Excerpts from UOB KH report

With an eye on the economic damage and savings erosion that could take place if social distancing and stay-home measures persist, the budget provides generous support to lower-income households and individuals, taking into account the increased labour participation in the gig economy and the self-employed. At the end of his Supplementary Budget speech, Mr Heng noted that the government “does not rule out further stimulus and rescue packages as the situation remains highly fluid and uncertain.” |

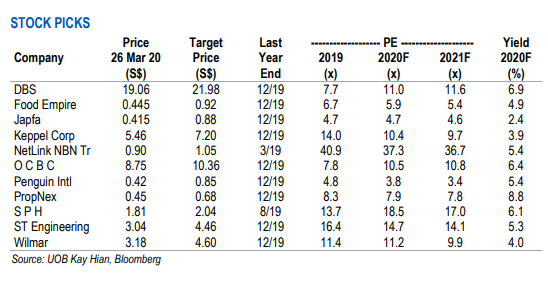

• Key stocks impacted by the Supplementary Budget 2020. In our coverage, companies such as SIA and SATS in the aviation sector will be the key beneficiaries while consumer and F&B stocks such as Koufu and Sheng Siong will have the negative effects of the COVID-19 outbreak cushioned somewhat by rental waivers and cost savings from the property-tax rebate being passed on by their landlords.

| CONSUMER/F&B (MARKET WEIGHT – Unchanged) • Sector expected to remain negative despite wage support. Measures directly related to the sector include the increased co-funding of wages and enhanced rental waiver. We believe the increased co-funding of wages as part of the job support scheme from 8% to 25% will help low wage and labour intensive industry, especially F&B service companies (licensed food shops and food stalls, including hawker stalls) which will enjoy a higher cofunding of 50%. For F&B service companies, staff cost accounts for approximately 17% and 30% of Koufu’s and Jumbo’s revenues respectively. Based on the dependency ratio ceiling (DRC) for the services sector, we estimate local hires command approximately 70% of its total workforce. Based on these assumptions, our back-of-envelope calculations indicates an additional (from last round) cash grant of roughly S$7.0m (25% of 2019 earnings) and S$3.5m (30% of 2019 earnings) for Koufu and Jumbo respectively. Although the cost savings does help support earnings, we think it acts more as a cushion and we still expect a net negative impact to earnings from COVID-19, given that the situation has deteriorated and additional travel restrictions have been put in place.  • Rental waiver to cushion higher costs. In addition, commercial tenants in governmentowned facilities who qualified for the half a month’s worth of rental waiver (announced in Budget 2020) will now get two months. We believe that Sheng Siong and Koufu will be eligible given that both the companies lease a significant number of HDB shop units. Given that Koufu would likely have to pass on some of the cost savings to stall tenants in coffee shops and food courts, the main beneficiary of the scheme would be Sheng Siong, in our view. Our back-of-envelope calculations indicate c.S$2.4m (3.2% of earnings) for the 1.5 months additional waiver. Further, we estimate Sheng Siong would also receive an additional (from last round) cash grant of S$6m-6.5m, or 7.9-8.6% of 2019 earnings for the enhanced Jobs Support Scheme (JSS). That said, these cost savings could be used to cushion the potential increase in input prices from supply chain disruptions. |

Full report here.