|

Coal producers continue to enjoy robust profits from high prices for the commodity, as illustrated by SGX-listed coal miners (See: GOLDEN ENERGY & RESOURCES: On track for record year?). In this article, HK-listed and Singapore-headquartered Agritrade Resources shows it is getting its share of the pie -- a hefty US$54 million of profit for FY18 ended March and its stock is up 218% over the past 12 months. |

Excerpts from NRA Capital's report

Analyst: Liu Jinshu

| Preparing for Next Stage of Growth ▪ Background. Agritrade Resources Limited (stock code: 1131) is a Singapore headquartered coal mining, shipping and energy conglomerate listed on the Hong Kong Stock Exchange.

The high growth delivered by the group in FY18 makes it an interesting prospect to consider. |

||||

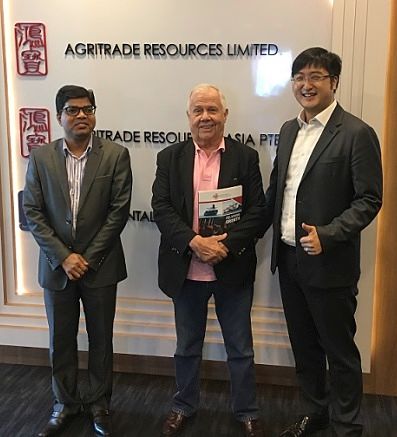

▪ Higher selling prices and volume growth to sustain growth into FY19. The group expects to achieve coal output of 6m tonnes in FY19, to be driven by the installation of new capacity of 2.5m tonnes.  L-R: Ashok Kumar Sahoo, CFO | Jim Rogers, Advisor to the Board | Ng Xinwei, CEO. Photo: CompanyWe expect output to grow by 0.5m tonnes to 6.2m tonnes in FY19, assuming some gestation period for the new capacity to ramp up to full utilisation.

L-R: Ashok Kumar Sahoo, CFO | Jim Rogers, Advisor to the Board | Ng Xinwei, CEO. Photo: CompanyWe expect output to grow by 0.5m tonnes to 6.2m tonnes in FY19, assuming some gestation period for the new capacity to ramp up to full utilisation.

Coupled with higher selling prices in FY19, we expect coal revenue to grow by 23% in FY19 to HK$2.39 billion. We expect higher selling prices in FY19 due to higher contribution from the 6,426 kcal/kg MERGE mine and higher prices achieved in 2H FY18. Moreover, contracts secured in CY18 suggest a 30% increase in selling prices over that achieved in FY18.

| ▪ Strong balance sheet provides support. Given the performance of the group and the prospect of higher production, we rate the group Overweight. One key investment merit is that the group is lowly geared with estimated net borrowings of 6.7% of common equity at end of FY18. However, we qualify our rating with a high-average risk rating, pending more detailed review such as the group’s mine plans etc. Based on our forecasts, we value the group at HK$1.93 per share, translating to upside of 37.9%. -- NRA Capital |

▪ MERGE Mine still has room to grow. The group operates three mines in Indonesia, of which the MERGE is being scaled up for higher production in FY19. In FY18, MERGE contributed HK$52.4m in operating profit from only 0.5m tonnes of production.

MERGE’s production schedule, as per the 2015 technical report, was to ramp up production to 6m tonnes per year. Therefore, we can infer that there are parts of MERGE that can be developed to raise production even after hitting the FY19 planned capacity of 3.5m tonnes per year.

▪ Key risks. While coal prices have remained steady or risen in 2018, any correction in coal prices will impair our outlook. As at 31 March 2017, the group had >50% ownership of 102.4m tonnes of proved and 94.7m tonnes of probable coal reserves.

Our forecasts assume extraction of 170.7m tonnes of these reserves from FY18 to FY33F (15 years). While we assume that the group will optimise production to achieve best value, actual production will depend on factors such as site conditions and mine design.

Full report here.