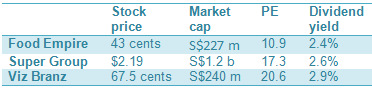

SUPER GROUP has done superbly, its shares rising from $1.29 at the start of this year to $2.19 this week.

Now, consider another instant coffee player listed on the Singapore Exchange -- Food Empire.

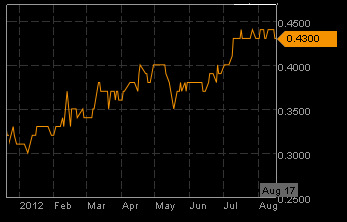

Its stock started the year at 31 cents and ended last week at 43 cents.

We checked out its story, and found things to like about it.

Its revenue for the first half year was US$110.7 million, an increase of 3.4% year on year.

Profit after tax jumped 24.6% to US$8.7 million on improved margins and a tax write back.

The improved margins arose from decreases in the prices of the raw materials it used for its coffee products - coffee, sugar and creamer.

Unlike Super Group which focuses on markets such as Singapore and the region, Food Empire is big on Russia, where its sales stood at US$64.9 million in 1H.

Food Empire's other key markets are Eastern Europe and Central Asia (comprising Ukraine, Kazakhstan and the CIS Countries) where sales rose by 4.4% to US$33.1 million

Historically, people in Russia, Middle East, China and India have not taken to consuming coffee in a big way.

But in the recent decade, coffee cultures have been developing in these regions at rates that beat economic growth.

For example, China’s annual coffee consumption is growing rapidly at around 15% a year.

Coffee drinking is still at an infancy stage in China, where per-capita consumption is about 3 cups a year, versus 3.5 cups a day in the US.

Which is why Food Empire wants to penetrate the Chinese and Indian markets.

Last month, it incorporated subsidiaries in China and India to bring its products into China and to manufacture instant coffee in India.

Right place right time

Food empire founder Tan Wang Cheow did not start out in F&B, but was exporting personal computers and related peripherals to Eastern Europe and Central Asia in the late eighties.

Some of these countries had freezing winters with temperates dropping below 30 degrees Celcius. People drank Vodka and bought hot coffee beverages from street side stalls to keep warm.

He decided to provide a convenient solution to help people keep warm and the group started distributing third party brands of 3-in-1 instant coffee in Kazakhstan and Russia in 1993.

When Soviet Union disbanded in 1991, Mr Tan’s F&B products sold like hot cakes to pent-up demand for all manner of capitalist goods.

About 57% of Group revenue in FY2011 was from Russia, where its flagship MacCoffee has been consistently ranked as the leading 3-in-1 coffeemix brand.

Other than Russia, MacCoffee is also the no.1 coffee brand in Ukraine and Kazakhstan. Food Empire products are exported to over 60 countries, especially Central Asia and the Middle East.

It markets over 400 types of products under its proprietary brands, which also include MacChocolate, MacTea, FesAroma, MacCandy, Zinties, Melosa, Petrovskaya Sloboda, Klassno, OrienBites and Kracks.

Like everyone else, Food Empire wants a piece of the China pie, but its F&B market is known to be the toughest in the whole world.

Singapore F&B players have a track record of success there.

Viz Branz, which owns Gold Roast, BenCafe, Café 21, CappaRoma and Jaffa Juice, derives half of group revenue from China.

In FY2011, its sales from China grew 10.5% year-on-year to reach S$83.4 million.

Super, Southeast Asia's leading 3-in-1 coffeemix player, has also made headway in China with non-diary creamer ingredient sales.

Its brands include Super, Café Nova, Super Power, Owl, Yé Yé, Coffee King, Gold Eagle, Negresco, Eagle King, Liang Bao and Superkids.

Food Empire has been very successful employing sophisticated brand-building activities, after the style of the world's top brands.

It is so good at marketing that in spite of the runaway success of its own brand, 18.6% its FY2011 revenue was from marketing and packaging services for third party brands.

The company invests in creative advertisements and promotions, as well as sponsorships to ensure high brand cognition when consumers shop.

The question is, will it be able to export its successful branding and marketing campaigns to new markets like China and India?