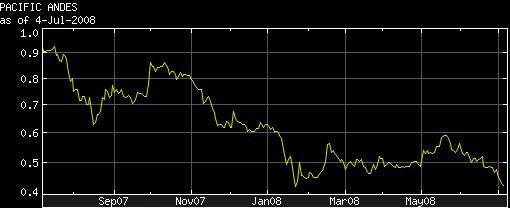

Below are reasons for my decision to buy, which led to my average cost being reduced from 65.5 cents per share to 54.75 cents per share.

This move was a calculated and well-thought one as I had been studying and reading up on the company and industry since my first purchase in March 2006, and have been waiting for Mr. Market to sell to me at an attractive valuation.

1) Pacific Andes is in an industry which has high barriers to entry. Only a few large players have access to fishery resources and many players are limited by the high capex required to operate a fishing SCM system and fishmeal plants.

Smaller players own a few vessels only and cannot achieve the economies of scale which will make their operations more efficient; thus they risk being bought out in an industry consolidation (which has been occurring during the last few years).

PAH also owns 64.1% of China Fishery Group (CFG) which is growing its trawling operations and has expanded its activities and fleet through its 3rd and 4th Vessel Operating Agreements. CFG has plans to grow its revenue and bottomline which will enhance the earnings flowing to PAH.

2) Dividend yield is attractive at my purchase price of 44 cents per share as the final dividend declared is 2.07 cents per share. This translates into a yield of 4.7% which is 5.3 times better than the prevailing interest rate offered by Maybank’s iSavvy account (0.88%) where I am stashing my opportunity fund.

3) Peru had recently, on June 28, 2008, introduced the ITQ (Individual Transferable Quota) system, and this will apply for the next 2 fishing seasons once all the applicable regulations and legislation are passed through. The benefits of this system are:

a] Ensuring the long-term sustainability of fish sources and preservation of the environment – this move will prevent over-fishing and is good for the long-term future of the industry;

b] Austevoll Seafood ASA and Copeinca have both commented on the ITQ as opposed to the old method using the “Olympic” system. Austevoll says that this will ensure a move away from an “expensive” way of harvesting to one which is more focused and will reap economies of scale and improvements in the quality of raw materials and finished products.

This would translate into higher prices for the industry overall as higher prices accompany higher quality. Copeinca has also commented that it envisions a 30-40% increase in EBITDA as a result of greater efficiencies in fishing processes and deployment of vessels (in a separate press release). However, one small downside is the imposition of a new fee of USD 1.95 per ton of fish unloaded which is to be set aside for the fisherman’s retirement fund (this also helps to build loyalty among the fishermen and minimizes strikes and riots which could disrupt operations);

c] The new ITQ system makes it easier to schedule and plan for vessels to be allocated to various fishing grounds as it is no longer a “mad rush” to fish as much as you can before the season ends and the quota is reached. Thus, this benefits all players within the industry as they can now selectively deploy their vessels and schedule them for maximum efficiency, further enhancing economies of scale.

4) In the last 2 quarters (3Q 2008 and 4Q 2008), PAH has achieved better efficiencies in terms of lowering its cost of goods sold (COGS) with respect to its revenues. The growth of revenue is greater than the increase in COGS, which implies economies of scale from the Peruvian acquisition of fishmeal plants and vessels should be kicking in and showing its effects.

For China Fishery’s 1Q 2008 financials, the results are very dramatic in that revenues dropped 2% while COGS dropped 42.3%. This shows the dramatic efficiencies being achieved for CFG with respect to its new fishmeal business as well as trawling operations. The ITQ system should help to enhance this efficiency and make it even more pronounced, but this will take time (probably 2-3 years).

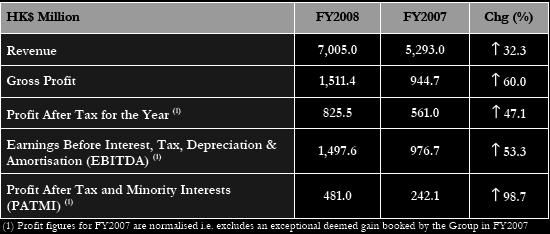

5) Valuations are attractive as PAH is only trading at a historical PER of 6.2 times (using net profit attributable to shareholders of HK$481 million @ 1:5 divided by share capital of 1.35 billion shares to get EPS of S$0.0713). Compared to global peers such as Copeinca which are trading at 10-12x, this makes Pacific Andes under-valued (perhaps due to the China inflation factor depressing the valuations of many S-shares listed on SGX, regardless of the nature of the business or inherent characteristics of the company).

6) Management has a good track record and understanding of the business and they have built up many years of growth for the company by using strategies to grow their fleet organically (through fleet enhancements) and through acquisitions. It is because of this track record that I have confidence that management can steer through any rough patches (which any normal business will encounter). Many Chinese companies have just come into the market (in 2 to 3 short years of operation) and hence lack a good track record to justify purchase.

7) Management is planning to add a new revenue stream from July 2008 by deploying 3 upgraded super-trawlers to South Pacific to fish in Chile. They will target a new species (Mackerel) and a new market (South Africa). This will add to the company’s top line and hopefully, bottom line as well.

8) The financial controller, Mr. Dennis Chan, has mentioned in an interview that PAH intends to increase its investment in Peru, though he did not give details due to disclosure confidentiality requirements. The fishing industry there is still very fragmented (according to a discussion with him during CFG’s AGM) and there are many opportunities for PAH to acquire smaller players in order to boost its fleet.

9) Even though a key risk is bunker costs rising as a result of record high fuel prices, this is an industry which can raise prices without affecting demand too much as it is controlled by a few large players, and fish are part of the staple diet of much of the world’s population and also a good source of protein.

Hence, I see short-term price pressures which may push down net margins due to high fuel costs; but the trend for fish and fishmeal/fishoil prices is upwards over time, due partly to food inflation and rising consumption of fish by the world. In the long-term, I believe this risk will be mitigated.

10) PAH has always had high gearing, and finance costs are a major source of expense which will eat into net margins. However, CFG and PAH are in a business with high operational cash inflows, as observed by their financials over several quarters (adjusted for some timing difference in recognition of receivables and inventories).

Thus, I see this gearing as merely assisting them in aggressively expanding their fleet, which they can then use to generate free cash flow to pay off their loans, bonds and notes gradually. As mentioned in a previous posting on leverage, it is difficult to determine the optimal amount of leverage required for any company, unless we are keenly aware of how that industry works. For example, Olam is aggressively taking on debt in order to finance acquisitions which are earnings accretive to its business, and which help it to vertically integrate. Thus, it can be argued that high gearing is not necessarily bad as long as the company knows how to properly manage it and not to let it get out of hand.

11) As a result of high finance costs and record-high oil prices (US$146 as at time of writing July 3, 2008), PAH and CFG could see short-term margin squeeze which would affect profits in the next few quarters. However, taking a long-term perspective, there is much to look forward to with regards to their business model and expansion plans as Management has a clear vision of what it wishes to achieve.

Instead, it is adopting a more cautious stance amidst the current economic slowdown and choosing to conserve cash while trawling for quality opportunities to increase the company’s asset base through acquisitions of vessels or plants.

This article is reproduced with the kind permission of Musicwhiz, whose blog can be accessed here.

30-something Musicwhiz works in the investment industry and adopts a value investing philosophy based on the teachings of Benjamin Graham, Warren Buffett and Philip Fisher.