Excerpts from DBS report

Analyst: Lee Keng LING

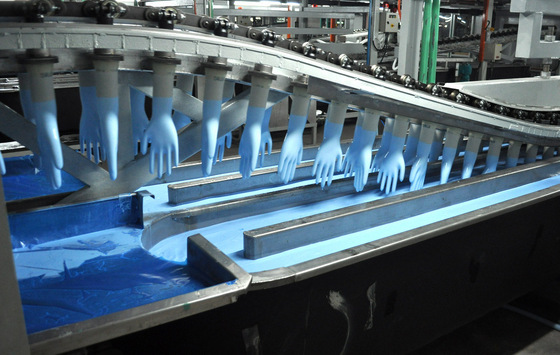

| Benefitting from COVID-19 Maintain BUY with higher TP of S$2.20; expect better quarters ahead on higher ASP and robust demand. Riverstone has been witnessing an uptick in orders from both new and existing customers in the cleanroom and healthcare segments.

Riverstone is running at full capacity now at c.95% utilisation rate. Any increase in volume can only come from the capacity expansion, which is expected to increase by 1.4bn (+15.6%) in FY20. |

||||

Supported by strong operating cashflow, Riverstone had a healthy cash position of RM170.7m as at end1Q20. NextInsight file photo

Supported by strong operating cashflow, Riverstone had a healthy cash position of RM170.7m as at end1Q20. NextInsight file photo

At current price-to-earnings (PE) of 17.7x and 18.3x on FY20F and FY21F earnings respectively, Riverstone is trading at a c.42% discount to peers.

This is unjustifiable, in our view, given its leadership position in the cleanroom segment.

We see value in Riverstone’s hard-to-replicate cleanroom business that sets it apart from its competitors.

Where we differ:

We are optimistic that Riverstone can continue to generate above-industry margins given its strong market share in cleanroom gloves.

Potential catalysts:

Further capacity expansion, sustained increase in cleanroom glove mix (and thus margins), higher ASP and inorganic growth are potential catalysts.

| Valuation: Maintain BUY call with higher TP of S$2.20. Earnings for FY20F/FY21F are raised by 27%/19% on higher ASP and margins. Our TP is pegged to 26x FY20F earnings. This is equivalent to a c.30% discount to its bigger peers. |

Key Risks to Our View: Global economic slowdown.

While margins for cleanroom gloves are higher, demand for these gloves could be threatened by a global economic slowdown

Full report here.