OSK: BAOFENG’s ‘Buy’ Call Maintained

OSK Securities said it is maintaining its ‘Buy’ recommendation on Baofeng Modern (HK: 1121), China’s leading casual footwear maker.

“Baofeng’s growth is well supported by new product lines," OSK said.

After announcing a strategic partnership with Swarvoski Elements, Baofeng plans to launch the new Swarvoski product line shortly under its retail brand ‘Boree’ for the 2012 spring/summer collection. This will mark Baofeng’s second partnership since the NBA product line, which was launched in September.

The brokerage added that it believes these strategic partnerships will help hasten Baofeng’s switch from an OEM to a branded flip flops retailer, and OSK forecasts revenue contribution from branded products to account for 51% in FY11F from 38% (FY10A).

Blended gross margins are expected to improve as higher-end “Boree” products command higher gross margins than OEM products (42.5% vs. 25.8%).

“Together, we expect Baofeng’s new designs and more partnership product lines to be share price drivers going forward. We make no earnings adjustments and maintain our BUY rating, but lower our target price by 25% to HK$1.82, based on 7x FY12F PER on increasing risk aversion among the retail sector.”

Swarvoski Summer Shimmer

Photo: Aries Consulting

Under the recent agreement, Swarovski will assist Baofeng with design and production, marketing support, retail and channel support, and among others, supplying crystal products and components for mass production of Baofeng’s products.

In return, Baofeng has to meet a minimal order of Swarvoski crystal, in which the management indicated the amount is easy to fulfill.

“The new product line will use genuine crystals provided by Swarvoski Elements, and we estimate the retail price to be at least double Baofeng’s current ASP of RMB100-250 (i.e.up to >Rmb1K/pair).”

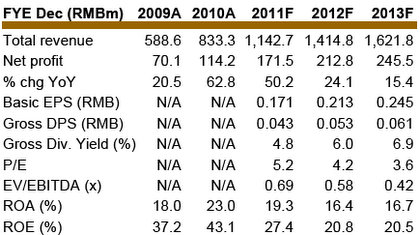

OSK added that Baofeng offers “impressive earnings growth” of 24.9% CAGR (FY11F-FY13F), yield of 5% and strong net cash position.

“But we believe investors are incorrectly comparing Baofeng with Fujian based sportswear companies, as industry growth of China’s fashionable footwear market will likely outperform the oversaturated sportswear market in our view. The counter trades at a discount to its sportswear and footwear peers.”

Baofeng’s major shareholders are Director Ching Bor Sze (52.01%) and Citic Capital (8.53%).

See also:

MISS ASIA Contestants Lend ‘Hand’ To China’s Top Slipper Play

BAOFENG: Aiming To Crystallize New Orders With Swarovski

BOCI: CHOW SANG SANG’s ‘Buy’ Recommendation Reiterated

BOCI Research said it is reiterating its ‘Buy’ recommendation on major jeweler Chow Sang Sang (HK: 116).

At the same time, the brokerage is lowering its target price on the Hong Kong-listed firm to 22.9 hkd from 36.7.

It said the same-store-sales growth (SSSG) of Chow Sang Sang at its Hong Kong shops slowed further from 50% during October's Golden Week to the mid-teens during November 2011.

But a notable pick-up in demand was seen in December, when SSSG in Hong Kong and the PRC exceeded 30% and 40%, respectively.

“Under the sluggish gold price scenario, the gross margin on gold products could decline from 15% at present to 12% by end-2012.

"We are also concerned that jewelry sales could soften in February again following the Chinese New Year,” BOCI said.

See also:

HK Jewelry Retailers: 'Buy CHOW SANG SANG, LUK FOOK On Weakness'

CHOW SANG SANG, FOCUS MEDIA: Jewelry, Ads Show Recession-Resistant Results