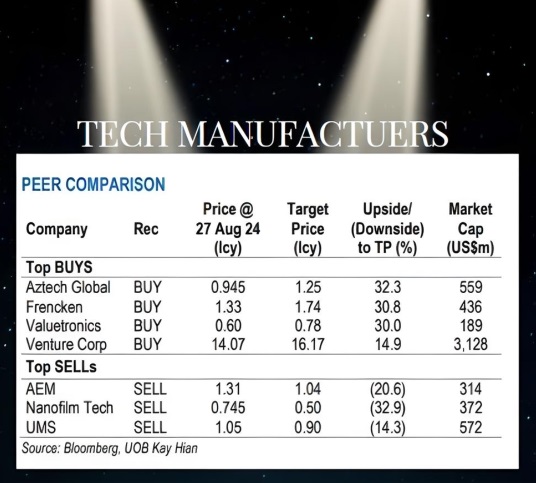

• Tech stocks are often characterized by high growth potential and volatility. The tech sector has gained further allure for investors with the emergence of Artificial Intelligence. • Within the tech sector is a very broad range of players -- from software to robotics to telcos to hardware of all sorts. • Listed on SGX are 7 tech manufacturers which are covered by UOB Kay Hian, which has just analysed their 1H24 earnings. Bottomline: Their performance ranged from very promising to very disappointing. • No surprise then that UOB KH has 4 "buys" and 3 "sells". Read more below ..... |

Excerpts from UOB KH report

Analyst: John Cheong

Tech Manufacturers – Singapore 1H24 Review:

Crucial To Be Selective; Top BUYs: FRKN, VMS; Top SELL: AEM

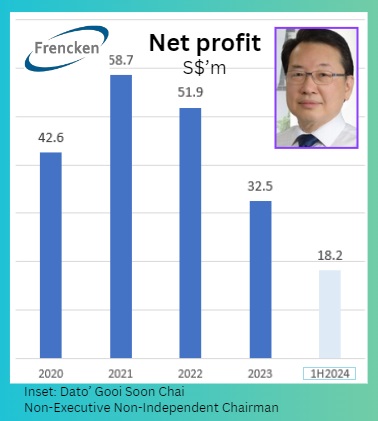

| Two-thirds of the tech manufacturing stocks under our coverage reported weaker-than-expected 1H24 earnings, except for Frencken and Aztech, due to weak customer demand (AEM, Nanofilm, Venture) and slow ramp-up of new plant (UMS). Our top picks are Frencken and Venture given their positive outlook for sequential earnings growth, especially for Frencken which is seeing strong orders from ASML. We also have BUY calls on Valuetronics and Aztech, and SELL ratings on AEM, Nanofilm and UMS. Upgrade the sector to OVERWEIGHT. |

WHAT’S NEW

• Two-thirds of tech manufacturing stocks missed our 1H24 earnings estimates. All the tech companies under our coverage have just released their results and it has not been a good season, with two-third of the stocks missing our earnings estimates.

This was mainly due to weak customer demand (AEM, Nanofilm, Venture) and slow ramp-up of new plant (UMS).

On the other hand, Frencken and Aztech met our expectations due to robust customer demand.

• Earnings misses were due to weak customer demand: expect further downside especially for AEM given its weak guidance and challenging outlook for Intel.

A key takeaway from the 1H24 results season is that each tech manufacturing company is going through their own earnings cycle and facing challenges due to issues with their major customers, especially for AEM and Nanofilm which reported losses in 1H24.

For AEM, we note that its performance was impacted by Intel’s weak PC demand and inability to gain traction in the AI-related sector, which has impacted its financial performance and results guidance.

Recent negative developments from Intel such as management departure and delay in completion of new plants suggest more problems ahead.

For Nanofilm, it has it is encountering weak demand for its industrial equipment business unit due to a soft market for capex spending.

On the other hand, UMS did not fare too badly despite the earnings miss, reporting a decent 2Q23 earnings of S$9.3m (-20% yoy/-5% qoq), as it is overcoming the issue of reduced market share from its existing customer AMAT as well as slower-than-expected ramp-up of new customer, Lam Research.

| • Given the huge disparity in financial performance, it is crucial to be selective: Frencken and Venture are our top BUY picks. We like Frencken because its outlook has turned more bullish with expectation of better revenue in 2H24 vs 1H24, mainly driven by the semiconductor segment.  In addition, in 2Q24, Frencken encountered delays in shipments for some sizeable ASML orders which will be recognised in 3Q24, indicating a strong qoq earnings growth. In addition, in 2Q24, Frencken encountered delays in shipments for some sizeable ASML orders which will be recognised in 3Q24, indicating a strong qoq earnings growth. Margins are also expected to increase due to higher utilisation. Lastly, Frencken still has ample capacity to take on more orders. On the other hand, Venture has maintained its expectation that its revenue will be stronger in 2H24 compared with 1H24, and Venture remains proactive in pursuing multiple initiatives to further improve its performance in 2H24. These include the onboarding of new customers, new product introduction activities and supporting customers with geopolitical risk mitigation strategies. |

Full report here.