- Posts: 55

- Thank you received: 0

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

rickers maritime

16 years 4 months ago #1781

by peter lee

rickers maritime was created by peter lee

hello , i am holding this counter. may i know what is your view on this counter? which should i do ? (either hold, sell or buy more of this counter) thank you

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 4 months ago #1782

by Dongdaemun

Replied by Dongdaemun on topic Re:rickers maritime

some people i know hv sold off Rickmers after it announced a cut in DPU a month back - ard there. it is a negative for investors who are looking for a good yield . rickmers faces more challenges than other ship trusts - pacific ship trust looks good. good luck. at this price, difficult to say if one shd sell or just put away in drawer until better times return for the shippping biz.

Please Log in to join the conversation.

16 years 4 months ago #1784

by peter lee

Replied by peter lee on topic Re:rickers maritime

Thank you for the comment. according to what i know, the shipping reit CEOs together have assured public before that they can pull through this crisis. this counter has high gearing - wonder whether it will go suspended. btw, i hv enough suspended counters and no room to keep an additional worthless paper. gd night.

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 4 months ago #1787

by Dongdaemun

Replied by Dongdaemun on topic Re:rickers maritime

rickmers up 2 cents today - closed at 39 cents! the selling seems done for now, & long-term investors have picked up the shares.

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 4 months ago - 16 years 4 months ago #1797

by Dongdaemun

Replied by Dongdaemun on topic Re:rickers maritime

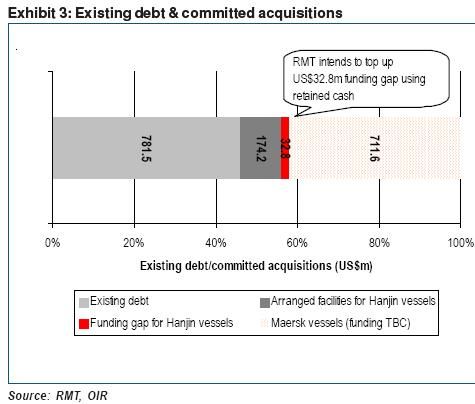

peter, did u today read abt Pacific Shipping Trust\'s good news ? that\'s why the stock is up slightly now. i think Pacific is a reasonably good shipping trust, cos they dont hv refinancing issues, and they are accumulating cash for opportunistic acquisitions. rickmers is a different animal - weakened cos of it loan challenges, and a while back it cut DPU by 70%, which is not even significant enuff considering its challenges. its Q3 results shld be coming soon, and that may be a useful time to check your compass again. at 39 cts, the stock seems to be holding up reasonably well. maybe longer-term believers are into the stock. But the debt and commitment to acquisitions add up to USD1.7 billion! Hell of a lot of leverage which isnt a great thing at this time.

Last edit: 16 years 4 months ago by Dongdaemun.

Please Log in to join the conversation.

16 years 4 months ago #1798

by erelation

Replied by erelation on topic Re:rickers maritime

Hi, I totally agree that Pacific Ship Trust is a better bet with 12% dividend yield which is more sustainable and without refinancing problem. I am monitoring the counter too.... looking for it to cool off before buying in.... Cheers erelation

Please Log in to join the conversation.

Time to create page: 0.231 seconds