Company overview

Link to StockFacts company page. |

||||||||||||||||||||

1. What is the primary focus of CNMC’s operations in FY2019 that its shareholders can look forward to?

• We will be embarking on underground mining for the first time at Sokor. While this will cost more than open-pit mining, which is now our main method of mining, it is expected to yield higher-grade gold ore and will enable us to produce and sell more gold. The resultant increase in revenue is expected to offset the rise in expenses for underground mining.

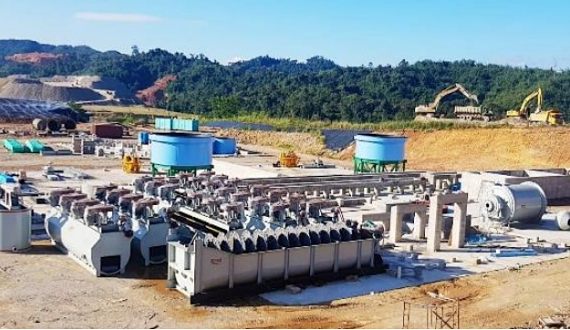

• In seeking to diversify our income streams, we recently started putting together a flotation plant for processing lead and zinc. The plant, slated to be completed before the end of 2019, will be able to process about 500 tonnes of ore daily.

Machineries for CNMC’s proposed flotation plant, which will be able to process about 500 tonnes of ore a day to monetise silver, lead and zinc resources.

Machineries for CNMC’s proposed flotation plant, which will be able to process about 500 tonnes of ore a day to monetise silver, lead and zinc resources.

Photo: Company

2. What are some plans in place to improve CNMC’s financials and its profitability/margins?

• We have been profitable every year since 2012. Our highest annual revenue so far is US$39.5 million, achieved in 2018, as we ramped up gold production after our carbon-in-leach (CIL) plant began commercial operation in May 2018.

• Our foray into underground gold mining and planned diversification into the production and sale of lead and zinc concentrates are our latest efforts to boost revenue and earnings. We expect the production and sale of these other metals to start generating revenue in the first half of 2020, barring any unforeseen circumstances.

• We are also actively managing costs to help improve profitability. We are looking to install a national grid power line at Sokor so that we can be more self-sufficient in energy generation. This is expected to yield significant cost savings on energy cost as we now rely on diesel generators to power operations. Diesel is one of our main mining consumables.

3. Any development plans to grow dividends paid to investors?

• We have a dividend policy to distribute up to 30% of our earnings as dividends. In 2016 and 2018, we went above and beyond this guideline by paying out 37% and 36% of our earnings respectively to our shareholders as a way to reward them for their support.

4. CNMC’s fine gold production increased 112.4% to 31,473 ounces in FY2018 from 14,817 ounces in FY2017. How does the management intend to sustain this growth?

CEO Chris Lim. NextInsight file photo• One key growth driver for 2018 was our CIL plant, which began commercial production in May 2018. This facility is used for processing higher-grade ore and boasts a gold recovery rate of more than 90%. We are looking to double the production capacity of the CIL plant to 1,000 tonnes a day from 500 tonnes currently.

CEO Chris Lim. NextInsight file photo• One key growth driver for 2018 was our CIL plant, which began commercial production in May 2018. This facility is used for processing higher-grade ore and boasts a gold recovery rate of more than 90%. We are looking to double the production capacity of the CIL plant to 1,000 tonnes a day from 500 tonnes currently.

• We are also expanding the production capacity of our heap leach (industrial mining process used to extract precious metals) plant, which is meant for low-grade ore. We have already installed the first of two new leaching pads at the heap leach plant to replace the existing leaching pads, which have a total annual leaching capacity of about 2.8 million tonnes of ore. The second leaching pad will be ready in 4Q2019. These two leaching pads are designed to hold the mined ore for continuous leaching to enhance gold recovery. Once completed, the upgraded heap leach plant will be able to process 6 million tonnes of ore annually.

5. How will the recent increase in gold prices amidst the ongoing US-China trade war rhetoric affect CNMC’s outlook on the market in FY2019?

• In times of uncertainty, gold is typically seen as a safe haven for investors. While higher gold prices bode well for us as we can sell our gold bars at better prices, they are ultimately determined by market forces, which are beyond our control.

• Our focus is and has always been to increase gold production. If gold prices continue to climb, and as we continue to expand gold production, we believe our revenue should head higher. This in turn should translate into better earnings, barring any unforeseen developments.

6. How will CNMC manage its portfolio of mineral resources to counteract the depleted resources and future gold production expansion?

• At CNMC, we have an ongoing exploration programme to locate new gold resources. We have been successful every year in locating additional gold resources in the ground to not only replace depleted resources but also increase our in-ground gold resources ever since this programme began in 2007.

• To ensure that our eggs are not all in one basket, we acquired two mineral exploration projects in Kelantan in 2017, namely Kelgold Mining Sdn Bhd and CNMC Pulai Sdn Bhd. We are working at getting these two projects to the production phase.

7. Aside from Sokor, what are the plans for the two acquired exploration projects: Kelgold and Pulai?

• Exploration work at Kelgold and Pulai is ongoing. Sample test results for Kelgold are promising and we believe it has potential based on the geological information available. It also offers strategic synergy as the 15.5km2 concession is only about 30km northwest of Sokor.

• As for Pulai, geological data collected by previous explorers supports the potential for primary gold mineralisation similar to that discovered at Sokor. Pulai is already producing feldspar, a raw material used for making glass and ceramics.

8. CNMC’s flagship Sokor project in Malaysia’s Kelantan state has about 914,000 ounces of untapped gold resources estimated as at 31 December 2018. How does the company foresee this impacting gold production and earnings in the years ahead?

• The 914,000 ounces of gold in the ground are estimates provided by Optiro, an independent mining consulting firm based in Australia. This is the highest figure ever recorded since we started our exploration programme at the 10km2 gold field in 2007. It is also 26% more than the 724,000 ounces of untapped gold resources as at 31 December 2017.

• Even though we produced a record amount of gold in 2018 – 31,473 ounces – Optiro’s estimate of 914,000 ounces of gold in the ground implies that we can continue to mine before we are anywhere near extracting all the gold at Sokor. We believe that this bodes well for us as we embark on underground mining. All the gold we have produced so far comes from open-pit mining, also known as surface mining.

9. What are some key challenges facing the mining industry? How does CNMC mitigate these challenges and boost long-term profitability?

• Mining is capital-intensive and there is no guarantee of success. We have been fortunate to strike gold some three years after we began exploration at Sokor in 2007. Our public listing on SGX in 2011 enabled us to raise funds to sustain and scale up our operations.

• As one of the biggest mining companies in Malaysia, we also have a responsibility to safeguard the environment for the local community. This responsibility is all-encompassing and covers everything we do, ranging from the acquisition and development of land and concessions, operations, and disposal of waste to rehabilitation. We have invested substantial resources over the years in ensuring that our operations pose no risk whatsoever to the local communities. We believe this commitment to their wellbeing has enabled us to carry out our exploration and production programmes on a sustainable basis.

| 10. What is CNMC’s value proposition to its shareholders and potential investors? What do you think investors may have overlooked about its business? • While there are many listed junior mining companies worldwide, we believe not many are like CNMC – in production, generate consistent cash flows from operations, are profitable and pay dividends regularly. • Investors generally tend to be wary of mining companies, as mining is capital-intensive, offers no guarantee of success, and can be harmful to the environment and to the people doing the work if the proper safeguards are not in place. Over the years, not only have we been able to sustain our operations, we believe that we have also been generating regular returns for shareholders while ensuring that our activities are safe for the local communities and for our workers. |

First published on SGX website

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials. This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For company information, visit http://www.cnmc.com.hk/

Click here for FY2019 2nd Quarter Earnings Announcements