This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 7 October 2015. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 7 October 2015. The article is republished with permission.

Growing up, Dr Lee Hung Ming remembers holding his grandmother’s hand and leading her around the house because she could not see.

Kelantan-born Lee obtained his basic medical degree and Master of Medicine in ophthalmology from the National University of Singapore. He is also a Fellow of the Royal College of Surgeons of Edinburgh. |

Forging Ahead

The jovial 51-year-old gets an adrenaline rush by pushing the boundaries of medical technology within safe limits.

“I am excited about new technologies, but the welfare of my patients will always come first.”

In 2003, he was the first surgeon in the world to perform the new wave-front guided LASIK using the iris-tracking technology developed by Bausch & Lomb. In 2004, he performed Singapore’s first bladeless LASIK. He also carried out the city-state’s first bladeless laser cataract surgery in 2012.

“Previously, to cut the flap on the cornea, we would use motorised blades. Now with the femtosecond laser, there’s increased safety, effectiveness and predictability,” he said.

|

Markets like Vietnam, with a population of 90 million, and Myanmar, with a population of 50 to 60 million, lack eye clinics. - Dr Lee Hung Ming ISEC Healthcare |

Femtosecond lasers emit light pulses of extremely short duration, which allow tissue to be cut more precisely, and with practically no heat generation.

“These are technologies that will bring the outcome for patients to another level. In medicine, we must always try to do things safer and better,” he added.

For Lee, medicine is very much a family business. His wife, previously his university sweetheart, is a General Practitioner who runs a chain of four clinics.

His two oldest daughters, 23 and 21, are studying medicine in the National University of Singapore. His third daughter, 17, is in junior college, and his son, 15, is in secondary school.

An optimist by nature, Lee believes life should be savoured and enjoyed.

“Of course there will always be ups and downs – it’s up to you how you deal with them. When the chips are down, you must believe that tomorrow will always be better.”

| ♦ Daily Satisfaction | ||||||||||||||

|

It’s also important to enjoy what you do, he added.

“During weekdays, I eat very simply – mostly fruits, veggies and home-cooked fare, but I reward myself with something special two to three times a week.” |

||||||||||||||

Branding and Scale

Potential partners also like ISEC’s brand name, its economies of scale, and the training it can provide across ophthalmological sub-specialties.

“We have funds to acquire the latest medical technologies in the market. We are also able to leverage our size, reaping economies of scale in the purchase of equipment, machines, lenses and disposables,” he added.

|

- Dr Lee Hung Ming ISEC Healthcare |

Diversification may also be on the cards.

“Eyes are our core business but we may want to diversify into other areas which have synergies, such as general medicine. GPs can refer cases to our eye centres in both Singapore and the region.”

A keen sportsman in his younger days, Lee has a passion for badminton and running. “Medicine and sports share similar principles. There are five Ps –Perseverance, Passion, Professionalism, Practice and Perfection,” he smiled.

Despite his happy-go-lucky disposition, Lee still frets about his patients from time to time.

“I think a lot about how to turn my patients’ conditions around, like helping them save or recover their sight. I also mull over our M&A strategy – what’s the best way to win over potential targets and get them to share our vision,” he said.

The future looks bright, thanks to high entry barriers and robust growth prospects.

“Ophthalmology deals with age-related conditions, and many of our markets have ageing populations. Macroeconomic drivers in the region, including rising income levels and medical tourism, will also continue to boost private healthcare demand.”

Financial results

| Year ended 31 Dec (SS$ 000) |

FY2015 | FY2014 | FY2013 | FY2012 |

| Revenue | 26,690 | 21,997 | 17,537 | 15,089 |

| Gross Profit | 11,917 | 9,582 | 6,870 | 5,357 |

| Net Profit | 2,760 | 1,967 | 2,684 | 1,838 |

| Quarter ended 30 Sep (SS$ 000) | 3QFY2016 | 3QFY2015 | y-o-y chg |

| Revenue | 7,416 | 6,286 | 18% |

| Profit before tax | 1,972 | 944 | 109% |

| Profit attributable to shareholders | 1,679 | 680 | 147% |

Source: Company data

| Outlook & Risks | ||

|

||

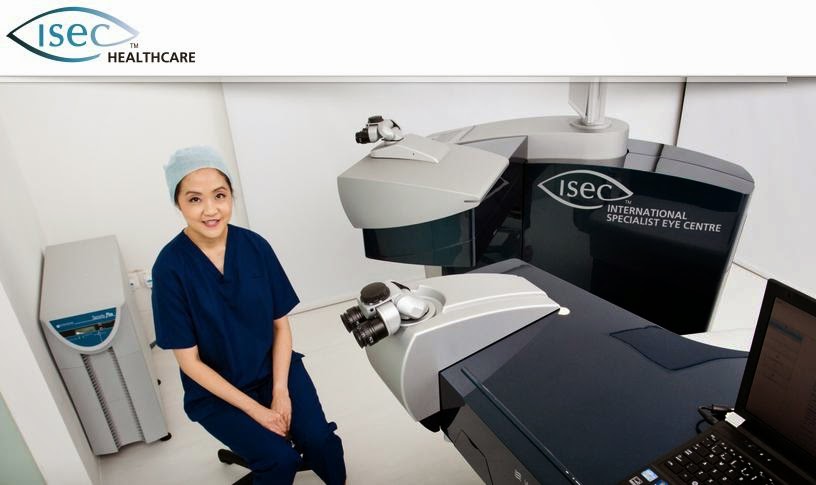

ISEC Healthcare

ISEC Healthcare provides specialist medical eye care services with 19 specialist doctors at four locations in Malaysia and Singapore. The company offers a range of tertiary specialty ophthalmology services in the areas of cataract and intraocular lens implants, refractive surgery, vitreous and retinal diseases, adult strabismus and paediatric ophthalmology, glaucoma diagnostics and therapeutics, medical retinal diseases, uveitis, and optometry and orthoptics, as well as cornea, external eye diseases, anterior, oculoplastics, facial cosmetics, and aesthetics surgery. In the last quarter, Isec experienced a 18% YoY increase in total revenue, from S$6.3 million in 3Q2015 to S$7.4 million in 3Q2016.

The company website is: www.isechealthcare.com.

Click here for the company's StockFacts page.

For its results for the third quarter ended 30 Sep 2016, click here.

I am excited about new technologies, but the welfare of my patients will always come first.

I am excited about new technologies, but the welfare of my patients will always come first.