the company's strengths are:

1) ideal breeding location

2) know-how to enhance survival rates

3) economies of scale

4) favourable tax incentive support

5) relation with Ah Yat Abalone Restaurant

Risks:

1) No insurance for abalones

2) Significant land requirement

3) Inbreeding degeneration

4) Short track record

5) Sabotage by competitors

Report No. 1 from the Agri Roadshow: GMG taps on Africa's vast resources

Recent Oceanus story: OCEANUS: Daiwa's target price is 53.5 cents