A SHAREHOLDER recently was quoted in The Edge Singapore as saying that Sing Holdings looks like a value trap.

Sing Holdings’ CEO seems to see something else.

Mr Lee Sze Hao has bought 149,000 and 210,000 shares of Sing Holdings in the past three weeks.

All at 30.5 cents.

It’s not just last month that he has been accumulating the stock but also 1Q and last year -- and beyond.

The latest purchases at 30.5 cents was at a sort of mid-point between the 27-35 cent range that Sing Holdings has traded in since Sept 2010.

Almost two years it has been, and the stock shows no sign of breaking out. In that time, Mr Lee has bought a total of 3,818,000 shares from the open market.

It’s not just Mr Lee who sees something else other than a value trap but also FH Lee Holdings, which has been upping its stake for a long time too.

This is the investment vehicle for various Lee family members, including the founder and executive chairman of Sing Holdings, Mr Lee Fee Huang, 83.

FH Lee Holdings owns 34.1% of the stock, and has just added 104,000 and 146,000 shares in two transactions in June 2012. All at 30.5 cents.

The upcoming 2Q results should be pretty.

Sing Holdings has sold approximately 94% of the units in “The Laurels” at Cairnhill Road, amounting to contracted sales value of about S$666.2 million.

Of this, approximately S$239.2 million has been recognised as revenue up to 1Q2012.

The balance S$427.0 million will be progressively recognised from 2Q2012 to 3Q2013.

The expected profit jump for FY2012 and FY2013 gives this "value trap" the attributes of a bomb shelter -- and indeed it has withstood the shelling from the euro crisis.

Aside from development properties, Sing Holdings draws a small revenue from the rental of 60 units it owns in BizTech Centre, a freehold light industrial building.

Its next story is in Robin Road/Robin Drive where it will start constructing a project in 2013 on land area of 8,172 sq m.

Its exciting attributes include a potential upward revision of its plot ratio by the government as well as its proximity to the future Stevens Road MRT station.

Recent story: SING HOLDINGS: Stock price is no reason for shareholders to sing

Excerpts from yesterday's DMG & Partners' report...

'Technics is an undersearched oil & gas play with high-yield'

Analysts: Jason Saw & Terence Wong CFA

We initiate coverage with a Buy rating and TP of S$1.28.

Technics is a full service integrator of compression systems and process modules for the oil and gas sector.

We estimate that the net profit of this small-cap is set to grow +12.6% CAGR over FY11-14F, driven by strong industry spending, and capacity expansion in Vietnam.

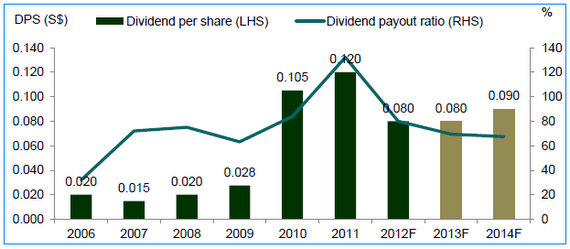

We like Technics for its undemanding valuation at 9.3x FY12F P/E, attractive yield of 8.6% and earnings growth.

Valuation: TP of S$1.28 implies 37% upside.

Technics’ valuation at 9.3x FY12 P/E with 8.6% yield is appealing.

We use a target P/E of 12x on blended FY12/13F EPS, at the top of its historical range, as we expect P/E valuation to expand on stronger earnings, higher recognition by the market (stock is underresearched) and spin-off of Norr Offshore Group. Key risks are project execution, erosion in pricing power for EPCC projects, and delay in award of projects.

Recent story: SUNTEC REIT, SHENG SIONG, TECHNICS: What Analysts Now Say…