In March 2016, Anchor Resources became the second Malaysian-based gold explorer and miner to be listed in Singapore, after CNMC Goldmine.

Not surprising, as it had reported losses amounting to RM32.9 m and RM19.5 m for 2016 and 2017, respectively. (The net loss in 2017 was mainly due to one-off expenses). Recently, on 15 Aug, the company announced business updates that look interesting and foretell a possibly strong recovery: The start of gold production and a maiden contract -- worth S$75 million -- to supply granite to a key Brunei contractor. Anchor Resources said, without giving revenue figures, that it had just exported 74 tonnes of "semi-processed gold concentrated ore" with an average grade of approximately 34 grams of gold per tonne. All that has yet to cause a re-rating of the stock. Perhaps a continued positive newsflow will be the catalyst. |

||||||||||||||||

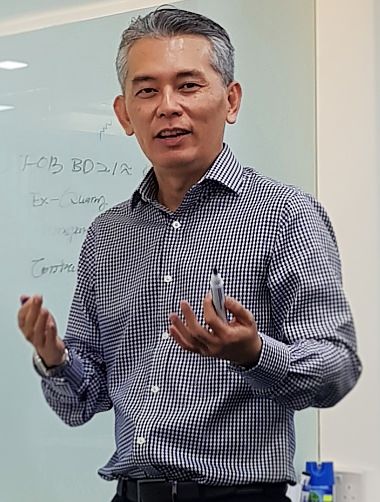

Lim Chiau Woei, MD of Anchor Resources, owns a 40.59% stake in the company. NextInsight photo"We are being valued as an exploration company when we are now a production company," said Lim Chiau Woei, the MD of Anchor Resources, in an interview with NextInsight.

Lim Chiau Woei, MD of Anchor Resources, owns a 40.59% stake in the company. NextInsight photo"We are being valued as an exploration company when we are now a production company," said Lim Chiau Woei, the MD of Anchor Resources, in an interview with NextInsight.

He described two major developments in the past two years to get the company to become a producer:

♦ Extensive tunneling work, nearing completion now, to reach depths sufficient to extract gold ore at its Lubuk Mandi Mine in Terengganu, Malaysia.

♦ For business risk diversification, Anchor acquired two granite quarries last year. Tunnel of 210 metres at Anchor Resources' gold mine in Terengganu, Malaysia. Photo: CompanyFirst, the gold mine: Anchor Resources took over an open pit of 40 metres depth previously mined by a state government-linked company.

Tunnel of 210 metres at Anchor Resources' gold mine in Terengganu, Malaysia. Photo: CompanyFirst, the gold mine: Anchor Resources took over an open pit of 40 metres depth previously mined by a state government-linked company.

In order to extract gold at greater depths, Anchor Resources decided on a more economical method -- tunneling.

It contracted Great Aims Resources to create a tunnel, which now has reached over 210 metres in length and 90 metres in vertical depth --- and expects to start extracting hardrock over the next few months.

This table shows the resource estimate of 115,000 oz of gold for the Lubuk Mandi Gold Project. It dipped to 109,000 in 2017.

|

Category (1) |

Hard Rock at 0.3 g/t Au |

Tailings at 0.4 g/t Au cut-off |

||||

|

Gross attributable |

Contained |

Gross attributable |

Contained |

|||

|

Tonnes |

Gold grade |

Tonnes |

Gold grade |

|||

|

Measured Mineral Resources |

-- |

-- |

-- |

-- |

-- |

-- |

|

Indicated Mineral Resources |

1.5

|

1.46

|

2,220 (71)

|

1.3

|

0.73

|

970 (31)

|

|

Inferred Mineral Resources |

0.3

|

1.01

|

295 (9) |

0.1

|

0.83

|

70 (2)

|

|

Total Resources |

1.8

|

1.39

|

2,515 (81) |

1.4

|

0.74

|

1,040 (34) |

|

(1) As defined by the JORC Code |

||||||

Generally, under an agreement, Great Aims Resources would bear the capital and operating cost in exchange for a share of the revenue from extracting gold.

(Obligations under the agreement and details of the sharing of revenue and expenses were announced in May 2017 and amended in April 2018.)

Great Aims Resources was also contracted to develop a processing facility to process hard rock extracted from the mine.

The facility also is to process"tailings" (which is estimated to contain 2 tonnes of gold) left behind by the previous operator.

In the first half of July 2018, after processing, tailings yielded 74 tonnes of "semi-processed gold concentrated ore" which were exported to China.  "Semi-processed concentrated ore" being shipped out. Photo: Company

"Semi-processed concentrated ore" being shipped out. Photo: Company

Based on the offtake agreement to deliver 300 - 500 tonnes per month of "semi-processed concentrated ore", and assuming an average grade of approximately 34 grams of gold per tonne, a selling price of USD1,200/oz and all-in costs of USD600/oz, the projected profit for a full year would be USD2.6 million.

This does not include sales from the hardrock production which Anchor Resources said is expected to start by end of 2018.

In addition, assuming a 7% industry average net margin from the recent granite aggregate offtake agreement across 4 years, the S$75 million contract will contribute RM4.0 million per year.

If they are more offtake agreements from the granite quarry business and with the inclusion of the hardrock production from the gold mining business, the company could stage a turnaround in 2019.

Anchor Resources' Lubuk Mandi Mine in Terengganu is Malaysia's first underground goldmine with tunneling now complete to extract gold ore from under an open pit. Photo: Company

Anchor Resources' Lubuk Mandi Mine in Terengganu is Malaysia's first underground goldmine with tunneling now complete to extract gold ore from under an open pit. Photo: Company

| Anchor Resources acquired GGTM, which owns an exclusive dimension stone granite concession of 800 acres in Terengganu, in Aug 2017. The concession is for a 14-year period expiring on 26 October 2029. The quarry, Bukit Chetai Mine, is 300 acres, and produces dimension stone granite which is used as premium flooring and facade, etc. The JORC resource was valued at S$100 million - based on 5% extraction of the total deposit of the Bukit Chetai Mine. Not included in the estimation was the value of granite aggregates in another quarry under GGTM, the 500-acre Bukit Machang, which will supply 3.6 million tonnes of aggregates to SIVLI Sdn Bhd of Brunei over the next four years. Granite aggregates are in demand for projects as diverse as roads and land reclamation. |