Republished from ThumbTackInvestor with permission. The investor's portfolio is valued at close to S$1 million.

I spent the past couple of days dissecting LTC Corporation’s recently released Annual Report 2016. This post is about what additional information I have gleaned. Since this is an update, I won’t be spending any time on the basic characteristics of the company. I reckon unvested readers who have not previously looked at the company, will probably find this irrelevant and very dry. Anyhow, here goes.

To put some context in place, here are related earlier posts about LTC:

LTC Corporation & Asia Enterprises Holdings – What Are Investors Missing?

1. Strong start to CF generation in FY17

Under “Current Assets”, within the “completed properties held for sale”, the company’s balance sheet recorded $27.9mil. This includes properties in Malacca, JB and the 7 Crescent bungalows. The 7 Crescent bungalows had 4 unsold units recorded.

Details of this are found in page 65 of the AR:

While I do not know with certainty if the company is making $$$ from selling at $3.6mil, I do know that this is a great start in terms of CF generation, to FY17. In my guesstimate done 2 years ago, I’ve worked out the total developmental costs to be in the range of $50mil or so. This excluded transactional costs such as legal fees, taxes and agent fees. If so, the sale of these 4 units would be done at almost cost price, not sure if it’d contribute much to earnings. While I do not know with certainty if the company is making $$$ from selling at $3.6mil, I do know that this is a great start in terms of CF generation, to FY17. In my guesstimate done 2 years ago, I’ve worked out the total developmental costs to be in the range of $50mil or so. This excluded transactional costs such as legal fees, taxes and agent fees. If so, the sale of these 4 units would be done at almost cost price, not sure if it’d contribute much to earnings. |

BTW, the company has a June year end.

Since the AR was compiled though, LTC has successfully sold off the remaining 4 units of the 7 Crescent project. In fact, they were sold right after the AR was compiled.

The remaining 4 units were sold at the end of June and July 2016, at $3.6mil each.

This means that the project is fully sold, and we should be seeing the effects of this in the upcoming FY17Q1 results to be released probably in a couple of weeks.

In my earlier report, I surmised that LTC has been using its FCF generated to pay off debt and that starting from FY17, the FCF will truly… be free. It’d be interesting to see how the management utilizes it.

LTC Corporation & Asia Enterprises Holdings – What Are Investors Missing?

The CF from this ($3.6mil x 4) is, thus, a nice start and reaffirms the points I made in the earlier report.

2. Poor returns from USP acquisition

Again, in an earlier post, I’ve explained why I was disappointed with the… I believed I used the word “asinine” deal.

USP is the holding company for a 90% stake in the SOGO departmental stores in Malaysia. As I’ve explained, with corresponding figures, it seems the management overpaid for the acquisition.

On top of that, it hardly seems wise to use CF from a very tough steel industry now, to jump both feet into another, probably even tougher industry. (Retail)

The figures basically confirm my fears. Under “Share of results of a joint venture” in the income statement, USP contributed $506k.

To be fair, USP has contributed only 3 quarters of earnings, and it’s hard to gauge how it’d perform without longer term data.

Also, as of Q3 results, USP recorded -$171k, hence, in the 4th quarter, they actually earned (506k + 171k).

Still, the ROE figures are not great. Let me be generous and assume that in FY17, USP contributes 2x what it did for 9M16. That’s about $1.01mil.

The 50% stake is carried in the BS at $24.07mil.

This means that USP generates an annualised ROE of 4.2%

Hardly something to be proud of eh.

Well, LTC’s ROE figures were equally as shabby: 3.52% in FY14, 4.04% in FY15 and 2.75% in FY16. But if you’re going to spend $$$ to acquire unrelated assets to “expand” or “diversify revenue stream”, common reasons managements give to justify going into uncharted territory, I’d think the 1st thing you want to do is to make sure it pulls up your overall ROE figures. Which is why I said it’s asinine.

3. Account for goodwill when determining valuation based on BS

To add on to why the USP acquisition was dumb, the company paid up massively more than the book value of the acquisition.

Of the recorded $24.07mil in the BS, about $10.5mil comes from “goodwill on acquisition”.

That’s jargon for “additional money paid above the market price of the assets of the company”.

I get that sometimes, we do have to have goodwill payment. But not for retail. Not for retail in Malaysia. And certainly not for retail, in Malaysia, in the present climate.

Anyway, my take home message here is that when determining intrinsic value, I would write off the goodwill portion completely.

4. Minimal impact from FRS109 implementation

To summarize, basically LTC has to implement FRS109 by 1 Jan 2018. FRS109 basically states that you’d have to mark to market price, any unquoted equity investments that the company has.

Currently, LTC carries these unquoted equity investments at historical cost.

The company doesn’t release any info about what these “unquoted equity investments” actually are, so there’s no way to evaluate if the current market value is more or less than the historical cost.

In any case, it’s not that important as there’s only $3.69mil of these unquoted equity investments carried under long term investments. Don’t think it’ll make much of an impact.

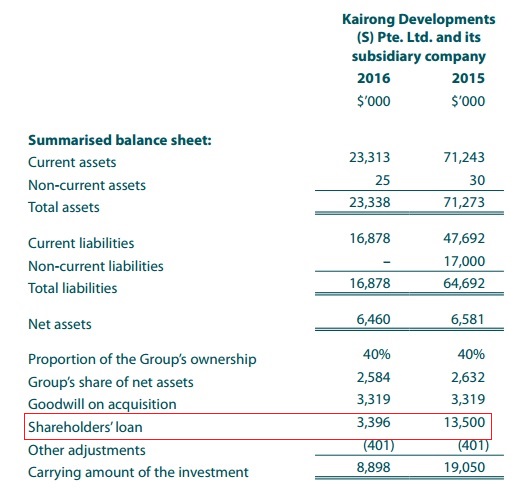

5. Associate company, Kairong developments, has paid off a chunk of the shareholder loans

This is certainly a good thing. Always nice to see shareholder loans to associates being repaid. From my previous experience with King Wan, this is a metric that’s very important to track.

If $$$ starts getting repaid, everything is great. If not, start worrying and digging deeper.

This is taken from page 61 of AR16.

As highlighted, I noted the drop in shareholders loan by just over $10mil.

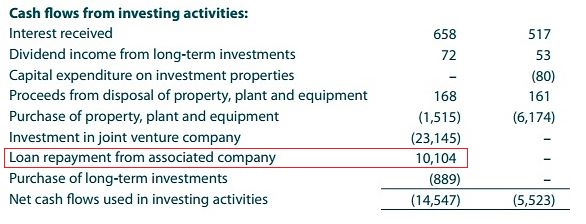

This shows up accordingly in LTC’s CFs (Page 36 of AR16)

Hooray.

To kinda sidetrack a bit, I love tracking these figures in various statements. If it all adds up, it’s very satisfying. Like putting in the final pieces of a puzzle.

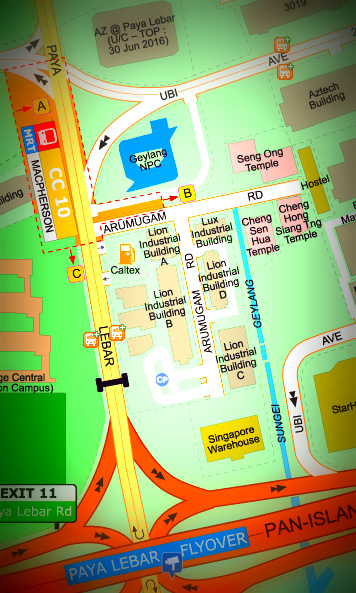

Collectively, the numbers tell a story. LTC investment property in Paya Lebar comprises 4 buildings on freehold land. Map: Streetdirectory.com6. Value and rent of the industrial investment properties has held up in 2016

LTC investment property in Paya Lebar comprises 4 buildings on freehold land. Map: Streetdirectory.com6. Value and rent of the industrial investment properties has held up in 2016

Self explanatory. The value (as determined by Knight Frank), has remained constant at $118mil. The rent has decreased very slightly in FY16.

While all these have held up thus far, it is hard to say how they’d perform in FY17. My best guess is that we’d again see fairly constant valuations and rent in FY17, without much change y-o-y.

7. Fx is favorable for the company thus far

LTC is exposed to currency risks. Fx though, has thus far been kind to the company.

A strengthening USD-SGD is good for the company. Every 3% increase in USD-SGD results in an increase of PBT of $1.42mil

A strengthening MYR-SGD is bad for the company. Every 2% increase in MYR-SGD results in a decrease of PBT of $39k

Surprisingly, the ringgit doesn’t have too big an impact on the company. Only $39k for every 2% change. The USD impact is much much stronger, and thus far it’s been all good. We all know how strongly the USD has performed versus the SGD.

8. Big shareholders have increased their stake in the company in in FY16 compared to FY15

Again, self explanatory.

Top 20 shareholders list in 2015:

The same list in 2016:

Morph Investments Ltd in particular, is interesting. They’ve increased their stake quite a lot in the past year, from just under 1.4mil shares, to 2.16mil shares as of FY16. I have zero knowledge of Morph Investments, but I did notice them in many undervalued companies that I have studied over the years.

These guys obviously practice a very strict, warren buffett inspired “cigarette butt” type of investing style, going for deeply undervalued companies, with ultra long holding periods. I don’t think they’ve ever over paid for anything. They’re the kinda guys who go straight to the bargain bins when shopping.

Can’t be a bad thing at all to see them increasing their stake.

Finally, I stress-tested the valuations (based on the BS), just to have a sense of how ridiculously low the market is pricing the company currently.

The equity attributable to owners of the company is currently $251,539,000.

This is the latest asset side of the BS:

| (SGD '000) | FY09 | FY10 | FY11 | FY12 | FY13 | FY14 | FY15 | FY16 |

| ASSETS | ||||||||

| Non-current: | ||||||||

| Investment properties | 76,000 | 79,800 | 86,100 | 101,890 | 115,000 | 117,100 | 118,000 | 118,000 |

| Property, plant & equipment | 12,825 | 16,126 | 15,662 | 14,741 | 15,903 | 17,842 | 31,211 | 29,871 |

| Subsidiary companies | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Joint venture company | - | - | - | - | - | - | - | 24,071 |

| Associated company | - | 2,616 | 15,835 | 15,794 | 17,789 | 16,913 | 19,050 | 8,898 |

| Long-term investments | 3,720 | 3,730 | 3,730 | 3,730 | 3,730 | 3,730 | 3,730 | 4,651 |

| Properties under development | 57,442 | 52,012 | 47,591 | 53,034 | 66,822 | 13,868 | 13,546 | 13,069 |

| Fixed deposits | - | - | - | - | - | - | 46 | 16 |

| Deferred tax assets | 1,331 | 2,126 | 734 | 347 | 366 | 1,050 | 1,287 | 589 |

| Total Non-current: | 151,318 | 156,410 | 169,652 | 189,536 | 219,610 | 170,503 | 186,870 | 199,165 |

| Current: | ||||||||

| Non-current assets held for sale | 0 | 0 | 7,015 | 5,067 | 1,620 | 1,492 | 0 | 0 |

| Completed properties held for sale | 32,586 | 30,365 | 24,566 | 21,425 | 17,918 | 61,873 | 50,357 | 27,921 |

| Inventories | 24,166 | 25,218 | 28,880 | 50,958 | 41,985 | 44,122 | 29,226 | 39,555 |

| Prepayments | 0 | 0 | 290 | 96 | 71 | 96 | 129 | 97 |

| Trade debtors | 23,961 | 22,202 | 26,717 | 27,523 | 31,421 | 24,453 | 22,969 | 16,433 |

| Other debtors | 1,151 | 1,505 | 3,383 | 2,255 | 1,906 | 2,204 | 4,141 | 368 |

| Amounts due from related parties |

10,132 | 2,532 | 234 | 548 | 784 | 862 | 880 | 395 |

| Derivatives | - | - | - | - | - | - | 61 | 50 |

| Fixed deposits | 1,885 | 2,502 | 2,435 | 9,152 | 7,561 | 7,788 | 15,914 | 16,853 |

| Cash and bank balances | 24,609 | 9,843 | 10,202 | 13,420 | 20,641 | 31,215 | 28,880 | 17,519 |

| Total Current: | 118,490 | 94,167 | 103,722 | 130,444 | 123,907 | 174,105 | 152,496 | 119,571 |

| TOTAL ASSETS: | 269,808 | 250,577 | 273,374 | 319,980 | 343,517 | 344,608 | 339,366 | 318,736 |

Let’s start taking a chainsaw and cutting away big chunks of the assets to “Stress test” the company and incorporate a big Margin of Safety.

- Investment Properties – These are FH, but let’s assume the property market undergoes armageddon. The lowest in the past 8 years is $76,000,000, so let’s take that figure instead of the recorded $118,000,000.

- PPE – Let’s put a 50% write down to the $29.8mil figure.

- JV company – As mentioned above, I’d write off all of the goodwill of $10.5mil. But let’s be even more conservative and assume that even after writing off the goodwill, USP can only be sold at BELOW the net assets. So I’m taking off $14mil from this figure.

- Associated company – This refers mostly to Kairong developments. The figure has dropped as they’ve paid back the loans to LTC. But let’s be crazy and put a 50% write off to what remains.

- Long term investments, FDs, tax assets – Figures are not significant. Let’s write off EVERYTHING.

- Properties under development – another 50% write off.

- Completed properties held for sale – As mentioned above, the 7 crescent bungalows are all fully sold. All relevant QC charges have been paid (I forgot to add above that the AR also shows that they’ve reversed the overprovision for QC charges as well, so this project is def over for sure). Let’s just write off everything here. Assume whatever properties are worth 0.

- Inventories – well steel prices have really fallen, and these figures are weighted average figures (Explained in an earlier post). Let me assume the steel price market goes into another severe depression from the current already depressed figures, and drops another 50% again.

- Prepayments, trade debtors etc – OK, this is one hell of a crazy stress test. Let’s assume nobody pays back any debt, and we write off EVERYTHING.

So after the above mad scenario, we are left with equity of $99,322,500.

That means the book value per share is: 63.48 cents.

The current share price is hovering between 50 – 55 cents.

This means that after the above scenario where the whole market has gone to hell, the world is facing the end of humanity type of crisis, Mr Market is still willing to give you 63.48 cents worth of value if you give him 52 cents or so.

Oh, and did I mention that of the 63.48 cents, approximately 22 cents is in cash?

Crazy stuff.

|

CONCLUSIONS

I am expecting continued strong CF generation in FY17. In my earlier posts, I have mentioned that the CF is something that I’m monitoring closely, and I’ve shown how the company actually does generate a ton of FCF. It’s just that this has been used to pay down debt in the past years. |

Note: LTC Corp was formerly known as Lion Teck Chiang

Previous stories:

@ LION TECK CHIANG's AGM: Air of anticipation over Master Plan 2013

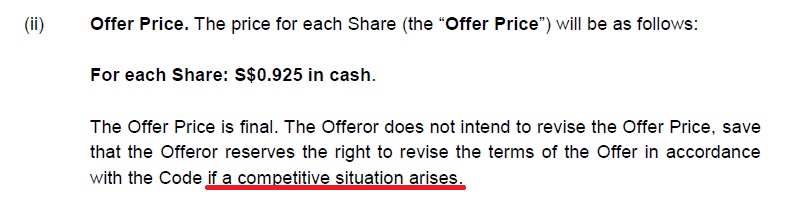

I don't think it will be privatized, although if I am part of the Chengs, I personally would. It's a no brainer

LTC though, has always traded on a severe discount to NAV, I don't see why they'd suddenly want to privatize it.

On top of that, the nature of the steel business makes it hard to privatize. This is because practically all similar companies (I've explained why this is so in a blog post about AEH) trade at a large discount, and delisting offers by virtue of its public nature, is very hard to b very low. So for eg. if the controlling shareholders offer a price at book value, they'd think they're over paying already, whereas the markets will think it's grossly underpaying. I haven't heard of a delisting offer that's so far below book value. So in short, it'd be hard to close this gap between markets expectations and the buyout party's expectations.

Congrats on the presidency btw.