Translated by Andrew Vanburen from a Chinese-language piece in the Chongqing Times

IN CHINA'S BARGAIN BASEMENT market, five sectors offer the best bang for your buck.

With the market down nearly a quarter from a year earlier, recession-proof remedies like drugs and medical devices are two, but the other trio might surprise you.

Having fallen over 24% over the past 12 months, there are a lot of toys on the floor waiting to be picked up.

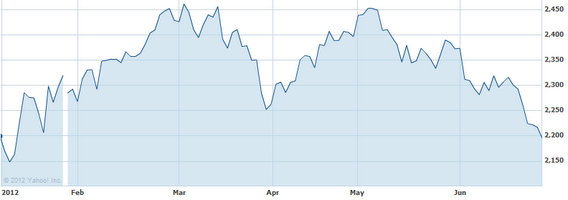

The declines since May 8 have been especially precipitous, with the benchmark Shanghai Composite Index on a virtual unimpeded descent, representing nearly 50 trading days of sub-par performance.

Over this stretch, only 22.7% of listed firms have added share value, leaving an orchard full of low-hanging fruit.

So with so many toys scattered about the floor, where’s the most ideal place to find the best playthings?

The key is to decipher which counters will do best under specific economic conditions and GDP growth patterns.

Therefore, given current average share levels for various sectors, and taking into account inflation history and expectations as well as possible stimulus measures -- pharmaceuticals, medical devices, environmental-themed shares, food/drinks/spirits and hotel/travel plays are the five most likely categories of counters to outperform the benchmark index going forward.

And while some of these five sectors have been showing more life than the broader market of late, there is no reason to believe they are overpriced or top-heavy at present.

Therefore, investors whose portfolios are more heavily represented by the above five sectors are asking themselves whether it’s time to cash in their chips and make a bit of profit.

This would be a premature move, as there is ample evidence that they are still trending even higher.

Southwest Securities analyst Ran Xu said that although these five sectors cannot emerge totally unscathed from an economic downturn, they are all certainly beneficiaries of a looser monetary policy in Mainland China.

Noteworthy is that all are broadly classed as consumer items, with some like essential medicines being far less “discretionary” than others.

But lower interest rates means more spending money, and that means shelling out less cash for more food, wine and hotel stays – and maybe a bottle of aspirin to ward off the indigestion or hangover the next day.

That being said, each sector as well as individual products react differently to various macroeconomic environments.

For example, he said wine and spirits have been on the rise for most of this year, and in fact have been on an extended three-year run.

Therefore, it may be time to consider putting the cork back in the bottle on some of the frothier and more bubbly counters in this sector.

Environmental stocks, hotels and travel, food and beverages, medical supplies and pharmaceuticals – biopharm in particular – have conversely all been collectively dragged lower than their true potential by the broader market.

None have truly shown anything close to vitality of late, and most fall short of the average daily climb even amid periodic benchmark index bouncebacks.

Investors should be wary of this trend, but also be aware of the “overdue” and “pent up” factor, Mr. Ran added.

But not everyone has leapt into the five-sector basket outlined above.

A market watcher with Huatai Securities said that resource and construction material stocks are worth a look due to their steep falls.

And all it takes is a gradual global rebound, another stimulus or two and a resurgence in construction activity to get these counters out of their ruts.

See also:

BUCKING TREND: China Shares Ready For Rebound?

TOUGH TALK: Dissecting China Market Fall, Fate

What’s Depressing P/Es In China?

DAMAGE CONTROL: Retail Investors Losing Confidence In PRC Mkt?