Excerpts from analyst reports

UOB Kay Hian upgrades palm oil sector to 'overweight' on CPO price recovery

Supply drying up: We upgraded the regional plantation sector to OVERWEIGHT from UNDERWEIGHT in view of the recovery in CPO prices on the back of easing concern over high inventory levels and a slower production growth in 2014.

Supply drying up: We upgraded the regional plantation sector to OVERWEIGHT from UNDERWEIGHT in view of the recovery in CPO prices on the back of easing concern over high inventory levels and a slower production growth in 2014.

The hot weather and the ringgit depreciation also provide short-term support to CPO prices.

We raised sector valuation to upcycle valuation given the improving CPO price uptrend momentum.

UOB Kay Hian upgrades palm oil sector to 'overweight' on CPO price recovery

Supply drying up: We upgraded the regional plantation sector to OVERWEIGHT from UNDERWEIGHT in view of the recovery in CPO prices on the back of easing concern over high inventory levels and a slower production growth in 2014.

Supply drying up: We upgraded the regional plantation sector to OVERWEIGHT from UNDERWEIGHT in view of the recovery in CPO prices on the back of easing concern over high inventory levels and a slower production growth in 2014. The hot weather and the ringgit depreciation also provide short-term support to CPO prices.

We raised sector valuation to upcycle valuation given the improving CPO price uptrend momentum.

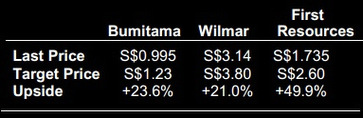

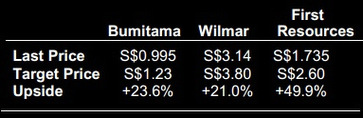

Stock picks. For sector exposure, we prefer: a) young and efficient upstream players like Bumitama and First Resources, b) integrated players with catalysts like Wilmar, and c) companies with high beta to CPO prices.

Maybank Kim Eng cautious on Neptune Orient Lines

Analyst: Derrick Heng

Source: BloombergWe assume coverage of NOL with a HOLD rating and TP of SGD1.25 based on FY13-14E P/BV of 1.1X (long term average: 1.2X).

Source: BloombergWe assume coverage of NOL with a HOLD rating and TP of SGD1.25 based on FY13-14E P/BV of 1.1X (long term average: 1.2X).

Maybank Kim Eng cautious on Neptune Orient Lines

Analyst: Derrick Heng

Source: BloombergWe assume coverage of NOL with a HOLD rating and TP of SGD1.25 based on FY13-14E P/BV of 1.1X (long term average: 1.2X).

Source: BloombergWe assume coverage of NOL with a HOLD rating and TP of SGD1.25 based on FY13-14E P/BV of 1.1X (long term average: 1.2X). Fundamentally, we believe that the container shipping industry is near its cyclical trough and expect better times ahead as the supply overhang diminishes over the next few years.

However, we remain cautious in our recommendation as the prospect of a third consecutive year of losses in FY13 (on our estimates) will likely weigh on sentiment towards the stock, especially as we believe consensus expectations of a profitable FY13 will be missed.