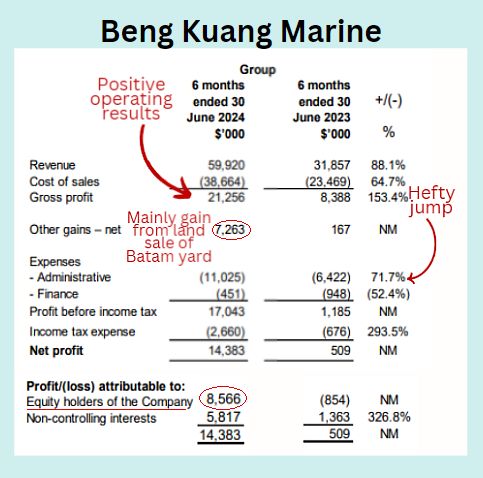

• It's rare that an analyst initiates coverage of a small-cap with a positive report, only to slash the target price just 4 weeks later. But that has just happened to Beng Kuang Marine whose stock price surged this year, thanks to a robust oil and gas industry. • The trigger for the 38% target price cut this week by Maybank Kim Eng (from 47 cents to 29 cents): Beng Kuang's 1H2024 core net profit came in below expectations because its admin expenses soared 72% to $11.0 million.  Beng Kuang (current market cap: S$39 million)said the admin expense increase was largely attributable to "higher remuneration and salaries due to increase hiring at our IE business and bonus provisions which were in line with the Group’s improved performance." "IE business" refers to Infrastructure Engineering -- maintaining FPSOs to ensure their hull integrity and overall operational safety. The bulk of the group's revenue comes via its 51% subsidiary, Asian Sealand Offshore and Marine Pte Ltd (ASOM). • Out at sea are FPSO (floating production storage and offloading) vessels that process oil from nearby oilfields, and store it until it can be transferred to a tanker. See Beng Kuang Marine's commentary on its FPSO business in 2023:  Read excerpts of Maybank Kim Eng's update below ... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Beng Kuang Marine (BKM SP)

2H likely to be stronger

BKM’s 1H24 revenue increased 88% YoY to SGD59.9m. |

| Robust FPSO-related activities boost 1H24 revenue |

BKM’s 1H24 revenue surged 88% YoY to SGD59.5m, mainly due to the strong performance by its 51%-owned subsidiary ASOM, which boosted IE’s organic revenue by 142% YoY in 1H24.

|

BENG KUANG MARINE |

|

|

Share price: |

Target: |

We expect 2H24E to likely replicate or perform even better than 1H24 due to the robust tailwind in the FPSO sector.

However, much higher than expected admin expenses hampered operating margins but we believe this will improve going forward.

| Bonus warrants of 3 for every 10 shares held |

BKM proposed a 3-year warrant on the basis of 3 bonus warrants for every 10 existing ordinary shares held with the right to subscribe at SGD0.22/share, exercisable 6 months from the date of listing of the warrants and expiring 36 months from the same date.

Total net proceeds could amount to SGD13.02m.

|

Full report here.