.

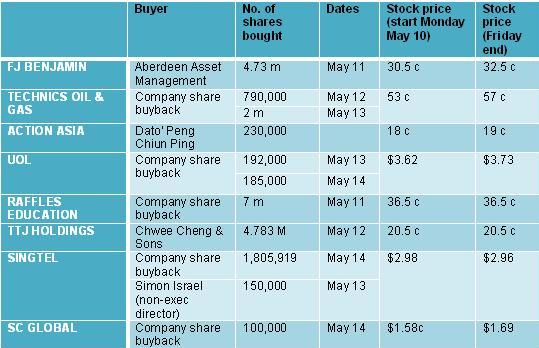

IN THE UNCERTAIN market of last week, several companies and insiders scooped up shares of their companies. Their stock prices stayed firm, ending the week either unchanged or higher.

Only in one case - SingTel - did the stock close marginally lower. SingTel had a major share buyback after reporting its Q4 net profit rose 12.3% to $1.02 billion.

* Raffles Education was a stand-out, buying 7 m shares at around 37 cents each, costing it about $2.6 million. The week before, Raffles had bought back 24 million shares.

Coming out of a blackout period prior to the release of their Q1 results, other companies and insiders who bought shares included:

Robin Ting, executive chairman, Technics Oil & Gas

*Technics Oil & Gas: It reported its 1H2010 results during lunch break of May 12, and on the same day, presumably after the lunch break, it went on to buy 790,000 shares. The next day, the company bought back 2 m shares.

Technics’ net profit for 1H2010 had surged 173% to S$5.24 million. Its revenue was S$52.08 million compared to S$56.85 million in 1HFY2009, but gross profit rose 20% to S$16.10 million and gross margin increased by 7.2 percentage points to 30.9%.

* Action Asia: Its non-executive chairman, Dato’ Peng Chiun Ping, 68, bought 230,000 shares last week. Prior to that, the parent company, Action Electronics, bought 607,000 shares.

The company’s Q1 result: Revenue rose 95% to S$68.9 million while its net profit surged 107% to S$6.97 million.

Action Asia is enjoying the expanded capacity of its new factory in Shenzhen for producing DVD players and digital photo frames for Philips.

The stock, at 19 cents, trades at a PE of 4X last year's earnings.

For more, read our recent story: ACTION ASIA, CHINA NEW TOWN: What analysts now say....

Action Asia's new 10-m unit capacity plant in Shenzhen.

Action Asia's new 10-m unit capacity plant in Shenzhen.

* FJ Benjamin: Aberdeen Asset Management was a buyer (4.73 m shares last week) but another fund, Arisaig Asia Consumer Fund, has been paring down its stake and ceased to be a substantial shareholder on April 20 after selling 9.77 m shares.

On May 10, FJ Benjamin reported net profit after tax rose to $3.0 million from a loss of $1.9 million in 3Q09, boosted by higher gross margins and favourable exchange gain of $2.8 million compared to a loss of $1.7 million before.

Recent story: INSIDER BUYING when the market weakened last week...