This article has been updated to mention other listcos which have reclassified their final dividends into interim dividends.

| Q&M Dental shareholders woke up this morning to some cheery news from the company. Q&M said it would reclassify a proposed Special Dividend and proposed Final Dividend for FY2019 to an interim dividend. That would be its second interim dividend for FY2019.

The reclassification enables the dividends to be paid earlier than otherwise, as they would not require shareholder approval at the FY2019 AGM. Q&M said the AGM date is currently being deliberated and remains uncertain owing to the Covid-19 situation. |

Q&M is the latest of a small number of SGX-listed company to do so:

| • On 8 April, CEI said it would replace its proposed special dividend (3.98 cents per share) with an interim dividend of the same amount. It, however, will subject its proposed final dividend of 0.4 cents per share to shareholder approval at its deferred AGM. • On 9 April, QAF said the Board was considering the possibility of paying an interim dividend of 4 cents per share in place of the proposed final dividend of the same amount. • On 13 April, TIH (fka Transpac Industrial Holdings) also said it was deferring its AGM and withdrawing its proposed 1-cent final dividend for FY19. Instead, it will in due course announce an interim dividend for FY2020 to replace the proposed final dividend for FY19. |

|

Shareholder support |

|

|

Earlier, across the Causeway, Maybank has done so, citing also the Covid-19 situation, as reported by The Edge magazine.

On March 27, 2020, the Bursa Malaysia-listed bank reclassified its final cash dividend of 39 sen per share to a second interim cash dividend of the same amount, to be paid on May 6, 2020.

Q&M's Special Dividend is 2-cents per share and Final Dividend, 0.42 cent per share, translating into a yield of 6.36% based on the current stock price of 38 cents.

Q&M said: "The Board is of the view that the Interim Dividend is in the best interests of the Shareholders as it provides certainty to the payment date. The payment of an interim dividend only requires the Board's approval, and does not require Shareholders' approval under the Company's Constitution.

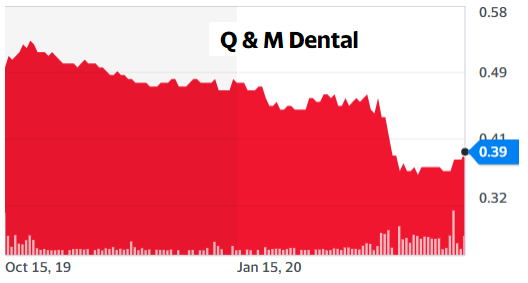

"Further, the Board is of the view that the Interim Dividend will not be prejudicial to the interests of the Shareholders as the aggregate quantum of the Interim Dividend will remain unchanged at S$0.0242 per share (i.e. equivalent to (now withdrawn) Special Dividend of S$0.02 per share and a Final Dividend of S$0.0042 per share)." In this 6-month chart, the highest price was 54 cents, while 39 cents is the current one. Chart: Yahoo!

In this 6-month chart, the highest price was 54 cents, while 39 cents is the current one. Chart: Yahoo!

| As background, as announced on 9 April 2020, Q&M had completed the disposal of its 36.0% stake in Aidite (Qinhuangdao) Technology Co., Ltd, and received net proceeds of S$47.72 million. With the significant gain from the disposal, Q&M had intended to reward the Shareholders through the payment of the Special Dividend. As for the proposed Final Dividend, this is in line with the Company’s past practice on dividends. |