Photos: Greentown

IS GREENTOWN CHINA the country’s property-sector version of Lehman Brothers?

Will it be the first big domino to fall, destined to take down an entire industry?

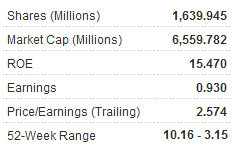

Greentown China Holdings Ltd (HK: 3900) recently shocked the property investment community by announcing it was sitting on a crippling 32.2 bln yuan in bank loans spread out over 10 major listed lenders as of June 30.

In a sign of trouble on the horizon reminiscent of the sub-prime loan fiasco which pounded Wall Street over three years ago, a Chinese-language piece in Sinafinance said that the Hangzhou-based developer could be the PRC’s version of Lehman Brothers – one of the first major financial institutions in the US to go under at the time.

The Hong Kong-listed real estate play, which went public just five years ago, is engaged in major property projects in Beijing, Shanghai and Hunan Province’s capital city of Changsha, among other locales.

But Sinafinance said it is also one of the most financially overburdened.

Song Weiping: How Can You Face Your Shareholders?

Such was the question posed by frequent Sinafinance contributing writer Liang Hong to Greentown’s chairman.

“Mr. Song, in my opinion, you are a decent man. And I have no problem with Greentown’s very attractive properties, having seen many, lived in a few, and I find them the pick of the crop and a great place to invest.

Photo: Greentown

“But as the chairman of a listed company, you simple don’t cut it. The current financial straits Greentown finds itself in are totally due to your ineptitude and poor decisions,” Mr. Liang said.

The disgruntled investor went on to say that, in his opinion, “the debt restructuring and ultimate bankruptcy of this once-proud firm is inevitable, and only a matter of time.”

“We all know what happened to the global economy in 2008, and most of us changed our ways and toned down our outlooks. But it seems like that event taught you nothing, and you continued down the same old paths undeterred by reality.

“How many Greentown investors have been devastated by your actions – or lack thereof? How can you still have the courage to face us?”

The disconsolate and financially hard-hit investor went on to compare Greentown’s chairman to a reckless poker player.

“For the past several years, you have been gambling away our money on reckless expansion and ill-advised over-leveraging. Mr. Song... might I remind you that you are not sitting at a card table with ‘house money’. You are wagering with OUR money and you have a responsibility to all of us.”

While it is often more useful and effective to air such grievances at scheduled and extraordinary shareholders meetings -- as well as behind thick wooden boardroom doors at board meetings – there comes a time when a large public firm’s performance elicits strong and heated opinions from a critical mass of shareholders so that other avenues of protest must be opened.

Such it is with Mr. Liang, Sinafinance said of the contributor.

“I’m from Zhejiang, home of Hangzhou, which is also home to Greentown. So from the start, I was very familiar with your firm, and your sprawling developments and residential projects have made Hangzhou an even more beautiful city and we have you to rightfully thank for that,” the investor added.

But Mr. Liang said that was where the credit must end.

“You also have consistently offered financial support to building up the local football team, and for that we Zhejiangers are very grateful, and we are proud of the team’s frequent successes and accomplishments, especially given the fate of the national team.

“But being chairman of a company is not like grooming a football team. The 11 players can expect to lose, and even losing seasons can be acceptable – as long as the fan base sees progress being made.”

However, Mr. Liang said the property developer was no football team.

“Mr. Song, the ‘team’ that is Greentown cannot keep losing, and we can’t keep comforting ourselves with the slogan: ‘Wait ‘til next year’!”

See also:

Natural Selection At Play In PRC PROPERTY SECTOR, Overweight Sector

TYCOON CHENG: Fundraising In Fretful Times