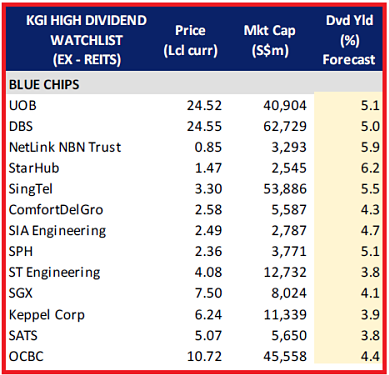

Excerpts from KGI Securities (Singapore) report

Analyst: Joel Ng

Joel Ng, head of research♦ Global growth is slowing down sufficiently enough that there is now a high probability of a rate cut at the Federal Reserve’s meeting in July 2019. In the search for yield, REITs have mainly benefitted. Joel Ng, head of research♦ Global growth is slowing down sufficiently enough that there is now a high probability of a rate cut at the Federal Reserve’s meeting in July 2019. In the search for yield, REITs have mainly benefitted.♦ In this report, we highlight our favourite high-dividend stocks in Singapore outside the REITs universe. ♦ These stocks offer higher growth compared to REITs but generally trade with greater volatility given their cyclical nature. |

Source: Bloomberg, KGI Research.

Source: Bloomberg, KGI Research.

Dividend forecast is based on consensus estimates for the companies’ next financial year. Financials. Both UOB and DBS offer around 5.0% forward dividend yields, almost 0.5% point above OCBC.

Banks are still offering earnings growth in 2019 and are trading at attractive price-to-book valuations after their price correction in May. KGI’s favourites: DBS and UOB.

Telcos. StarHub offers a 6.2% forward dividend yield but growth is uncertain given the disruption to both its mobile and cable TV businesses.

SingTel offers a better diversified business across multiple geographies, and its 5.5% dividend yield may be more stable than StarHub’s.

SingTel shares may also benefit from fund inflows from institutional investors seeking safety and yield in defensive names.

NetLink NBN Trust is perhaps the most defensive among the three while still offering growth potential from StarHub’s migration to fibre and participation in Singapore’s Smart Nation initiatives. KGI’s favourites: NetLink NBN Trust and SingTel.

Transport. ComfortDelGro remains our favourite given its strong balance sheet and healthy recurring cash flows.

Meanwhile, SATS has consistently increased its dividends every year since 2014 and is riding on long-term growth in air travel and cargo volumes, but share price at this level only offers a 3.8% yield.

We would avoid SIA Engineering for now given the intense competition and margin pressure on its business, even as it offers the highest yield in the transport sector. KGI’s favourite: ComfortDelGro.

Industrials. We like ST Engineering for its diverse business segments spanning defence, aerospace, marine and electronics. However, its share price at this point does not offer an attractive entry level and we would wait for a better opportunity to accumulate.

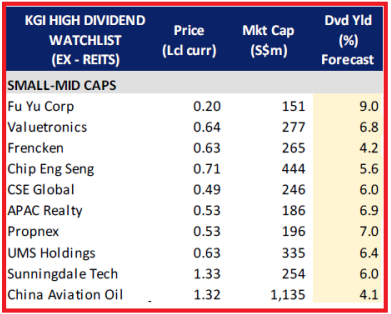

| Small-Mid caps |

There are attractive opportunities among small-mid caps but expect higher volatility in their share price compared to blue-chips. Source: Bloomberg, KGI Research. Source: Bloomberg, KGI Research. Dividend forecast is based on consensus estimates for the companies’ next financial year. Tech-manufacturers. Fu Yu and Valuetronics stand out with their 7-9% dividend yields, the highest in our list. They are backed by solid balance sheets where net cash accounts for half of their current market capitalisation. We also added Frencken to our watchlist as it is among the cheapest in its sector in terms of P/E and P/B valuations, while offering a decent 4.1% dividend yield. Real Estate. We added property-related services companies, APAC Realty and PropNex, as they offer attractive dividend yields of 6-6.9%, in addition to undemanding valuations of 7-9x forward P/E and strong balance sheets. In the case for PropNex, it is Singapore’s largest real estate agency in terms of agents, while net cash made up 40% of its market cap.  L-R: CSE Global MD Lim Boon Kheng | Chairman Lim Ming Seong | CFO Eddie Foo. NextInsight file photo. L-R: CSE Global MD Lim Boon Kheng | Chairman Lim Ming Seong | CFO Eddie Foo. NextInsight file photo.Oil & Gas. CSE Global offers an attractive 6.0% dividend yield and is well diversified across its businesses in Singapore, Australia, and the US. China Aviation Oil (CAO) is a good opportunity to participate in the rapid growth of air travel in China and the region, being a key supplier of imported jet fuel in China. Its long-term story remains intact and the share price weakness offers a good entry point. Overall, CAO offers a good combination of growth and 4.1% yield. |

Full report here.