This article was first published in April in Felix Leong's blog and is republished with permission.

IN 2009, I was pretty new to value investing. After reading a few Warren Buffett related books, I followed his advice and started reading annual reports beginning from companies starting with A!

When I came to C, I stumbled on IT retailer Challenger Technologies. I have been to its retail stores before and I was surprised that it is a listed company.

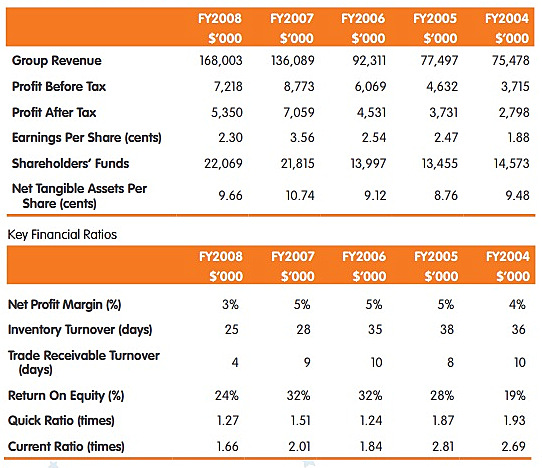

This was what their numbers looked like:

I couldn't help but notice their explosive revenue growth -- revenues more than doubled from 2004 to 2008, and profit after tax also nearly doubled.

2008 was when the global financial crisis happened but Challenger withstood the challenges well despite a fall in profits (many companies were doing a lot worse). I felt it had a defensive business selling needs instead of wants (everyone needed IT gadgets, funny and weird, isn't it?)  Challenger Technologies CEO Loo Leong Thye.

Challenger Technologies CEO Loo Leong Thye.

Photo: CapitaMall Trust annual reportAnother thing that I liked was the high return of equity (20-30%). I kept reading about Warren Buffett liking high ROE stocks but at that point I still didn't understand it much.

However, I also found out that Challenger had zero debt! It was a net cash company with no long term debt (meaning low risk) and was selling for only 5 times earnings!

Although I knew that IT retailing was a highly competitive industry (I was a nerd, I knew Sim Lim Square, Courts, Harvey Norman etc).

The stock was cheap and the business was within my circle of competence (I also studied electronics and computer engineering... well nerdy me liked IT stuff). So I ended up buying some shares of this little company.

As the years progressed, its results improved and I slowly accumulated more shares of Challenger over the next few years and steadily built up my position. At some point Challenger was almost 80% of my stock portfolio! (Yup like a true poker player, I didn't believe in diversifying. When you pick up Aces, you bet all your $$ and pray it holds up. A true gambler puts $100 on AA rather then $20 each on AA/KK/QQ/AK/AQ)

Over these years I bought it from as low as 5 times earnings and paid as high as 10 times earnings. Today it trades at about 12 times earnings (I guess more people are taking note of it thus the stock price moving in closer to its fair value)

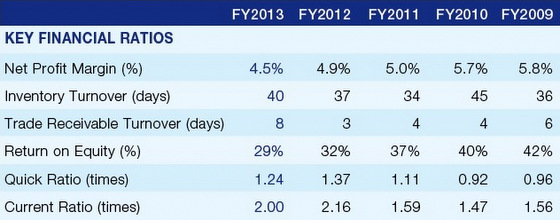

5 years later here are the results:

The trend continued as Singaporeans from kids to old folks picked up on IT products, Challenger's members grew from 200,000 back in 2008 to 500,000 today!

Over the last 5 years, revenues doubled again but profits grew slower but still a decent 1.5 times (this was due to the more intense and competitive IT retailing landscape which lowered everyone's profit margins. As you can see, net profit margin fell from 5.8% to 4.5%).

ROE was great over the last 5 years which averaged above 30%! Today, its balance sheet has become more solid than before, with ever more surplus cash (still net cash position and no debt at all). Of its NAV of 17 cents, most of it is still cash which would come in very handy on a rainy day (say another global financial crisis or crazy recession).

Over the last 5 years, its stock price gained a whopping 400%!!! |