|

CH Offshore Ltd., established in 1976 and headquartered in Singapore, owns and charters offshore support vessels (OSVs) for the oil, gas, and renewables industries.

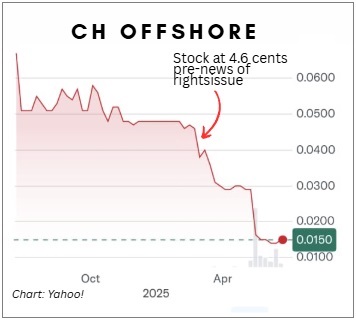

In Feb 2025, CH Offshore launched a 2-for-1 rights issue, offering new shares at S$0.01 each—a steep discount to the pre-announcement price of S$0.046. Results of the issue released on 18 June showed it was heavily oversubscribed, with only 115 million shares left unsubscribed, while excess demand reached 1.1 billion shares. As a result, the company’s free float rose from 11% to 45%, significantly improving liquidity and broadening the shareholder base. The remaining 55% is owned by Singapore-listed Baker Technology (whose $111 million market cap, by the way, stands way below its cash level, which is a story for another time). |

| Post-Issue Financial Position |

- Market Valuation:

- Current share price of $0.015 values the company at $31.5 million (2.1 billion shares × $0.015).

- Net cash stands at $16 million, representing half the market cap.

- Current share price of $0.015 values the company at $31.5 million (2.1 billion shares × $0.015).

- Book Value Analysis:

- New book value = $0.032 per share, placing the current price at a 53% discount.

- Historically, shares traded at a 40% discount to book value pre-rights ($0.046 vs. $0.077 book value).

- New book value = $0.032 per share, placing the current price at a 53% discount.

- Free Float Impact:

- Public float surged from 11% to 45% post-rights, enhancing liquidity.

- Public float surged from 11% to 45% post-rights, enhancing liquidity.

The capital raise generated $14 million for the company, yet market cap declined from $32.3 million (pre-rights) to $31.5 million despite the cash injection.

The rights issue strengthens CH Offshore's ability to seize opportunities to enhance its vessel fleet:

|