|

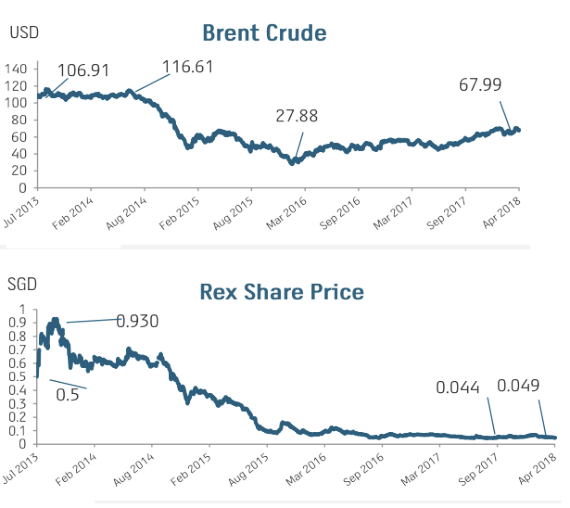

The recovery of oil has taken Brent, the international benchmark, to about US$75 a barrel in recent weeks, a level last seen in late 2014. |

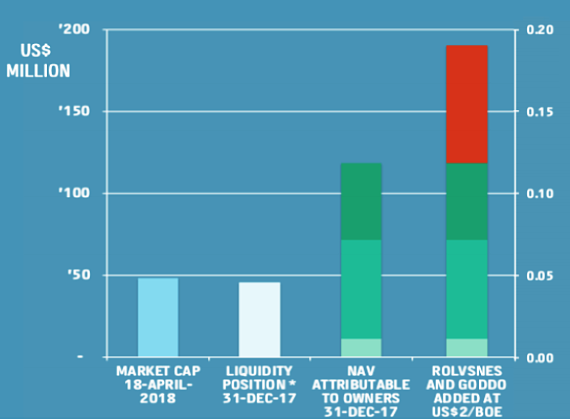

How market values REX and misses large parts of value  1) First 2 columns: At 4.9 cents stock price, the market cap of REX is only slightly higher than its cash, cash equivalents and quoted investments. 2) 3rd and 4th columns: Much higher than the market cap is the sum of the net asset values of REX subsidiaries (various shades of green) and the illustrative value of the oil resources in the Rolvsnes discovery and the Goddo prospect in Norway (red, purely an illustrative example using a conservative US$2 per barrel based on historic transactions for oil in the ground at the exploration stage). For more details, see REX presentation materials. |

All this intrinsic value of REX may yet find more love in the stock market in the light of a rebalancing of supply and demand in the oil market. The price of oil has recovered to around US$75 a barrel.

Source: REX presentation

Source: REX presentation

In Oman

There, REX is working to start oil production in 1H2019. REX holds a 92.65% stake in Masirah Oil Ltd, the operator and 100% owner of Block 50, located offshore of Oman’s east coast.

Under an agreement with the Oman government, half of the concession oil revenue will go to cover historical operating and capital expenditures, which currently total about US$100 million.

The other half of the oil revenue will be split 70:30 with the government and REX, respectively.

If it's successful in starting production, REX intends to recycle some of the strong cashflow into drilling new wells in Oman Block 50, which covers 17,000 sq km.

In Norway Dan Broström, executive chairman of REX.

Dan Broström, executive chairman of REX.

NextInsight file photo.Things work differently: The government pays oil exploration companies 78% of their exploration costs, even if they hit a dry well.

|

Stock price |

4.9 c |

|

52-week range |

4.4 – 7.1 c |

|

PE |

-- |

|

Market cap |

S$63 m |

|

Shares outstanding |

1.28 b |

|

Dividend |

-- |

|

1-year return |

-16% |

|

Source: Bloomberg |

|

REX has a credit facility in Norway which is 100% backed by tax refund receivables from the Norwegian government for 78% of its exploration costs.

It's interesting that REX subsidiary Lime Petroleum AS is, in the first place, eligible for the 78% refund.

"Not that many companies of our size are pre-qualified in Norway and I think it is right to say that our technology played a very important part in us getting that pre-qualification," said Mr Dan Broström, executive chairman of REX.

At the Rolvsnes discovery, drilling is ongoing for an approximately 2,000m horizontal test production well, including a Drill Stem Test.

Upon achieving success, the well will be tied back 4km to the Edvard Grieg platform for an Extended Well Test, giving first oil in late 2020.

As CEO Mans Lidgren recounted: "We have used our technology-led, de-risked exploration approach to build a cluster of investments in the Rolvsnes area in the North Sea. They are close to existing pipeline infrastructure, so that upon more discoveries, commercialisation can be fast-tracked."

| Rex Virtual Drilling -- new revenue stream Rex Virtual Drilling, a proprietary product of REX, analyses conventional seismic data to determine the presence of oil, and has been extensively tested and used in actual drilling campaigns. The technology has also proven to be highly accurate in predicting dry wells -- and was instrumental in the discovery of oil by REX in Norway and Oman. From being used exclusively in-house by REX and its partners, Rex Virtual Drilling is now being marketed to other oil explorers for a fee. Interest is expected to pick up given that oil companies, after the recent tough years, have become more sensitive to capex. As an illustration of the value proposition of Rex Virtual Drilling, Mr Lidgren said that in the past, it had been approached to farm-in various exploration projects. In all 17 sites the would-be partners were targeting to drill, the Rex Virtual Drilling analysis predicted dry wells, so REX declined to participate in the projects. Still, drilling went ahead with disappointing results: 15 wells were indeed found to be dry and two had non-commercial discoveries. The gross drilling costs amounted to about US$600 million. Put another way, those were massive savings for the would-be partners if Rex Virtual Drilling results had been heeded. |