WITH THE dramatic service breakdowns of the past few days, SMRT Corp is in hot soup.

As a result, the CEO, Saw Phaik Hwa, in particular, has been the subject of several media articles which brought up the question of whether she should resign.

While the service breakdowns are technical and customer service issues, it would be interesting to take a look at the financial and stock performance of the company.

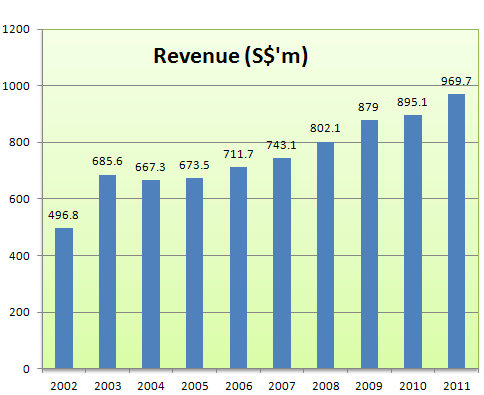

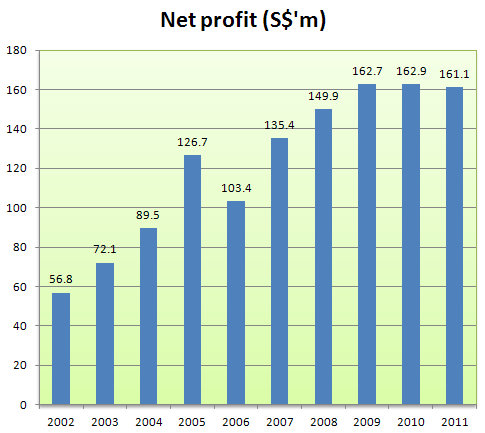

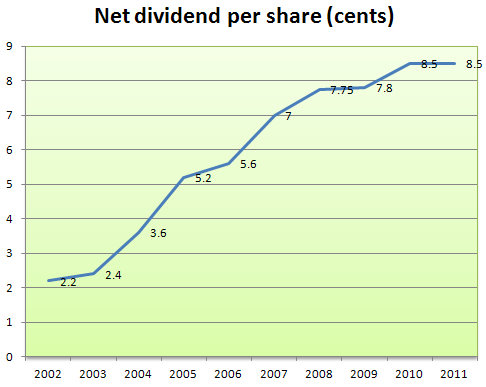

And, we found, that it has grown its revenue, net profit and dividends during Ms Saw's watch from 2002. (See charts below)

The stock price has tracked the business performance, having risen about 150% since the start of 2002 at around 72 cents and closing at $1.82 last Friday.

Add in the net dividends totalling 56.35 cents from FY03 (financial year ended March) to FY11, and the return rises to an excellent 230%. That would place it among the best investments available on the Singapore Exchange -- and, by the way, surprise investors who favour small caps for their higher growth potential.

At a stock price of $1.82, SMRT is a S$2.7 billion company whose stock currently trades at a dividend yield of 4.6%.

Based on the FY11 basic earnings per share of 10.7 cents, the stock trades at 17X PE.

However, the current FY12 is not looking great: Group revenue for 1HFY12 rose 6.8% to $514.2 million but net profit after tax decreased 18.0% to $68.9 million.

SMRT said it expected cost pressures particularly energy costs and staff and related costs to impact the Group’s performance in 3QFY12 and the next 12 months.

It said the profitability of the Group in FY2012 may not be maintained at the previous year’s level.

Actually, HDB is an example of nationalising public housing since it's a statutory board. When Dr Goh keng Swee was around, the policymakers could really afford quality and cheap housing. But now, things change not because also of the policy makers. of course, HDB used to operate at cost recovery but everything changed since 1994 or when Mah took over as HDB right now is also very profit-oriented.

In most countries, most transport companies tend to be in the loss as people there have the options to take cars and their land is big. In Singapore, the situation is contrastly different as our land is small and cars are expensive. No way can transport companies make a loss when over half of the population here rely on public transport everyday. so, if operate on a cost recovery basis, nationalising makes good sense, provided the policymakers want to do a good job.

80% payout ratio is too much... which means that majority of the fare hike doesn't contribute to the maintainence at all.

in my opinion, there could be another reason policymakers want to have a fare hike. since next yr projection is a slower growth, raising transport fare can artifically inflate the GDP figures to demonstrate growth. But this is a very bad way, because if raising transport fare, it will also affect other businesses as well and lower to middle class are the ones that suffer the most.

2. As for the 8.5 cent dividend payout, I think it's going to come down if maintenance expenses rise and eat into profits.

As Singapore is very small, public transport is an essential and concerns the daily livelihood of every Singaporean.

whether an oragnisation is efficient or not, it depends on the management running it. in my opinion, public transport should not be profit oriented. The increase in public transport fare affects the spending decision of many individuals and many small businesses. When Dr Goh Keng Swee was around, HDB could offer us cheap and efficient housing. That's an example of a good nationalisation. But why not? Maybe, the present leaders today are too obsessed with meaningless GDP growth and making money and they do not wish to offer housing at cost recovery basis. In my opinion, Ms Saw is not a suitable person to run an organisation like SMRT as she has no technical experience.

Ms Saw should just be sacked or give up her entire bonus salary for the year until the whole problem is resolved.

The arguing point is whether commuters are shareholders. No doubt that Saw has brought much values to the shareholders of SMRT but sadly, she did not improve the lousy system in SMART and LTA. It is a problem waiting to happen.

And I'd be happy to see SMRT's price get whacked because of this slight 'breakdown' problem.

I'm not that optimistic about the stock price.