| • Singapore’s Small-Cap Stocks performed in-line with stocks of the same market capitalisations across Asia in 2019. More than 160 Singapore-listed stocks with a market cap between S$100 million and S$1 billion (as of 31 Dec) generated a median 7% total return in 2019. • The combined daily trading turnover of the 160 Singapore-listed stocks averaged S$55 million per day in 2019 with the most actively traded Small-Cap stocks including AEM Holdings, Rex International Holding, UMS Holdings, Eagle Hospitality Trust and First REIT. • AEM Holdings and UMS Holdings were also among Singapore’s 10 Small-Cap stocks that saw the highest net institutional inflows proportionate to their year-end market capitalisation. These 10 stocks averaged a 75% total return in 2019, with their median total return at 81%. |

Executive Chairman of AEM, Loke Wai San. NextInsight file photo.In 2019, Singapore’s Small-Cap Stocks that encompass both companies and trusts performed in-line with stocks of the same range in market capitalisation across developing Asia exchanges.

Executive Chairman of AEM, Loke Wai San. NextInsight file photo.In 2019, Singapore’s Small-Cap Stocks that encompass both companies and trusts performed in-line with stocks of the same range in market capitalisation across developing Asia exchanges.

More than 160 Singapore-listed stocks with a market capitalisation between S$100 million and S$1 billion (as of 31 Dec) generated a median 7% total return in 2019.

In comparison, approximately 5000 stocks of the same market capitalisation listed across Developed Asia excluding Singapore generated a median total return of 9%, while approximately 4000 of the same sized stocks in same market capitalisation listed across Emerging Asia generated a median total return of 3%.

As discussed in a recent Market Update (click here), Singapore’s Mid-Cap Stocks that encompass both companies and trusts also performed in-line with stocks of the same range in market capitalisation across Asian exchanges.

Singapore Small-Caps with Significant Institutional Inflow in 2019

Singapore stocks with a market capitalisation greater than S$100 million and less than S$1 billion maintained a combined market capitalisation of S$58.5 billion as of the end 2019. Together this current group of stocks averaged daily turnover of S$55.3 million a day in 2019. The stocks also saw net institutional outflow of S$119 million for the full 2019 year.

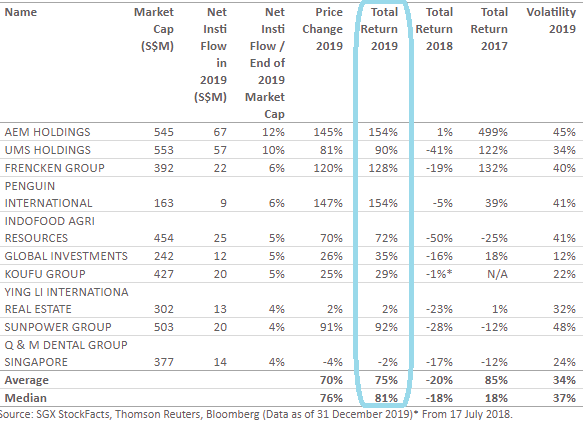

Eight of the 10 stocks that saw the highest net institutional inflow proportionate to their end of 2019 year market capitalisation significantly outpaced the Straits Times Index (“STI”) 9.4% total return in 2019.

This saw the average total return of these 10 stocks in 2019 at 75%, with a similar median total return showing an element of consistency in the past returns.

The two stocks that despite proportionately large institutional inflow, did not outpace the STI, were Ying Li International Real Estate and Q & M Dental Group Singapore.

These 10 stocks are tabled below.

|

Super Active |

|

The 10 stocks tabled above also accounted for close to a third of the combined turnover of Singapore’s Small-Cap stocks in 2019. The five most actively traded stocks of the 10 tabled above were AEM Holdings, UMS Holdings, Frencken Group, Sunpower Group and Koufu Group. |

AEM Holdings and UMS Holdings were also amongst the five most actively traded Small-Cap stocks in 2019, with Frencken Group and Sunpower Group amongst the 10 most actively traded Small-Cap stocks in 2019.

Other Small-Cap stocks that were amongst the most actively traded in 2019 included Rex International Holding, Eagle Hospitality Trust, First REIT, Valuetronics Holdings, Cache Logistics Trust and Keppel Pacific Oak US REIT.

The FTSE ST Small-Cap Index which generated a total return of 15% in 2019, maintains 49 constituents with a similar range in market capitalisation to the group of more than 160 Small-Cap stocks in Singapore. The full list of the relevant 164 stocks can be found here.

This article was first published on the SGX website.