This article, written by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange), originally was published in SGX's kopi-C: the Company brew series on 28 October 2016. The article is republished with permission.

This article, written by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange), originally was published in SGX's kopi-C: the Company brew series on 28 October 2016. The article is republished with permission.

Five years ago, Dr Goh Jin Hian took a vault into the unknown.

"Do I relish a challenge? Yes. Am I a sucker for pain? No. I don't like the feeling of uncertainty, but for some things, you've just got to take that leap of faith." |

A Compelling Challenge

The transition was tougher than expected.

"Entering the oil and gas industry was not as easy as it looked," Goh said.

"Despite building a lot of networks during my time with Parkway, and receiving a lot of support from these networks in developing new business initiatives, it was pretty much an uphill trek."

The opportunity for Goh to join NSG emerged three years later, in early 2014.

"My entry into the Group was not something I actively sought - it came about when the company was still operating under the name of Digiland," he recalled.

|

- Dr Goh Jin Hian New Silkroutes Group (Photo: LinkedIn) |

"Through a mutual friend, I met the Chairman, Mr Cai Sui Xin. He was eager to take the company out of the SGX Watchlist and turn the business around. We believed it was a challenge we could tackle."

Established in 1994 as a wholesaler of computer peripherals and hardware, Digiland International Ltd was placed on the SGX Watchlist in December 2011 after reporting several consecutive years of losses.

By the time Goh stepped in, Digiland had already obtained a permit to trade marine oil. That eventually paved the way for IEG to be incorporated into the restructured Digiland group.

The reorganised entity, which exited the SGX Watchlist in November 2014, was renamed New Silkroutes Group Ltd last July.

"We wanted a corporate identity that better reflected our ambitions - trade on the ancient Silk Road was a significant factor in the development of the civilisations of China, the Indian subcontinent, Persia, Europe and Arabia," Goh said.

"The name also captures the essence of the exchange of ideas, cultures, philosophies and technologies."

| ♦ For Better or Worse | ||||||||||||||

|

The road ahead, however, remained bumpy.

Oil prices plummeted from a peak of more than US$100 a barrel in July 2014 to end last year at around US$37 a barrel. |

||||||||||||||

Lofty Ambitions

As the Group's expansion strategies began to take shape, funding needs also escalated.

"By end of last year, we realized we couldn't depend on the usual sources, such as the market or banks, to finance our business. We wanted to take things into our hands, so we decided to develop our own ability to raise capital," Goh said.

As a result, New Silkroutes Capital was born.

Set up earlier this year, the Singapore-based subsidiary offers investment management and advisory services to institutions, enterprises and high net-worth individuals. It has a joint venture in New York that will launch funds for the energy and resource, healthcare, technology and real estate asset classes, as well as develop structured products. The Group's asset management joint venture is also applying for the Capital Markets Services licence from the Monetary Authority of Singapore, which will allow it to offer private equity funds in the region.

Last month, New Silkroutes Group marked its entry into healthcare - a sector close to Goh's heart - by acquiring a 51% stake in Singapore-based Healthsciences International (HSI). A healthcare practice group with expertise in designing, developing and running hospitals, HSI also operates three clinics in the city-state.

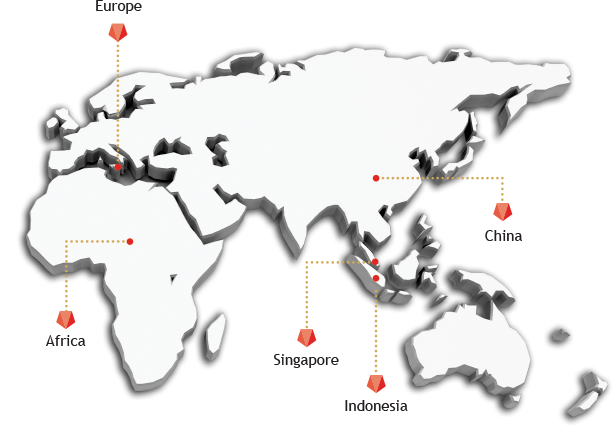

Most of New Silkroutes Group's revenues currently come from its wholly-owned oil & gas trading arm, International Energy Group (IEG). IEG is headquartered in Singapore and has business presence Jakarta, Beijing, Tianjin and Malta.

Most of New Silkroutes Group's revenues currently come from its wholly-owned oil & gas trading arm, International Energy Group (IEG). IEG is headquartered in Singapore and has business presence Jakarta, Beijing, Tianjin and Malta.

(IEG map)

The Group will continue to seek acquisitions of suitable healthcare services companies - ranging from hospitals and pharmacies to imaging centres and laboratories - in the Asia-Pacific region, Goh said.

As for the restructured Digiland business, now the Group's infocomm technology division, it will focus on big-data analytics, facilities management, and cloud-based services for e-government projects, Goh said.

It will also help regional governments develop public housing schemes, advising them on policies, using the success of Singapore's Housing and Development Board (HDB) programs as a model.

Management hopes to mould NSG into an investment holding company with businesses in investment management, energy/resources, technology and healthcare. This multi-pronged approach aims to turn the Group into "a leadership stock" on SGX, Goh said.

"The foundations of the first three pillars are already being laid, while the fourth will be in place within the next year," he added.

As part of its transformation, the Group also carried out an exercise in August 2015 to consolidate every 500 ordinary shares into one single share to reduce sharp swings in its stock price and comply with SGX's minimum trading price rule. Completed in December 2015, the exercise is the largest of its kind in Singapore's corporate history.

| ♦ Proof in the Pudding | |

|

With NSG issuing more announcements over the last 12 months than in the past 12 years, and changing management five times over that period, shareholder confusion has prevailed.

And so far, the proof has been in the pudding. |

Adapt or Perish

There's more work to be done, he added.

"As with many growth companies, there's a need to deepen the management bench. We've been very lean over the last 20 months, without much capital to spare for hiring new talent. Now that we do, our growth should be more exponential going forward."

By extension, as people are the Group's most important asset, keeping the team together can be difficult, he admitted.

"Managing and retaining talent within the Group is not easy, particularly with a team that has expertise in so many different industries. There is a need to pull everyone together and make sure they run in the same direction. As we continue to evolve into this complex animal, it will become more challenging."

"We are, however, putting in place the right culture - one that's centred on integrity, is people-oriented, and focused on deliverables. That should help."

|

- Dr Goh Jin Hian New Silkroutes Group |

Looking back on the last 20 months, where change has been the only constant, Goh highlights the importance of being adaptable. "Change is inevitable, and everyone should embrace it. You need to be willing to take risks and step out of your comfort zone."

One way to overcome the stress of a volatile situation is to control it. "Be the agent of change so you're in charge. Once you're in control of an evolving story, it's not as scary."

Life-long learning is another principle close to his heart. "Once you realise learning never stops, and you need to move out of familiar surroundings to develop new skills, change should not be so frightening."

The father of three girls aged 12, 14 and 16 constantly reminds his children to develop a thirst for knowledge. "Many kids these days think that after they graduate from college or university, the learning process stops. But I always tell them that even at 50, 60 or 70 years old, you should still be accumulating knowledge."

It's also important to develop a clear moral code, Goh said. "Your word must be your bond, and you should always do things that are consistent with your ethics."

These principles, however, can be hard to uphold, given the complexities of the corporate world, he acknowledged.

"But this is where faith comes in. I believe if you hold fast to your convictions, the right opportunities will emerge."

Financial results

| Year ended 30 Jun (US$000) |

2016 | 2015 | YoY Change |

| Revenue | 54,296 | 38,692 | 40.3% |

| Loss before taxation from continuing operations | 3,303 | 1,594 | NM |

| Loss for the year | 3,515 | 2,573 | NM |

*NM - not meaningful

| Outlook and Risks | ||

|

||

New Silkroutes Group Ltd

New Silkroutes Group Ltd is a Singapore incorporated company listed on the Mainboard of SGX. It is evolving into an investment holding company with core competencies in Capabilities Enablement, Capital Allocation, and (Policy) Analysis. The group, through its subsidiaries and associate companies, has exposure to key sector verticals, including Energy/Resources, Healthcare and Infocomm Technology, with a focus on Security & Governance.

The company website is: www.newsilkroutes.org

Click here for the company's StockFacts page.

For financial statements from its 2016 annual report, click here.

I wanted to see if the management skills and competencies I developed during my time in Parkway could be used in other industries.

I wanted to see if the management skills and competencies I developed during my time in Parkway could be used in other industries.