Soo Jin Hou, an investor living in Melbourne, contributed this article to NextInsight.

Soo Jin Hou, an investor living in Melbourne, contributed this article to NextInsight.

|

With the US-China trade war in full swing, it is difficult to find companies with a positive outlook, let alone one trading at compelling valuations.

But Penguin International (SGX: BTM) is such a company. Its investment metrics on a trailing 12-month basis (ttm) are reflected in the table (right). |

Penguin is the largest builder of aluminium crewboats in the world (length 30m-50m). It made twice as many boats as its nearest competitor, Grandweld, from 2008-18, and thrice as many as 3rd place Strategic Marine.

Interestingly, Phillip Capital noted that Penguin has benefitted from reduced competition from Strategic Marine which is currently undergoing financial restructuring.

Just to digress a little, since the story on Strategic Marine is quite interesting, or distressing, depending on whether you are a shareholder of Triyards. Strategic Marine is a wholly-owned subsidiary of Triyards, and Triyards is a highly competent shipbuilder specializing in high specification vessels including liftboats and catamarans.

Its Lewek Constellation, a subsea construction vessel with ultra deepwater pipelaying and heavy lift capabilities, won the Support Vessel of the Year at the 2016 Offshore Support Journal Awards.

Despite the accolade, Triyards got into trouble when its parent Ezra ran into financial difficulties when oil prices crashed. Turns out Triyards has foolishly guaranteed almost USD 40m of Ezra’s debt.

So when creditors came knocking and Ezra couldn’t pay, it turned to Triyards. The whole case smacks full of abuse and conflict of interest because some of Triyards’ directors sit on the boards of both companies. Anyway, this certainly plays into Penguin’s hand as Triyards finds it much harder to win contracts given its uncertainty of going concern.

To be sure, aluminium vessels are premium boats. Aluminium is 30% lighter than steel, and aluminium boats can go faster as a result. However, aluminium is about 3x more expensive than steel. In addition to crewboats, Penguin also manufactures armoured security boats, passenger ferries, patrol boats, windfarm support vessels and fire fighting search-and-rescue vessels.

Ships are either built-to-order or built-to-stock. Low volume custom orders are typically built-to-order. Management is conservative for their built-to-stock program, as they only draw from their cash and not borrow. Being conservative enabled management to weather the drought years 2016-2017.

Another company, Nam Cheong, which leveraged heavily during the good times to build stock, became a negative equity company after the OSV market tanked.

Still, despite being the largest revenue contributor at around 4/5th of the total, shipbuilding is not the most lucrative business segment for Penguin. The most lucrative is the chartering segment making up the rest of the revenue, which is basically the business of moving people using own-built ferries. Despite making up only a fifth of revenue, it contributes to the lion's share of profit, as the table below shows:

|

|

2018 |

2017 |

2016 |

|

Shipbuilding rev |

82,540 |

58,719 |

12,438 |

|

Charter rev |

24,728 |

21,042 |

20,967 |

|

Shipbuilding PBT |

5,290 |

(1,012) |

(3,506) |

|

Charter PBT |

12,935 |

4,599 |

(955) |

|

Shipbuilding margin |

6.4% |

Loss |

Loss |

|

Charter margin |

52.3% |

21.9% |

Loss |

Quite obviously, Penguin staged a turnaround in 2018, but more impressively, charter margin was magnificent at 52% and it contributed 71% to pre-tax profit.

CIMB’s initiation report revealed that the primary customers for Penguin’s charter segment are Petronas and ExxonMobil. In other words, Penguin is a proxy to Malaysian offshore O&G activities.

After a 2-year hiatus, Petronas is again spending big on offshore activities. There are 2 reasons for this:

| 1) the heavy capex needed to build the RAPID refinery has finally ended as production commences, 2) oil has stabilized around USD 60/barrel. Across the causeway, O&G stocks have gone completely bonkers this year not because oil price is particularly attractive, but solely because Petronas is spending. Stocks like Dayang and Carimin hit multi-year highs as Petronas dishes out contract after contract. |

Penguin stands to benefit from Petronas’ resumption of offshore activities because the current oil price is particularly conducive to its business. In my opinion, current oil price is in a Goldilocks state: It is neither too high where offshore O&G staff fly to work via helicopter, nor is it too low where offshore activities cease.

In its Annual Report 2017, Penguin revealed that it benefits from “chopper swappers” due to the current subdued oil price. Management has guided for improving charter rates for every quarter since 4Q18.

Revenue and profit for the past 4 quarters were lumpy. Revenue is heavily influenced by shipbuilding deliveries, since the business is high value and low margin. Profits, however, should be more stable because they are underpinned by the low-value and high-margin chartering business.

|

|

2Q19 |

1Q19 |

4Q18 |

3Q18 |

|

Revenue |

52,127 |

15,809 |

41,853 |

19,721 |

|

Gross profit |

13,409 |

5,484 |

13,911 |

6,862 |

|

PBT |

8,503 |

982 |

7,494 |

985 |

|

Net profit |

7,455 |

910 |

7,259 |

665 |

Given the trend of improving conditions, 1Q19 looks unusually weak. Management attributed the weak quarter to a decrease in sale of stock crewboats, but reported improved chartering activities on a yoy basis. But was the chartering business worse qoq? I cannot be absolutely certain because no segmental breakdown was given.

However, across the causeway, Dayang reported a shock loss and Carimin and Uzma reported very weak numbers, which were attributed to subdued offshore activities as a result of the monsoon season. From that, I speculate that charter activities were weak in 1Q19 on a qoq basis, even though it was stronger yoy. If this thesis is correct, it reinforces the notion that Penguin is indeed an excellent proxy to the surge in O&G offshore activities in Malaysia.

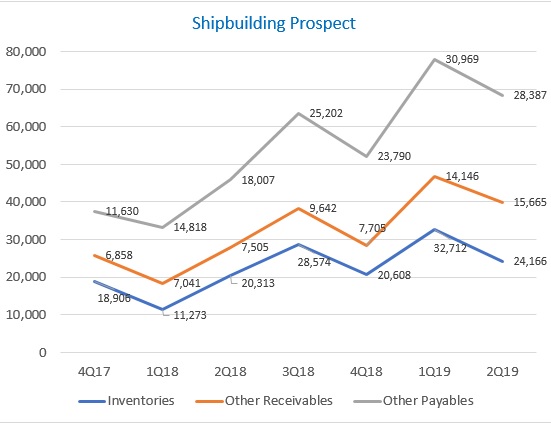

| While the ferry segment looks pretty, so does the shipbuilding segment. Since the company does not disclose its order book, a way to gauge the health of its prospect is to examine its Inventories, Other Receivables and Deposits and especially its Other Payables and Accruals. Other Receivables include receivables for fleet vessel sales and deposits paid by Penguin for equipment purchase with long lead time. Other Payables include advance payments and deposit received, which is directly reflective of order book.  As can be seen from the chart, over the past 1.5 years or so, all 3 metrics have been increasing steadily, especially for Other Payables. According to Penguin’s Annual Report 2018, a fifth workshop will be built in their Batam shipyard to cope with a higher workload, a move that will add 6-8 vessels of capacity per year, according to CIMB. |

With both cylinders firing, and with such a massive cash hoard, Penguin is highly attractive, probably even more so than O&G stocks in Bursa. Most Bursa O&G stocks have already risen to high single-digit PE levels, but most are still debt-laden from their misadventures before oil price tanked.

Dayang will be undertaking a rights issue to pare down its short-term borrowings, and even the healthiest among them all, Carimin, is only trading at 11% net cash. In contract, Penguin’s balance sheet is spanking clean with 39% net cash.

Finally, like it or not, the fortunes of all O&G service-related stocks in Bursa are still largely dependent on oil price, the higher the better. In contrast, Penguin thrives when oil price isn’t all that great.

With oil demand growth in question as the global economy slows, Penguin is more insulated than service-related stocks. Barring a massive rally or a catastrophic plunge in oil price, Penguin’s lucrative chartering business should do very well in the current Goldilocks condition.