Excerpts from analyst reports

Maybank says Hankore may be a good turnaround story

Analyst: Wei Bin

We recently met with Hankore’s management and visited one of its water plants in Suzhou. We are impressed by the restructuring and progress that occurred in the past few years and think there are some improvements in company’s fundamental. The stock seems gain more interest after introducing a strategic investor in July 2013. We highlight this stock to investors as we think it might be a good turnaround story.

We recently met with Hankore’s management and visited one of its water plants in Suzhou. We are impressed by the restructuring and progress that occurred in the past few years and think there are some improvements in company’s fundamental. The stock seems gain more interest after introducing a strategic investor in July 2013. We highlight this stock to investors as we think it might be a good turnaround story.

Maybank says Hankore may be a good turnaround story

Analyst: Wei Bin

We recently met with Hankore’s management and visited one of its water plants in Suzhou. We are impressed by the restructuring and progress that occurred in the past few years and think there are some improvements in company’s fundamental. The stock seems gain more interest after introducing a strategic investor in July 2013. We highlight this stock to investors as we think it might be a good turnaround story.

We recently met with Hankore’s management and visited one of its water plants in Suzhou. We are impressed by the restructuring and progress that occurred in the past few years and think there are some improvements in company’s fundamental. The stock seems gain more interest after introducing a strategic investor in July 2013. We highlight this stock to investors as we think it might be a good turnaround story.After a series of developments including debt restructuring (2008), appointment of new management (2011) and liquidation of some non-performing assets (2011), Hankore successfully recovered from a net loss of RMB407m in FY11 to a profit of RMB103m in FY12.

David Chen, executive chairman of HanKore.

David Chen, executive chairman of HanKore.

NextInsight file photo.Hankore is upgrading or expanding 5 out of its total 11 water projects in China, which gives growth potential to the company. The turnaround might be sustainable given the better earnings visibility and cleaner balance sheet.

David Chen, executive chairman of HanKore.

David Chen, executive chairman of HanKore. NextInsight file photo.Hankore is upgrading or expanding 5 out of its total 11 water projects in China, which gives growth potential to the company. The turnaround might be sustainable given the better earnings visibility and cleaner balance sheet.

We identified three main growth drivers for the company:

(1) in FY6/14, there could be a big increase in the construction revenue as the existing 5 upgrading and expansion contracts delivered to the government;

(2) FY6/15 onwards, the ongoing expansion works will increase the water processing capacity by around 33% from current level; and

(3) water tariff hike due to the improved water quality after the upgrades are completed.

(1) in FY6/14, there could be a big increase in the construction revenue as the existing 5 upgrading and expansion contracts delivered to the government;

(2) FY6/15 onwards, the ongoing expansion works will increase the water processing capacity by around 33% from current level; and

(3) water tariff hike due to the improved water quality after the upgrades are completed.

In our view, there are three main risks to almost any water treatment companies including Hankore:

(1) interest rate risk,

(2) liquidity risk and

(3) credit risk.

Lack of a strong parent company could also be one of the disadvantages for Hankore compared with other SOE backed water companies such as Beijing Enterprises Water Group (371: HK) and SIIC Environment (SIIC: SP).

(1) interest rate risk,

(2) liquidity risk and

(3) credit risk.

Lack of a strong parent company could also be one of the disadvantages for Hankore compared with other SOE backed water companies such as Beijing Enterprises Water Group (371: HK) and SIIC Environment (SIIC: SP).

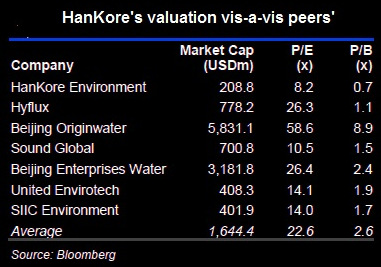

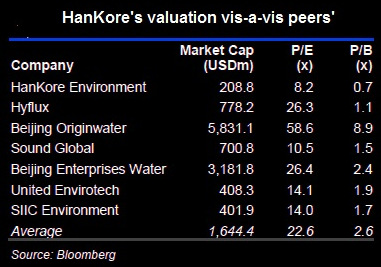

Hankore provides a very attractive exposure to China's water industry. It is currently trading at 8.2x 12m trailing PER compared with 22.6x average for SGX-listed peers.

Recent story: HANKORE: Entering high growth phase for BOT projects

UOB Kay Hian highlights Yangzijiang as Baltic Dry Index rebounds

A ship being launched at Yangzijiang. File photo: Company

A ship being launched at Yangzijiang. File photo: Company

With China’s economy showing signs of a rebound and shipping rates rising, prospects for shipyards and port businesses look rosier.

A ship being launched at Yangzijiang. File photo: Company

A ship being launched at Yangzijiang. File photo: Company With China’s economy showing signs of a rebound and shipping rates rising, prospects for shipyards and port businesses look rosier.

Yangzijiang Shipbuilding (YZJ) is our only BUY amongst Chinese shipyards as it has proven its ability to navigate successfully even amid sector downturns.

We maintain SELL on COSCO Corp (COSCO) as we think the positives from the supportive policies have already been priced in.

We like Hutchison Port Holdings Trust (HPHT) due to its attractive 7% yield and limited DPU downside.

We continue to be comfortable with YZJ’s strategy to earn extra returns by investing in held-to-maturity financial assets. Its balance sheet remains robust as these assets are well-protected and highly liquid.

Management believes YZJ will be a long-term beneficiary of the government’s supportive policies for the shipyard sector.

We have a target price of S$1.32, based on 1.3x 2014F P/B.

Recent story: YANGZIJIANG Wins 'Outperform', 'Buy' Calls from Credit Suisse, Deutsche, CIMB

Management believes YZJ will be a long-term beneficiary of the government’s supportive policies for the shipyard sector.

We have a target price of S$1.32, based on 1.3x 2014F P/B.

Recent story: YANGZIJIANG Wins 'Outperform', 'Buy' Calls from Credit Suisse, Deutsche, CIMB