| Semiconductor stocks are gaining traction as the industry upcycle presents itself. Maybank KE has just initiated coverage of Frencken Group, following a number of reports on the industry such as: » Semiconductor Plays Amongst Singapore’s Most Traded in 2020 YTD » "Still Bullish On Semiconductors; Still OVERWEIGHT" » DBS' tech stock picks: AEM, UMS, Frencken, DELTA |

Excerpts from Maybank KE report

Analyst: Gene Lih Lai, CFA

Frencken manufactures components and modules for market leaders leveraged to growth trends in 5G/ AI, health and wellness and population aging.

Our FY21-22E PATMI are 14% higher vs. Bloomberg consensus, as we believe margin uplift potential from a breadth of new products with higher design content is underappreciated. |

|||||

Growth through market-leading customers

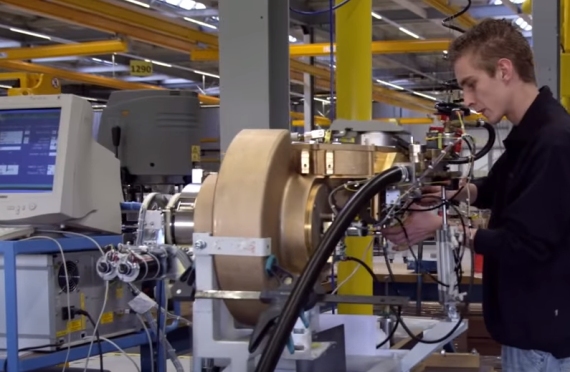

In mechatronics (82% of revenues), Frencken’s market-leading customers include ASML, Seagate, Thermo Fisher and Philips.

Mechatronics products tend to be critical, have demanding requirements, and Frencken is usually the sole source.

Frencken is currently involved with a breadth of new products across semiconductor, analytical, medical and more.

Resilient to Covid-19 and US-China tension

Current demand disruptions are largely due to order or receipt delays and cancellations are not material.

"We estimate 46% of Frencken’s revenue are leveraged to secular technology trends such as cloud, 5G and AI (through the semiconductor and industrial automation subdivisions) while 33% of revenue are linked to trends relating to health and wellness, and population aging (through the medical and healthcare segments)." "We estimate 46% of Frencken’s revenue are leveraged to secular technology trends such as cloud, 5G and AI (through the semiconductor and industrial automation subdivisions) while 33% of revenue are linked to trends relating to health and wellness, and population aging (through the medical and healthcare segments)."-- Gene Lih Lai, CFA |

Customers like Philips and Thermo Fisher expect the resumption of elective surgeries and lab work to reinvigorate sales; Semiconductor is benefitting from strong cloud demand.

All factories are now operating as usual. We see resilience to US-China tensions, given:

| i) Frencken predominantly serves domestic supply chains and/or markets; and ii) China accounts for only 15% of sales. |

Frencken is a contract manufacturer that provides end-to-end solutions from product conceptualisation and design to volume manufacturing and logistics services. Its key segments are mechatronics and integrated manufacturing services (IMS). Photo: YouTube Frencken is a contract manufacturer that provides end-to-end solutions from product conceptualisation and design to volume manufacturing and logistics services. Its key segments are mechatronics and integrated manufacturing services (IMS). Photo: YouTube Swing factors We expect FY20E PATMI to fall 11% YoY before rebounding by 10-17% in FY21-22E. We expect core NPM to improve to 7.7% by 2022 from 7.1% in 2019. If i) industrial automation and semiconductor sales are stronger than expected and ii) net margin hits 9% by 2022E, we see bull-case fair value of SGD1.45. However, if i) protracted economic weakness erodes demand resilience; and ii) supply chain disruptions recur, we estimate bear-case fair value of SGD0.95 – suggesting an attractive margin of safety |

Full report here.