Not just drones: Thakral now also has a thriving joint venture called GemLife developing homes for retirees in Australia.

Not just drones: Thakral now also has a thriving joint venture called GemLife developing homes for retirees in Australia.

|

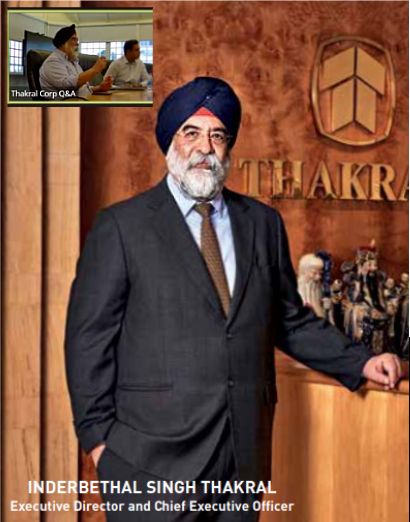

When it comes to business, change is inevitable, declares Inderbethal Singh Thakral, the chief executive officer and executive director of Thakral Corporation. Since he joined the family business more than 40 years ago in 1975, it has undergone several evolutions.

Beginning as a textile store in 1905, it grew into a reputable trading firm in the sector before diversifying into consumer electronics distribution in China in the 1980s. Its listing on the Singapore Exchange’s main board in 1995 was the country’s biggest listing of the year. |

||||||||||||||||||

After a few false starts, the group found its footing again in distributing beauty and fragrance products to an increasingly wealthy Chinese population eager and able to spend on them. It is now a diversified conglomerate that focuses not just on personal care products and at-home beauty devices but also tech gadgets, from drones and accessories which include cameras.

Its distributorship spans fragrances from Ralph Lauren and Maison Margiela, hair care products from John Masters Organics and a variety of other brands mainly in Greater China, as well as drones, cameras, gimbals and accessories from DJI, the world’s largest drone maker. It has also invested in real estate, including commercial properties in Japan.

Even before Bethal became Thakral’s chief executive in 2016, he played an instrumental role in the group’s listing and repositioning, and in broadening its income streams beyond China with investments in other markets such as Singapore, Japan and Australia. He is a member of its investment committee and a director of its subsidiaries in China, Hong Kong and Singapore.

“If there’s one thing that I’ve learned, it’s that you have to keep evolving if you want to survive. Things change, and you have to be prepared to change along with them. Don’t cling on to the past. You have to move forward,” he says.

| Of drones and over-50s lifestyle resorts |

Today, the group continuously looks for new business opportunities to boost its earnings and fortify its resilience. “We try to see what are the sectors that are likely to grow over the next 20 years and even longer,” he explains.

One of its more recent bets is on drones and related accessories and components. It has become a regional distribution partner for DJI, winning exclusive distributorship for the latter’s commercial and consumer drones in South Asia.

| “I am very excited by the future of our drone business. There is no end to what we can do in this space.” |

“We saw the potential in drones very early on and got in the game quickly. This has brought in strong sales for us.”

Bethal points to drones’ multitude of possible applications. “We can go into mining, security, analytics and more.”

In the Maldives, Thakral has sold DJI’s Agras T30 agricultural drones to an organisation using it to safe-guard trees in a more effective and eco-friendly manner.

Building on the momentum, Thakral has invested in Skylark Drones, a start-up specialising in integrating drones in workflows in different industries. “I am very excited by the future of our drone business. There is no end to what we can do in this space.”

Since 2016, the group has reaped dividends from another shrewd investment, in over-50s lifestyle resorts in Australia. “We were doing business there when my father started to think about its ageing population, and how more seniors were moving to retirement communities.”

Aiming to capitalise on the trend, Thakral found the perfect partner in the Puljich family, which had been constructing and managing over-50s lifestyle resorts in Australia for over three decades under the Living Gems brand. The two companies formed a joint venture, established a new GemLife brand and quickly launched two resorts in Queensland.

The collaboration now has 11 projects underway in Queensland, New South Wales and Victoria that have delivered, or are in the process of delivering almost 3,000 homes. Bethal notes the venture’s immense prospects: “You have ageing populations everywhere, including in Singapore, Japan, Thailand and Hong Kong, and those are only some of the ones in our region.”

| Having an ear to the ground |

To keep its finger on the pulse of developments, Thakral has regular brainstorming sessions at the divisional and team levels. “We discuss where we are, what’s working and what’s the road forward. How do we keep ahead of trends to understand what’s coming, and how should we evolve to stay current?”

“These days, with things like artificial intelligence and blockchain, changes in sectors happen in three months, not three years. You don’t want to be blindsided and left behind.”

| “We discuss where we are, what’s working and what’s the road forward. How do we keep ahead of trends to understand what’s coming, and how should we evolve to stay current?” |

Thakral maintains close relationships with its suppliers, who often have insight into business and consumer trends three to four years ahead of time due to their work.

It also invests in start-ups like Skylark Drones to learn from their founders. In addition, it has strategic minority stakes in Fraction, a start-up providing a blockchain platform to enable trading, investment and secure ownership of fractions, which are portions of a company stock or other asset that are less than a full share.

With the goal of impact investing, especially in the field of climate change, it is a cornerstone investor in BillionBricks, a company that addresses both climate change and affordable housing challenges by constructing sustainable and cost-effective homes.

“In my experience, you can discover a lot by talking to the founders, even during the process of deciding which start-ups you want to invest in,” Bethal highlights.

With the accelerating pace of technological and other advances, he believes that Thakral will continue to change in the years to come. He says: “What’s the next hot sector? Where should we put our money? We want to create more and more value, not just for the company but for people too.”

About Thakral Corporation Ltd

Thakral Corporation Ltd is listed on the SGX Mainboard since December 1995. The Group’s core business comprises a growing investment portfolio in Australia, Japan and Singapore. Its investments in Australia include the development and management of over-50s lifestyle resorts under the GemLife brand, a joint venture with the Puljich family. Its Japanese investment portfolio comprises landmark commercial buildings in Osaka, the country’s second largest city. The Group also invests in the management and marketing of leading beauty, fragrance and lifestyle brands in Asia. Additionally, the Group makes strategic investments, including as a cornerstone investor or participating in early funding, in new economy ventures which complement its existing business relationships and network as well as harness potential synergies and explore new business opportunities.

The company’s website is https://www.thakralcorp.com/

About kopi-C: the Company brew

This article was first published in kopi-C, a regular column by SGX Research in collaboration with Beansprout (https://growbeansprout.com), a MAS-licensed investment advisory platform, that features C-level executives of leading companies listed on SGX. These interviews are profiles of senior management aimed at helping investors better understand the individuals who run these corporations. Written by Feng Zengkun.