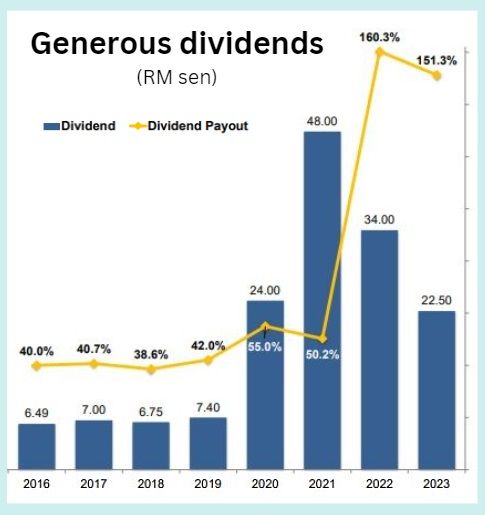

Riverstone (market cap: S$1.15 billion) manufactures gloves for the cleanroom and healthcare sectors. Riverstone (market cap: S$1.15 billion) manufactures gloves for the cleanroom and healthcare sectors.• In recent years, Riverstone Holdings has proven to be an outperformer among glove producers. Not just in terms of profitability. Its dividends too have been a strong stream. For 2023, the dividends totalled approximately S$96 million. • 2024 is looking brighter with a recovery in its semiconductor clients and Riverstone's greater emphasis on higher-margin healthcare gloves. As a result, Riverstone could deliver a dividend yield of ~10% based on the current stock price of 79 cents, says UOB Kay Hian's latest report. • Riverstone had a healthy cash balance of RM$875.4m as at end-2023 and reported RM249 million in net operating cashflow for 2023.  Riverstone made exceptional profits during the Covid years 2020 and 2021 and bumped up its dividends. Post-Covid, the dividends continued to be much higher than pre-Covid. Riverstone made exceptional profits during the Covid years 2020 and 2021 and bumped up its dividends. Post-Covid, the dividends continued to be much higher than pre-Covid. • The analysts also lay out their case for why Riverstone's profit potential looks even more resilient than ever. |

| Riverstone Holdings - BUY (John Cheong & Llelleythan Tan) |

• Riverstone's cleanroom gloves, which contribute around 80% of earnings, are expected to see a recovery in demand, driven by new clients onboarded in the preceding year and improvement in the semiconductor industry in 2024.

|

RIVERSTONE |

|

|

Share price: |

Target: |

According to International Data Corporation (IDC), the semiconductor sales market is expected to recover with a 20% growth rate in 2024.

This is also supported by the SEMI World Fab Forecast reporting 42 new projects in 2024, up from 11 in 2023.

• Benefitting from higher-margin customised healthcare gloves. Riverstone is in the midst of demolishing its 10-year-old production lines to build six newer lines for customised products that will be operational from 2H24.

This has allowed it to expand its gross margin substantially, as customised gloves fetch approximately 30% gross profit margin, around six times that of generic gloves.

Moving forward, higher demand for customised healthcare gloves will drive higher margins for Riverstone.

• Potential dividend increase backed by strong balance sheet. Pending approval, Riverstone declared a special interim dividend of 5.0 sen and a final dividend of 7.5 sen.

Together with the first two interim dividends of 10.0 sen, 2023 total dividend totals to 22.5 sen (vs 34.0 sen in 2022), implying a payout ratio of 151.3% and dividend yield of 9% for 2023.

Backed by its healthy cash balance of RM$875.4m and operating cash flow, we expect 2024-26 payout ratio to be maintained at 140% to reward shareholders.

This translates to an attractive dividend yield of 10% for 2024.

John Cheong, analyst• Maintain BUY with a PE-based target price of S$0.88, pegged to 17.6x 2024F PE, or 1SD above the long-term historical mean. John Cheong, analyst• Maintain BUY with a PE-based target price of S$0.88, pegged to 17.6x 2024F PE, or 1SD above the long-term historical mean. We think that Riverstone stands to benefit from its higher-margin customised glove offerings and the improving cleanroom glove demandsupply dynamics. SHARE PRICE CATALYSTS • Events: a) Higher-than-expected demand for cleanroom and healthcare gloves, and b) higher dividend payouts. • Timeline: 3-6 months. |

See also: RIVERSTONE: While peers continue to bleed, it makes lots of profit -- & pays dividends