|

In the ongoing boom in the construction industry and regional data centres, the beneficiaries span multiple industries and roles. Tai Sin has been involved in big-name projects, some of which are highlighted on its website as follows:

FY2025 HighlightsReflecting the buoyant construction and data centre sectors, Tai Sin delivered a stellar FY2025 (ended June). |

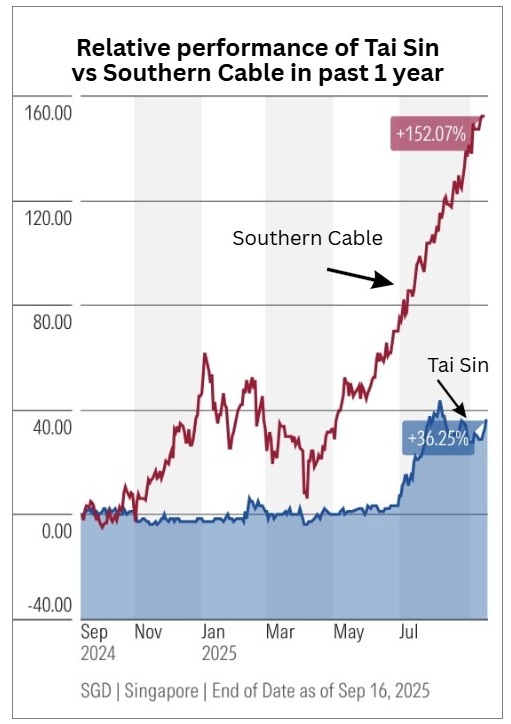

Despite its low profile, with no analyst and media coverage (unlike construction stocks upstream in the supply chain such as Pan-United, BRC Asia, and Hong Leong Asia), Tai Sin's stock price has gained a commendable 33% year-to-date.

Most of the gain took place from July, raising the stock's PE to 9.2X. How does this look?

Without a comparable company on the SGX, let's look across the Causeway.  Source: Morningstar

Source: Morningstar

Southern Cable's Performance

On Bursa Malaysia is Southern Cable Group, which is benefiting from demand for high-voltage cables in data centres, renewables and and rail projects.

Southern Cable's trailing 12 months (July 2024–June 2025) showcased strong growth, with revenue hitting MYR 1.53 billion (up ~13% YoY on a comparable basis).

Net profit soared to MYR 102.86 million (~42% YoY increase).

Despite profit gains, free cash flow was negative at MYR 44 million due to capex for capacity expansion.

| Comparing Tai Sin and Southern Cable |

|

Metric |

Tai Sin Electric |

Southern Cable |

Notes |

|

Revenue |

480.7 |

1,530 |

Tai Sin is slightly ahead. |

|

Net Profit |

25.9 |

102.9 |

Southern's absolute profit higher (~SGD 31M equiv.), but Tai Sin's 78% YoY vs. 42% shows catch-up. |

|

EPS |

0.0564 SGD |

0.90 MYR |

Southern's trailing PE is 23.3X while Tai Sin's 9.2X. The former's market cap is RM2.1 billion (S$650 m) versus Tai Sin's S$242 million. |

|

ROE |

11.1% |

21.9% |

Southern excels in returns, leveraging equity better. |

|

Debt/Equity |

0.41 |

0.59 |

Both prudent. |

|

Operating Cash Flow |

-5.1 |

25 (est.) |

Southern positive; Tai Sin's negative on higher working capital needs. |

| Dividend Yield | 4.5% | 1.0% | Tai Sin clearly has a higher yield |

Its strengths include ISO certifications and iconic project wins Singapore. Southern, listed in 2020, focuses on specialized manufacturing for power, telecom, and fire-resistant cables, emphasizing smart tech and in-house testing. Opportunities abound for both in ASEAN's green energy shift. Risks include swings in the price of copper price, the main input material for making electrical cables. Tai Sin hedges part of its copper exposure. Southern Cable appears as a growth stock with stronger margins and higher ROEs, which suits growth investors. Tai Sin, at 9.2X PE or roughly half of Southern Cable's and offering a higher dividend yield of 4.5%, suits value seekers eyeing meaningful capital growth too. As new data centres and colossal infrastructure icons like Changi Terminal 5 and the Tuas Mega Port get built, they will pulse with life, energized likely by Tai Sin Electric's robust cables. |

→ Tai Sin's FY2025 results release is here. → Tai Sin's FY2025 results release is here.→ See also: TAI SIN ELECTRIC: Construction & Data Centre Boom Boosts This Company's Cable Business But It Has to Navigate Copper Risks |