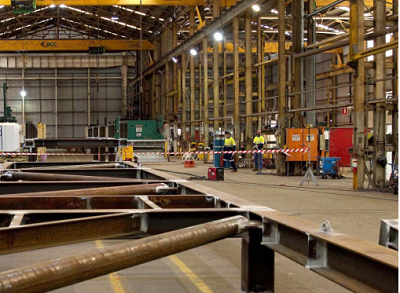

AusGroup's Kwinana facility provides integrated mechanical, fabrication and access services to the lithium market. Photo: Company Australia overtook Chile to be the world’s No.1 lithium producer in 2017 at the dawn of the electric vehicle era, a development which Singapore-listed AusGroup is benefiting from. AusGroup's Kwinana facility provides integrated mechanical, fabrication and access services to the lithium market. Photo: Company Australia overtook Chile to be the world’s No.1 lithium producer in 2017 at the dawn of the electric vehicle era, a development which Singapore-listed AusGroup is benefiting from.

AusGroup operates a manufacturing facility in Kwinana, a location which The West Australian has described as being "the epicentre of a booming global lithium market". Given that, it will come as no surprise if AusGroup continues to bag contracts related to lithium projects. |

||||||||||||||||

“We are proud to be part of these critical lithium projects that are important not only to Western Australia, but to the local Kwinana region. AusGroup has been operating the Kwinana fabrication premises for almost 30 years and is well positioned to provide integrated mechanical, fabrication and access services to the lithium market which is experiencing accelerated growth.” “We are proud to be part of these critical lithium projects that are important not only to Western Australia, but to the local Kwinana region. AusGroup has been operating the Kwinana fabrication premises for almost 30 years and is well positioned to provide integrated mechanical, fabrication and access services to the lithium market which is experiencing accelerated growth.”-- Shane Kimpton (photo), CEO and Executive Director, AusGroup. (Source: Press release) |

AusGroup is supporting the start of construction of a state-of-the-art battery-grade lithium hydroxide plan by Tianqi Lithium Australia at Kwinana, about 32 km from Perth.

AusGroup's work is valued at A$9.7M.

In addition, the AusGroup facility is involved in ongoing construction work to expand lithium concentrate production capacity at the Greenbushes site -- about 250km south of Perth -- of project operator Talison Lithium, a JV between Tianqi and Albemarle Corp.

There, AusGroup has a A$38M contract covering structural, mechanical and piping installation as well as electrical and instrumental services.

Overall, with other parts of its business on an upturn, AusGroup has had strong FY18 (ended June):

♦ 4QFY18 was its 7th consecutive profitable quarter. EBIT was AU$5.4m, contributing to a full year EBIT of AU$25.2m.

♦ Full-year FY18 profit after tax was AU$13.5m (+195% y-o-y).

♦ Revenue of AU$566.8m (+30.3% y-o-y) was its highest in five years.

AusGroup, whose work on hand stood at AU$230m as at 30 June 2018, offers a range of integrated service solutions to the energy, resources, utilities, port & marine and industrial sectors.

Its diversified service offering supports clients at all stages of their asset development and operational lifecycle.

Its business growth would be boosted through a planned placement of shares and a rights issue, as announced in March 2o018. (See: AUSGROUP: To place out S$37 m new shares and launch rights issue)