note: Yinda Infocomm has since changed its name to ToTm Technologies and continues to be listed on the Singapore Exchange.

| There's a business that relatively few investors in Singapore have heard of: biometrics. A low-profile Singapore listed company (market cap: S$27 million), Yinda Infocomm, is about to step into that business. To start the story a little way back, in 2009, India started the world’s largest biometric ID system, the Aadhaar program. The programme has since collected iris scans and fingerprints of 1.2 billion citizens, giving each person a 12-digit identity number on a card.  Rahul Parthe: Quoted in CNN article: Think your mask makes you invisible to facial recognition? Not so fast, AI companies sayRahul Pathe, the chief architect behind that program, later went on to set up a private company which successfully won a tender for a biometrics project in Indonesia in 2011. Rahul Parthe: Quoted in CNN article: Think your mask makes you invisible to facial recognition? Not so fast, AI companies sayRahul Pathe, the chief architect behind that program, later went on to set up a private company which successfully won a tender for a biometrics project in Indonesia in 2011. He is the controlling shareholder of International Biometrics (InterBIO), which was incorporated in Singapore and controls the company that won the Indonesian project. According to its LinkedIn page, PT International Biometrics Indonesia has been maintaining the Indonesian national biometric system. It has the world's second largest biometric national ID database (after India) and was targeted to reach 200 million people by 2020. |

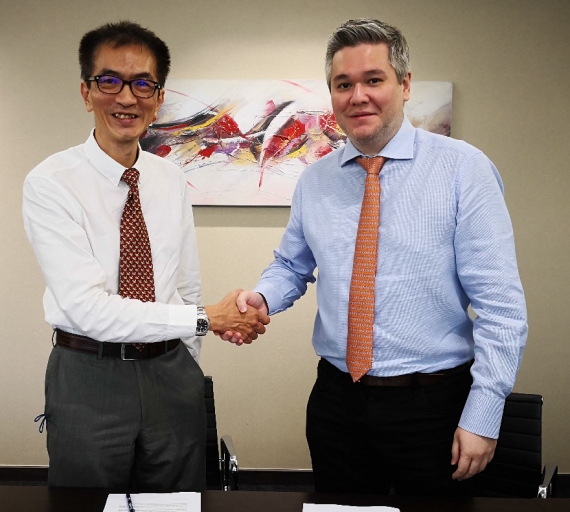

L-R: Gordon Tan, Executive Director of Yinda Infocomm | Pierre Prunier, Chief Strategy Officer of InterBIO. Photo: Company

L-R: Gordon Tan, Executive Director of Yinda Infocomm | Pierre Prunier, Chief Strategy Officer of InterBIO. Photo: Company

Today (2 Dec), Yinda Infocomm has signed a joint venture agreement with InterBIO to develop and expand the identity management, biometric security and software solutions businesses globally.

With Yinda Infocomm holding a 51% stake, the Singapore-incorporated joint venture company has an initial issued and paid-up capital of S$1 million.

The regions of potential business exclude Indonesia and the Philippines where InterBIO currently operates on an exclusive basis.

Now, the JV agreement needs a plank to stand on: InterBIO may terminate the agreement if Yinda Infocomm does not acquire at least 25% of InterBIO within 4 months from the date of the JV agreement.

The potential acquisition of InterBIO shares had been talked about earlier between the two parties.

On 2 Nov 2020, Yinda Infocomm had announced the proposed acquisition of up to 51% of the ordinary shares in InterBIO.

In an update, Yinda Infocomm said it is still in the midst of performing the necessary due diligence process on InterBIO's business.

Should the acquisition by Yinda Infocomm of InterBIO materialise and the JV agreement is not terminated, Yinda Infocomm will seek the necessary approvals from shareholders for the Group’s entry into the new business.

Yinda Infocomm currently is an integrated and innovative communications solutions and services provider in Southeast Asia.

InterBIO will be responsible for developing, updating and licensing the software to be deployed by the JV company in the projects secured, while the Company will source for suitable business opportunities andpotential customers for the expansion and growth of the JV company’s business through its network.

Mr Gordon Tan, Executive Director of Yinda Infocomm, commented, “This is the start of an exciting journey for the Group and we are glad to be able to partner with InterBIO, an established biometrics software technology solutions provider with a proven track record. We are seeing an increasing number of biometrics implementation taking place in the public and private sectors these days due to the global push in digital transformation. We believe that this joint venture will be a fruitful endeavour which will generate a new revenue stream for the Group.”

Growing implementation in various verticals such as mobile devices, healthcare, and financial institutes has positively impacted the biometrics market growth.

According to Global MarketInsights, the global biometrics market will grow at a CAGR of more than 20% for 2017 to 2024to over USD50 billion.

"This joint venture presents an essential platform for InterBIO to grow much faster jointly with a publicly listed company. We are looking forward to work hand-in-hand with Yinda Infocomm to grow our international business beyond Indonesia and the Phillipines.” |