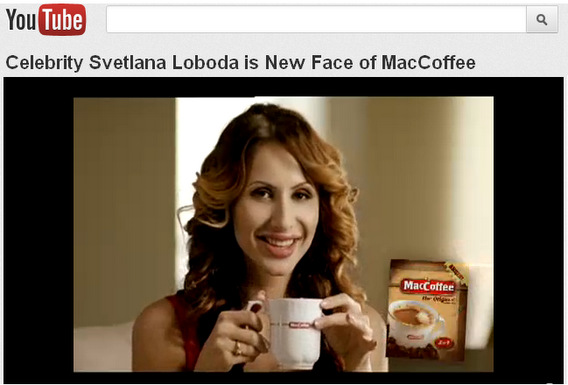

Click on it to watch Ukranian singer and composer Svetlana Loboda enjoying Food Empire's 3-in-1 MacCoffee.

Photos by Sim Kih

FOOD EMPIRE shares gained 9.9% yesterday to close at 50 cents after the company did a corporate presentation to over 100 remisiers and dealers at Phillip Securities' office in Raffles City on Monday evening.

The stock was also buoyed by an upturn in investor sentiment towards the F&B sector, with several F&B stocks such as Yeo Hiap Seng and Petra Foods rising yesterday.

Food Empire's executive chairman, Tan Wang Cheow, was asked about the falling cost of raw materials that Food Empire uses to produce its key products, especially 3-in-1 coffee.

In particular, there has been a lot of news recently about crude palm oil prices having corrected sharply throughout this year, leading to a selldown in the shares of palm oil companies such as Wilmar and Golden Agri Resources.

Palm oil is used in the making of non-diary creamer for 3-in-1 coffee. Would it follow that creamer costs have come down for Food Empire?

Mr Tan began by saying that in the last 1-2 years, prices of raw materials hit high levels but have come down since.

Sugar at its peak in 2008/2009 was trading at almost US$900 per tonne. Today, Food Empire is buying it at roughly US$630 per tonne, said Mr Tan.

As for creamer, Food Empire bought at the US$1.80 per kg level in the past two years. Now, it's US$1.50-1.60.

As for coffee beans, prices too have come down.

However, for freeze dried coffee, which is premium instant coffee, the price has not come down as significantly.

"At the high, we paid close to US$10 per kg. Today we are buying at slightly over US$9."

Mr Tan added: "All the savings will add to our profit margins -- as long as we can maintain the selling price of our products."

He cautioned that coffee, sugar and creamer are only one factor in the cost of production. There are also packing materials whose cost is linked to crude oil prices.

And there are other factors (which affect the suppliers of sugar, creamer and coffee) such as labour cost and energy cost, and these are all going up, said Mr Tan.

And with QE3 coming on stream, "we are not sure how it will affect commodity prices."

In that case, does Food Empire do hedging?

Mr Tan replied that hedging is a double-edged sword, citing the example of a company that suffered massively after its hedging on the price of oil went awry.

"We make judgemental calls on the market. We watch how prices are moving -- when they come down within a trading range, we will buy and stock up.

"When prices go up, we hold back and use up our stock."

If prices continue to go up, as happened in 2007, for example, Food Empire would have to pass part of the increase to the consumer. "It's unfortunate but the whole market will also have to do it," said Mr Tan.

Question: What is Food Empire's gross margin?

Answer: It depends on the market where the products are sold but it ranges between 35-50%.

Food Empire has had a good year so far. In 1H2012, its net profit rose 25.8% to US$8.8 million.

Its stock price has gone up 58.7% but is still cheaper than its peers Super Coffeemix and Viz Branz in terms of price/earnings (see table)

For more on Food Empire, read our recent stories:

Getting to know SUDEEP NAIR, the new CEO of Food Empire

FOOD EMPIRE: Making hot coffee for Russians & others