Excerpts from analysts' reports

Maybank Kim Eng highlights "imminent inspection weakness" for Vicom

Analyst: Derrick Heng, CFA (left)

Analyst: Derrick Heng, CFA (left)

Maybank Kim Eng highlights "imminent inspection weakness" for Vicom

Analyst: Derrick Heng, CFA (left)

Analyst: Derrick Heng, CFA (left)» Resurgent new-car market to lower inspection volume, its core business.

» With weakening demand, near-peak 18x trailing 12-month (TTM) P/E appears rich.

» No rating or TP.

Potentially lower inspection volumes

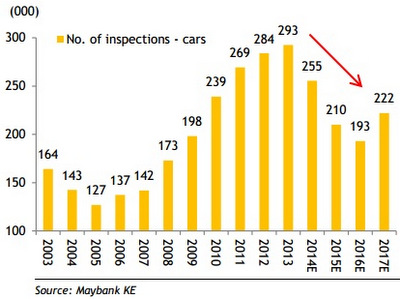

Potentially lower inspection volumesWe observe changing dynamics for VICOM’s vehicle-inspection business. Powered by 5.6% annual growth in inspection volumes over FY08-13, its EPS had expanded by an 11.6% CAGR.

While high historical EBITDA margins of 38% and a 74% market share are attractive, we believe its core vehicle-inspection business will slow down in the next three years.

The potential cause is a resurgent new-car market. As of Aug 2014, 275,500 or 45% of the cars in Singapore were 7-10 years old. These will likely be taken out of the market as they approach the end of their 10-year COE lifespan.

While high historical EBITDA margins of 38% and a 74% market share are attractive, we believe its core vehicle-inspection business will slow down in the next three years.

The potential cause is a resurgent new-car market. As of Aug 2014, 275,500 or 45% of the cars in Singapore were 7-10 years old. These will likely be taken out of the market as they approach the end of their 10-year COE lifespan.

Deregistration of these cars will feed into fresh COE supply and revive Singapore’s new-car market. New cars enjoy a honeymoon in the first three years with no inspections required. We expect this to drive down inspection volumes.

Valuations near historical peak

@ Vicom: An inspection costs $58 per car before 7% GST. Photo by Leong Chan TeikInvestors rewarded its strong earnings with a near-five-fold jump in share price, from a low of SGD1.40 in Oct 2008 to a recent peak of SGD6.80. Even after its recent correction, VICOM trades at 18x TTM P/E (10-year average: 11.9x, +1SD: 14.6x). With an impending smaller workload expected, valuations appear rich to us.

@ Vicom: An inspection costs $58 per car before 7% GST. Photo by Leong Chan TeikInvestors rewarded its strong earnings with a near-five-fold jump in share price, from a low of SGD1.40 in Oct 2008 to a recent peak of SGD6.80. Even after its recent correction, VICOM trades at 18x TTM P/E (10-year average: 11.9x, +1SD: 14.6x). With an impending smaller workload expected, valuations appear rich to us. Upside could potentially come from: 1) higher inspection prices; and 2) a revival of the COE market for cars older than 10 years old.

But until then, we believe the market could react negatively to its falling inspection volumes. Inspection prices are not regulated and were last raised in 2007.

Full report here.

Recent story: VICOM: Possible Downtrend In A Resilient Business?

Full report here.

Recent story: VICOM: Possible Downtrend In A Resilient Business?