UBS: XTEP Makes ‘Preferred List’ with ‘Buy’

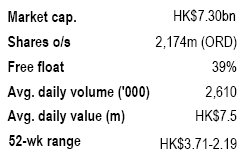

UBS has placed fashion sportswear firm Xtep International (HK: 1368) on its “Preferred List” for Hong Kong-listed consumer plays, giving the running shoe specialist a “Buy” recommendation with a target price of 4.00 hkd (recent price 3.17).

“We turned cautious on the Hong Kong/China consumer sector in September 2011 with a relative preference for consumer staples. We removed our preference for consumer staples in June 2012,” UBS said.

The research house added that its stock picking has since focused on the progress of destocking for companies and their distribution channels, and on the resilience of business models against a cyclical downturn.

“Heading into 2013, we maintain our cautious stance. We are unconvinced of a strong sales recovery without the backdrop of a recovering economy and property market that would boost the positive wealth effect.”

UBS said it views margins as a key source of downside surprise for 2012 results due in Q113.

“On the other hand, we could become more positive in 2013 should we observe consumer sentiment that is steadily strengthening. Under a recovering scenario, we expect consumer discretionary companies to outperform consumer staples.”

The Swiss brokerage said, however, that is would urge caution on structural issues faced by the department store subsector, including overcapacity and competition from other retail formats.

“We also expect structural consumption upgrades to resume, benefiting aspirational global brands and local ones. Scrutiny on management and product safety is expected to continue in 2013.”

See also:

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses

XTEP Kicking Things Up A Notch; CHOW SANG SANG Target Hiked

Credit Suisse: ANTA Kept ‘Outperform’ on Dividend Yield

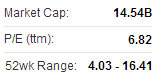

Credit Suisse said it is maintaining its “Outperform” call on athletic apparel maker Anta Sports (HK: 2020) with a target price of 7.6 hkd (recently 6.28).

“We believe the worst (1H13 trade fair orders) is already priced in by the market.

"We still like Anta’s prudent working capital control and high dividend yield,” Credit Suisse said.

Anta’s 2Q13 trade fair order value declined 15%-25% y-o-y, which Credit Suisse believes is rather a stabilization than big improvement sequentially, compared with 1Q13.

The decline was due to the increase in wholesale discount, decrease in order volumes, and lower ASP on lower materials costs.

Anta also reported a 3Q12 SSSG decline of mid-single digit percentage y-o-y, which was the same as the 1H12 SSSG.

“We revise down our 2012E-14E EPS by 1%-5% on lower revenue growth assumptions.”

See also:

XTEP's Rating Kept At ‘Buy’, Sportswear On Ascent

XTEP: Overperforming In Overcrowded, Overstocked PRC Sportswear

Photo: Company

Goldman Sachs: ‘Sell’ Call on ANTA Maintained

Goldman Sachs said it was keeping its “Sell” recommendation on sportswear play Anta Sports (HK: 2020) with a target price of 4.2 hkd (recently: 6.28).

Anta announced that its 2Q13 trade fair saw an order value decline by 15-25% y-o-y, driven by both price and volume.

3Q12 SSS declined by middle single digit on heavy discounting on summer products.

“Management observed an improvement in channel inventory but believe it is too early to say when a turn-around will materialize,” Goldman Sachs said.

Recent strong share performance suggests the market was expecting a sequential improvement from 1Q13’s order decline of 20-30%.

“A 15-25% decline in 2Q13 is not meaningfully better and will likely be interpreted as a disappointment, in our view,” the research house said.

Goldman Sachs added that it thinks China’s sports industry faces a structural demand shift as consumers move away from sports brands in favor of casual wear brands as their apparel choice.

“Even if channel inventory is cleared in 1-2 years, demand is unlikely to recover to more than double–digit growth, in our view.”

See also:

TWO LEFT FEET: China Sneaker Play Li Ning Sees Dire Year

Credit Suisse: Not all Chinese Shopping Malls Created Equal

Credit Suisse said it has created a bottoms-up analysis of shopping malls in 13 major Chinese cities and the submarkets within these cities, which covers more than 70% of key developers’ malls, adding that “not all Chinese shopping malls are created equal.”

Based on supply/demand outlook, vacancy rate, payback period, etc, Credit Suisse identified Guangzhou, Wuxi, Nanjing and Hangzhou as attractive markets, while other cites’ (and submarkets within each city) oversupply situations differ significantly.

CR Land’s mall locations are the best while Hang Lung’s are the worst.

Business models and cost structures are the key drivers for malls’ returns.

The research house said its analysis shows CR Land malls’ unlevelled IRRs are typically close to 20%, versus around 10% for Hang Lung, Wharf, and CapitaMall Asia.

“CR Land is the winner and Hang Lung the loser. Even with relatively undervalued book, CR Land’s valuation is still more attractive than its peers,” Credit Suisse said.

It added that Hang Lung’s low IRRs should not sustain the current high valuations. “We also like CapitaMalls Asia’s China assets.”

See also:

Top 1H HONG KONG GAINERS: Property King Of The Hill

Goldman Sachs: China Sportswear Industry Facing Tough Condition

Goldman Sachs said it believes end-demand for China’s sporting apparel firms is showing a limited recovery and that channel inventory remains a problem.

“The industry is facing a tough condition, and believes it may not see positive sales growth in 2H13, contrary to what is implied by consensus,” Goldman Sachs said.

The research house said it sees two reasons for the slow recovery in demand.

“China’s sportswear industry faces competition not only from within, but also from casual wear as a substitute for sports apparel; and industry participants have little experience in a downcycle and have been slow in responding to the end-demand slowdown.

Operating expense an easy lever to pull, but for how long?

With the exception of Li Ning, which is investing in restructuring, all industry participants are cutting back opex to help alleviate near-term margin pressure.

Wholesale brand opex is mostly fixed, but the biggest cost item, advertising and promotion (A&P), is somewhat discretionary. In prior years, a third of A&P was subsidies for retail stores.

“This year, this item was the first to be cut back. We think the opportunity for further opex reductions in 2013 will be much smaller given the low 2012 base.

“Li Ning has the strongest brand among domestic sports companies. We see earnings potential should the TPG-led turnaround be successful, but think at the current stage it is too early to be a buyer of the shares,” Goldman Sachs said.

For Li Ning, the research house is revising EPS by -14% in 2012E on higher restructuring cost, +18%/-8% in 2013E/14E on higher/lower govt subsidy.

Its target price for Li Ning is 4.40 hkd on 11X 2013E EPS.

See also:

ERATAT LIFESTYLE: 15.7 Cents Cash Per Share, 9.4 Cents Stock Price