Chow Sang Sang is benefitting from strong demand from gold and jewelry shoppers in Hong Kong, said Yuanta.

Chow Sang Sang is benefitting from strong demand from gold and jewelry shoppers in Hong Kong, said Yuanta.

Photo: Chow Sang SangYuanta: CHOW SANG SANG to benefit

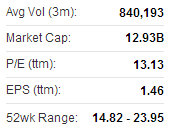

Yuanta Research said a stronger-than-expected consumer sector performance in Hong Kong last month is a good sign for jewelry retailer Chow Sang Sang (HK: 116).

“The 20.7% April y-o-y Hong Kong retail sales growth rate in value was above our 13% forecast, primarily as a result of a 68.4% y-o-y increase in the sales value for jewelry. Excluding jewelry products, total retail sales value increased 7.4% y-o-y in April.

“Gold/jewelry retailers should benefit from strong product demand including Chow Sang Sang,” said Yuanta.

Gold jewelry demand in April was aided by a declining global gold price.

By contrast, cooler than normal and rainy weather resulted in a weak apparel sales performance. Chow Sang Sang recently 18.3 hkd“We expect May retail sales growth will slow to 13% y-o-y.

Chow Sang Sang recently 18.3 hkd“We expect May retail sales growth will slow to 13% y-o-y.

“The slight global gold price rebound in the first half of May led to decline in gold jewelry demand in the month, but a low base effect and early department store promotional campaigns will be positive for May retail sales performance.”

Chow Sang Sang Holdings, founded in 1934, is a leading retailer of jewelry products in Greater China. It operates under the Chow Sang Sang and Emphasis brand names with a self-operated retail network of about 274 stores in China, 58 stores in Hong Kong/Macau and 20 in Taiwan. While jewelry manufacture/retail contributed the majority of its revenue (80%) and operating profit (90%), it also conducts wholesale of precious metals and securities/futures brokerage. It was listed on HKEx in 1973.

Bocom: Jewelry surge spurs HK retail growth

Bocom said that it expects continued tourist arrivals from the PRC to continue to buoy listed retail plays in Hong Kong, especially jewelry retailers.

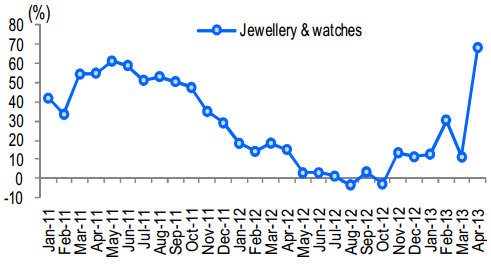

Source: Bocom

Source: Bocom

“Looking into the next few months, while we expect the sector growth is unlikely to sustain at the April level as gold sales normalize, the continued solid growth of Chinese tourist arrivals (+17% in April vs. March +14%, YTD +20%) coupled with the relatively stable local consumer climate and easier comps will continue to support a steady growth improvement,” Bocom said.

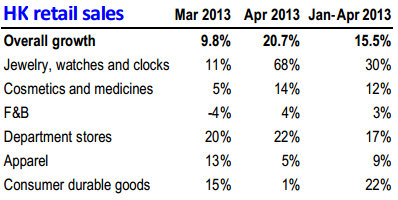

Source: BocomApril Hong Kong retail sales growth saw a strong improvement to 20.7% in value (vs. +9.8% in March) and 19.4% in volume (vs. +10.1% in March), and was better than the consensus estimate of 14.5% (both in value and volume).

Source: BocomApril Hong Kong retail sales growth saw a strong improvement to 20.7% in value (vs. +9.8% in March) and 19.4% in volume (vs. +10.1% in March), and was better than the consensus estimate of 14.5% (both in value and volume).

For January-April 2013, the average retail sales growth (in value) was 15.5%.

“As expected, jewelry & watches was the leading growth segment (+68% vs. +11% in March and +21% in Jan & Feb), similar to that of China (with April sales +72% vs. +26% in March and +14% in Jan & Feb), due to the robust demand for gold products by Chinese consumers as a result of the gold price decline,” the research house said.

That said, the performance of other segments was mixed.

The key categories that saw improvement were medicines & cosmetics (+13.8% vs. 5.4% in March), F&B (+4.4% vs. -3.7% in March) and department stores (+21.9% vs. 19.9% in March).

On the contrary, apparel (+5.0% vs. +13.2% in March) and consumer durable goods (+0.9% vs. +15.2% in March) saw considerable slowdowns.

See also:

CHOW SANG SANG Most Favored