Excerpts from analysts' reports

OSK-DMG highlights potential of more construction projects for Lian Beng after Centurion stake take-up

Analyst: Lynette Tan

Ong Pang Aik, chairman of Lian Beng Group. NextInsight file photoLian Beng announced that it has acquired a 5.03% stake in Centurion Corp for SGD21.7m.

Ong Pang Aik, chairman of Lian Beng Group. NextInsight file photoLian Beng announced that it has acquired a 5.03% stake in Centurion Corp for SGD21.7m. As both companies are already in a joint venture (JV), this acquisition will strengthen their present ties and potentially give rise to more construction contracts. It will also give Lian Beng some exposure to the accommodation business outside Singapore.

Maintain BUY, with a TP of SGD0.70.

More potential tie-ups in store. Lian Beng and Centurion (CENT SP, BUY, TP: SGD0.82) are JV partners in an industrial building and workers dormitory, M-Space, which has obtained temporary occupation permit (TOP).

Lian Beng, which has started recognising the rental income from the dormitory business of this venture, will book its share of profits from the sale of M-Space units in the current quarter.

Following the stake acquisition, Lian Beng would have an effective 57.3% interest (from 55%) in the JV. It is also a JV partner with Centurion on four other properties - Kovan Residences, Spottiswoode Suites, The Boutique Hotel @ 122 Middle Road and Eco-Tech @ Sunview.

It is likely that both companies may join forces in future projects, and that Lian Beng would secure the construction contracts for these projects.

Lian Beng, which has started recognising the rental income from the dormitory business of this venture, will book its share of profits from the sale of M-Space units in the current quarter.

Following the stake acquisition, Lian Beng would have an effective 57.3% interest (from 55%) in the JV. It is also a JV partner with Centurion on four other properties - Kovan Residences, Spottiswoode Suites, The Boutique Hotel @ 122 Middle Road and Eco-Tech @ Sunview.

It is likely that both companies may join forces in future projects, and that Lian Beng would secure the construction contracts for these projects.

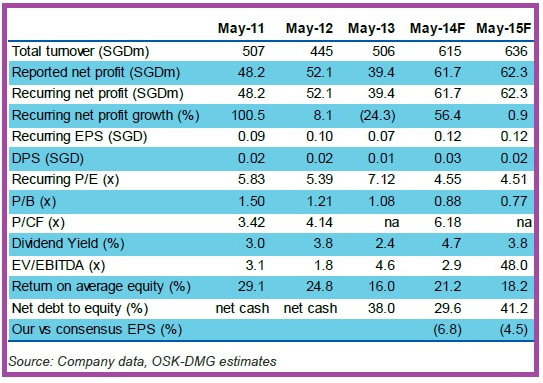

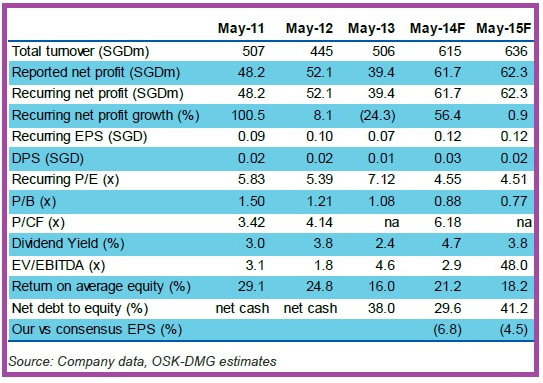

Marginal impact on financials. The impact on FY14 earnings is not expected to be significant.

With the additional share of associate earnings, we expect Lian Beng to book PATAMI of SGD61.7m for FY14 (from SGD61.2m). Including the full-year contribution from the new associate, we are projecting PATAMI of SGD62.3m for FY15 (from SGD60.6m).

We maintain our BUY recommendation and SGD0.70 TP on the stock, based on 6x FY14 earnings.

Recent story: OCBC Investment Research: Earnings spikes for Roxy-Pacific & Lian Beng

DeClout's FY13 net earnings of $1.9 m beat analyst's estimates

AmFraser Securities analyst: Valerie Chan

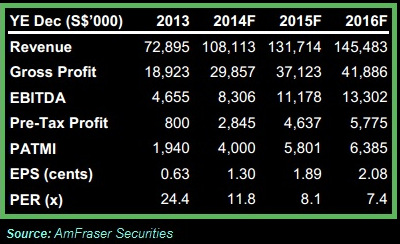

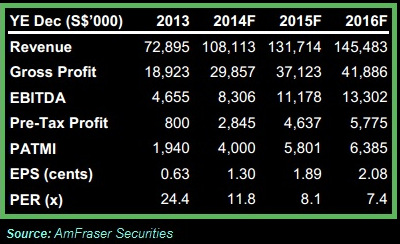

FY13 earnings above expectations due to stronger than expected 2H. DeClout made a turnaround from its loss-making position in 1H13 with a 64% increase in revenue from 1H13 to $45.3m in 2H13,mainly driven by growth in revenue from IT infrastructure business.

FY13 revenue increased 37% YoY to $72.9m driven by a 74% YoY growth in Sales and Trading revenue, which offset the 5% decline in revenue from Rendering of Services and Rental and Leasing.

EBITDA declined by 4% YoY to $4.7m on the back of lower FY13 gross margin from 29% to 26% due to changes in the revenue mix of Telco and Network Infrastructure business.

DeClout’s FY13 net earnings of $1.9m beat our estimates of $151k largely due to higher reported income tax credit ($1.1m) mainly from the recognition of deferred tax assets of S$0.7 million arising from the unabsorbed tax losses, productivity and innovation credit and capital allowances which is likely to continue in FY14F.

DeClout’s FY13 net earnings of $1.9m beat our estimates of $151k largely due to higher reported income tax credit ($1.1m) mainly from the recognition of deferred tax assets of S$0.7 million arising from the unabsorbed tax losses, productivity and innovation credit and capital allowances which is likely to continue in FY14F.

9-month contribution by Procurri to topline amounted to $16.4m in FY13 (11.4m in 2H13).

Excluding Procurri’s impact, the IT infrastructure segment grew marginally from $51.3m to $52.7m. Jointly, overall operating margins for IT infrastructure was lower at 9% (FY12: 11.8%).

Gaming VDC contributed $3.7m to Group earnings in FY13 (+102% YoY) of which $2.3m is made in 2H13.

Operating losses from the VDC segment declined from $2.0m to $1.6m. Being in a start-up phase, we expect a turnaround in the VDC segment to occur with greater critical mass from FY14F.

Raising revenue estimates by 16% in FY14 and 15% in FY15 as Group accelerates growth expansion plans to expand the IT infrastructure segment.

We expect the Group to announce an acquisition similar to Procurri in 2014 in new markets such as Europe. As a result we now expect revenue to grow by 16% to $108 million and net profit by 89% to $4.0 million in FY14F with the momentum continuing into FY15F.

We raise our DCF-derived TP to 16.9 cents. Our TP implies FY14F PER of 13x, and EV/EBITDA of 6.1x. We maintain our HOLD rating following the recent share price run-up.

With the additional share of associate earnings, we expect Lian Beng to book PATAMI of SGD61.7m for FY14 (from SGD61.2m). Including the full-year contribution from the new associate, we are projecting PATAMI of SGD62.3m for FY15 (from SGD60.6m).

We maintain our BUY recommendation and SGD0.70 TP on the stock, based on 6x FY14 earnings.

Recent story: OCBC Investment Research: Earnings spikes for Roxy-Pacific & Lian Beng

DeClout's FY13 net earnings of $1.9 m beat analyst's estimates

AmFraser Securities analyst: Valerie Chan

FY13 earnings above expectations due to stronger than expected 2H. DeClout made a turnaround from its loss-making position in 1H13 with a 64% increase in revenue from 1H13 to $45.3m in 2H13,mainly driven by growth in revenue from IT infrastructure business.

FY13 revenue increased 37% YoY to $72.9m driven by a 74% YoY growth in Sales and Trading revenue, which offset the 5% decline in revenue from Rendering of Services and Rental and Leasing.

EBITDA declined by 4% YoY to $4.7m on the back of lower FY13 gross margin from 29% to 26% due to changes in the revenue mix of Telco and Network Infrastructure business.

DeClout’s FY13 net earnings of $1.9m beat our estimates of $151k largely due to higher reported income tax credit ($1.1m) mainly from the recognition of deferred tax assets of S$0.7 million arising from the unabsorbed tax losses, productivity and innovation credit and capital allowances which is likely to continue in FY14F.

DeClout’s FY13 net earnings of $1.9m beat our estimates of $151k largely due to higher reported income tax credit ($1.1m) mainly from the recognition of deferred tax assets of S$0.7 million arising from the unabsorbed tax losses, productivity and innovation credit and capital allowances which is likely to continue in FY14F. 9-month contribution by Procurri to topline amounted to $16.4m in FY13 (11.4m in 2H13).

Excluding Procurri’s impact, the IT infrastructure segment grew marginally from $51.3m to $52.7m. Jointly, overall operating margins for IT infrastructure was lower at 9% (FY12: 11.8%).

Gaming VDC contributed $3.7m to Group earnings in FY13 (+102% YoY) of which $2.3m is made in 2H13.

Operating losses from the VDC segment declined from $2.0m to $1.6m. Being in a start-up phase, we expect a turnaround in the VDC segment to occur with greater critical mass from FY14F.

Raising revenue estimates by 16% in FY14 and 15% in FY15 as Group accelerates growth expansion plans to expand the IT infrastructure segment.

We expect the Group to announce an acquisition similar to Procurri in 2014 in new markets such as Europe. As a result we now expect revenue to grow by 16% to $108 million and net profit by 89% to $4.0 million in FY14F with the momentum continuing into FY15F.

We raise our DCF-derived TP to 16.9 cents. Our TP implies FY14F PER of 13x, and EV/EBITDA of 6.1x. We maintain our HOLD rating following the recent share price run-up.