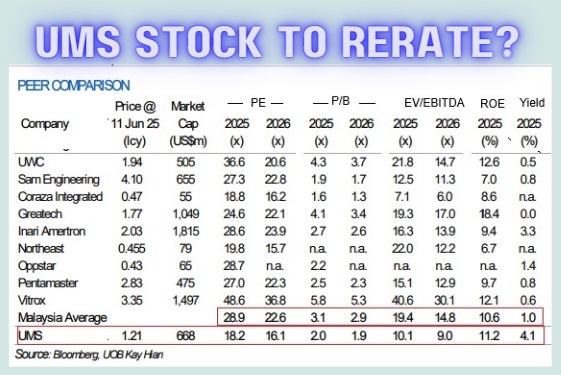

• Semiconductor firm UMS Integration is about to do something not seen before—at least not in a long time. Late next month, the Singapore listed company will achieve a secondary listing on Bursa Malaysia. • UMS provides front-end semiconductor equipment, supplying components and assembling chambers for customers, who make machines to produce wafers -- essential to create chips for devices like laptops, phones, and Artificial Intelligence systems. • Year-to-date UMS stock is up around 20% (from $1.05 to $1.23). Still, a big valuation gap remains compared to Malaysian peers like UWC and Sam Engineering trading at much higher multiples (see table):

• To drum up local interest, UOB Kay Hian organised a non-deal roadshow for its Malaysian institutional clients. UMS operates high-volume manufacturing in Malaysia and high-end engineering in Singapore.

|

Excerpts from UOB KH report

Analyst: John Cheong

UMS Integration (UMSH SP)

Key Takeaways From Malaysia NDR

| We hosted UMS for an NDR with our institutional clients in Malaysia on 11 Jun 25. Key takeaways include: a) UMS is seeing healthy orders from its new customer and maintains its revenue guidance of 10% growth qoq in 2Q25, b) dual listing in Bursa Malaysia is on track for completion in late-July 25 and UMS hopes that its valuation gap will narrow vs its Malaysia peers, and c) UMS is increasing market engagement ahead of its dual-listing. Maintain BUY and target price of S$1.32. |

| WHAT’S NEW |

• Seeing healthy orders from new customer and maintaining revenue guidance of 10% growth qoq. UMS Integration (UMS) continues to see healthy orders from its new customer while the order from old customers remains stable.

|

UMS |

|

|

Share price: |

Target: |

UMS is encouraged by the strong order flow from its new key customer as it seeks to divert its US supply source to Asia.

Also, UMS revealed that its capability to complete majority of the manufacturing processes in house such as plating, anodizing, brazing, welding, chemical cleaning, etc have helped to maintain healthy margins and enable it to achieve prompt delivery to its customers.

In addition, UMS has not seen any impact from the US trade tariffs as semiconductors are exempted from the tariffs. UMS has several measures in resolving its labour issues including training foreign workers and enhancing its staff retention strategy.  Andy Luong, chairman and CEO of UMS -- and JEP Holdings. NextInsight file photo.• Dual-listing in Bursa Malaysia is on track for completion in late-July 25, and the valuation gap with Malaysian-listed peers should narrow after that. UMS’s dual listing in Bursa Malaysia is on track to start in late-July 25.

Andy Luong, chairman and CEO of UMS -- and JEP Holdings. NextInsight file photo.• Dual-listing in Bursa Malaysia is on track for completion in late-July 25, and the valuation gap with Malaysian-listed peers should narrow after that. UMS’s dual listing in Bursa Malaysia is on track to start in late-July 25.

After that, UMS hopes that its valuation gap with its Malaysian peers could narrow.

UMS is currently trading at around 30% discount vs its Malaysian peers, at 2026 PE of 16x vs 23x. Key peers include UWC and Sam Engineering.

UMS also highlighted that its current dividend yield of 4% and frequent dividend payment on a quarterly basis are also more appealing compared to its Malaysian peers.

We also understand that majority of the institutional funds in Malaysia have a mandate of investing only in Bursa-listed stocks.

Moreover, UMS will engage the service of market makers at the initial phase to help enhance the liquidity of Malaysia-listed entity before more shares are being transferred from Singapore to Malaysia.

• Increasing market engagements ahead of dual listing. To improve its market awareness among the Malaysian investment community, it seeks to increase market engagement, including conducting more non-deal roadshows, plant visits, hosting seminars with retail investors, increasing media coverage and engaging with social media influencers.

• Maintain BUY and target price of S$1.32, based on an unchanged PE-based valuation of 17.5x 2026F EPS.  John Cheong, analystOur valuation is pegged to 1SD above UMS’s historical mean PE to reflect the better production ramp-up from UMS’ new customer and improvement in its earnings quality from new contributions from its new customer. John Cheong, analystOur valuation is pegged to 1SD above UMS’s historical mean PE to reflect the better production ramp-up from UMS’ new customer and improvement in its earnings quality from new contributions from its new customer. SHARE PRICE CATALYST • Higher-than-expected factory utilisation rates. • Return of orders for aircraft components to benefit subsidiary, JEP Holdings. • Better-than-expected cost management. |

Full report here.