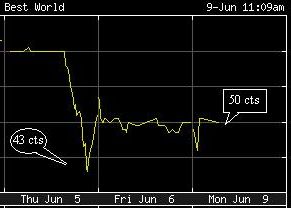

Finally, some answers to why Best World International’s stock tumbled last Thursday (5 June) by as much as 30%.

Internet forums have been abuzz with questions on the fall which saw the stock touch an intra-day low of 43 cents before closing at 52 cents.

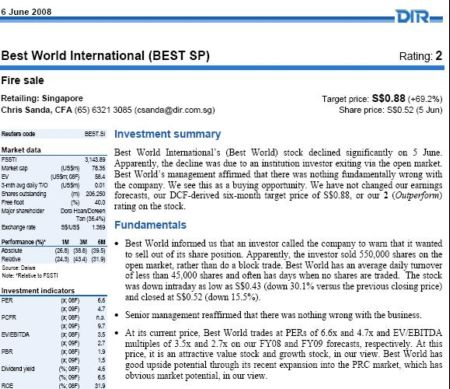

It has now come to our attention that Chris Sanda, an analyst with Daiwa Institute of Research, does have the answers.

In a report the next day, Friday, he wrote: “Apparently, the decline was due to an institutional investor exiting via the open market.”

Photo by Sim Kih

He added: “Best World informed us that an investor called the company to warn that it wanted to sell out of its share position. Apparently, the investor sold 550,000 shares on the open market, rather than do a block trade.”

Best World has an average daily turnover of less than 45,000 shares and often has days when no shares are traded.

Chris wrote: “Best World’s management affirmed that there was nothing fundamentally wrong with the company.

"We see this as a buying opportunity.

"We have not changed our earnings forecasts, our DCF-derived six-month target price of S$0.88, or our 2 (Outperform) rating on the stock.”

In his report, Chris also noted that at its current price, Best World trades at PERs of 6.6x and 4.7x and EV/EBITDA multiples of 3.5x and 2.7x on his FY08 and FY09 forecasts, respectively.

“At this price, it is an attractive value stock and growth stock, in our view.

"Best World has good upside potential through its recent expansion into the PRC market, which has obvious market potential, in our view,” wrote Chris.

He did not speculate on why the institutional investor sold out, but it is generally known that some funds could be facing redemptions by their clients.

5.10 PM LATEST: Postings on SGX website announce that CEO Dora Hoan and chairwoman Doreen Tan each bought 100,000 Best World shares last Friday at average prices of 49.75 cents and 50.45 cents apiece, respectively, on the open market.