Ajisen says its 499 restaurants in Greater China enjoy 69.2% operating margins. Photos: Ajisen

However, an official from the Hong Kong listed firm denies that its most recently announced sky-high operating margins of nearly 70% are a fabrication, despite repeated questions from the media.

In a Chinese language piece in Sinafinance, Hao Xiong -- an executive with the firm’s investor relations department -- reportedly confessed to a dogged Japanese media that Ajisen may have accidentally “souped up” the healthy benefits of consuming its products.

“We recently claimed on our official website that a bowl of our noodle soup contains four times the calcium content of an equal volume of milk, and ten times the equivalent of ordinary meat, and that our soup mix contains essential proteins, amino acids, fatty acids, vitamins and 43 additional important nutrients. We can now say that these claims were perhaps over-generalizations and in some cases even exaggerations, but were unintentional and due to a computational error,” Hao said.

Following the embarrassment of having to admit to exaggerating the nutritional qualities of its famed and jealously guarded soup mix formula, Ajisen resolutely stuck to its guns on the veracity of its most recent financial claims. Photo: Ajisen

“We fully stand by our financial claims,” he said.

“Souped-up” soup?

Up until recently, visitors to Ajisen’s official URL would find the following claims:

“One bowl of our standard 360 milliliter ramen noodle soup contains 1,600 milligrams of calcium, and one kilogram of our concentrated soup mix can produce 100 bowls of soup.”

However, using this mathematical formulation, one bowl’s calcium content should actually only total 48.5 mg of calcium, and not 1,600 mg as the firm’s website originally claimed (before being ignominiously retracted).

‘Soup-gate’ yes; ‘earnings-gate’ no

Following the embarrassment of having to admit to exaggerating (albeit unintentionally) the nutritional qualities of its famed and jealously guarded soup mix formula, Ajisen resolutely stuck to its guns on the veracity of its most recent financial claims.

Just after the truth about the calcium content was revealed, Ajisen (China) Holdings immediately revised the wording on its official company website while adding the following mea culpa to remedy any bad taste left in the mouths of investors and consumers following the admission:

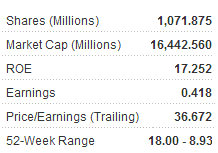

Ajisen now: 15.34 hkd

He added that the parent company had 102 restaurants in Japan, and an additional 499 shops overseas – mainly in Hong Kong and Mainland China.

“Ajisen (China) Holdings realized operating profit of 2.68 bln hkd last year, and our operating margins stood at 69.2%. We stand by these numbers,” Hao said.

See also:

AJISEN CHINA P/E Over 35x! What Analysts Now Say...

AJISEN: Gross Margins Were 69% Last Year!