REGARDING THE Singapore government property measures on Jan 11, I believe prices of properties could decline 5-10% this year. Another 5-10% decline in 2014/5 (due to the big number of units completing in both HDB and private markets) will be within my expectation, leading to a total of 10-20% price decline by 2015.

If other negative factors surface, especially higher interest rates, then a 20-30% price decline is possible.

The reason I am still invested in property counters is there was such a disconnect between property share prices and physical property prices over the past few years.

While the physical market was enjoying a bull run due to low interest rates and significant resident population growth, property stocks kept trading at huge discounts because of expectations of price corrections in the physical market. So, while one was running on greed, the other was being held back by fear.

What's next?

I believe demand for physical properties will fall significantly this year, and lead to a softening of prices, as the latest moves are rather drastic and will be quite effective in reining in buyers.

But whether that will translate to lower property stock prices is less certain.

One reason for being not too negative about that: despite the rally in property stocks over the past year or so, many counters continue to trade at big discounts to RNAV.

NextInsight file photo

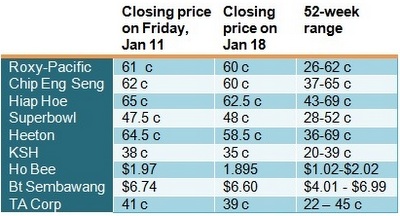

Second liner property stocks like Chip Eng Seng, Hiap Hoe, Heeton, Superbowl, and KSH are all trading at prices comfortably below 50% of their RNAV.

This provides not only good support for their share prices, but may also lead to privatization or takeovers, or simply more ammunition for upside movements. (However, unless sales are locked in, RNAV is not a fixed figure.)

An interesting note is that post-Jan 11, Aberdeen Asset Management continued to accumulate shares of Bkt Sembawang - a company that is exposed 100% to the Singapore residential market, while Simon Cheong continued to buy SC Global shares, and Ho Bee bought back even more shares.

This suggests that the deep undervaluation in property stocks is cushioning the impact of "negative" news, and values continue to be found in property stocks.

On the other hand, Wheelock is doing an about-turn in the SC Global saga, accepting Simon Cheong's offer.

This may simply mean that they have relooked at the maths post-Jan 11, and consider it prudent to exit SC Global, especially in view of their recent AMK land purchase and perhaps preferring to switch to cash and wait for opportunities in a softening market.

This leads me to the second reason for being not too negative. Land prices have stayed high simply because of intense demand from land-hungry developers, even if it meant thinner profit margins and higher risks. Measures to soften prices could be a good thing for developers which have run out of landbank. The net effect of Jan 11 moves, looked at from this angle, is thus positive.

Perhaps the way to look at property stocks post-Jan 11 is to examine each company more closely, for now it really matters which one will benefit form the curbs, or suffer from them.

For eg, some developers are rather exposed to non-residential sectors of the market (like Hiap Hoe and Superbowl to hotels, offices and shops; Ho Bee's huge commercial space in Metropolis - in both cases they mean substantial recurrent income), markets overseas (Chip Eng Seng in Australia, Ho Bee in China), have big investors who are accumulating their shares (Roxy-Pacific, TA Corp, Bkt Sembawang), heavy share buybacks (Ho Bee continuingly; and Chip Eng Seng previously).

Iskandar & Myanmar -- new catalysts?

If some of these developers start to enter the Iskandar or Myanmar markets, there will be a new theme play for their stocks. Myanmar is currently making changes to rules on property ownership and this could benefit foreign developers and buyers. Iskandar is seeing more participation from foreign developers like Peter Lim, Temasek and Chinese company Country Green (M$1b purchase of waterfront land recently), and this could set the trail for other Singapore developers to follow.

I recently visited Iskandar and I believe it is a great story that has only begun to unfold. Once the big negatives are removed - ie, security and traffic jams at the causeway - it will be ripe for big jumps in interest. I believe these negatives will slowly subside on the arrival of the positives - the increasing number of tourists visiting Legoland (and other new attractions like Peter Lim's Motorsports City), the building of big medical centres (Peter Lim again) and international schools, the announcement of the Johor MRT line, etc.

In short, once again we have the "fear factor" in the stock market with respect to an eventual fall in physical property prices. This fear has been around for quite some time but because of cheap loans, the physical market continued partying while stock investors looked on in disbelief.

There is a good chance the music will stop this year, but did stock investors really dance to the party tunes previously (ie, bought a lot of property shares) or had they been merely watching on the sidelines with grim expectations (and is the selling post-Jan 11 due to shorting)? Also, will there be new music from the north that will make reluctant stock investors stand up and shake a booty or two?

Personally, I am expecting the current tempo to slow down, but I can almost hear a foreign tune playing softly in the background.

This article was first posted in the NextInsight forum.

Recent story: Sumer: "Many of my property stocks have performed smartly in 2012"